Binance Trading Bots: Characteristics and Use Cases

Disclaimer: Digital asset prices can be volatile. Do your own research. See full terms here and our risk warning here. Binance Futures products are restricted in certain countries and to certain users. This communication is not intended for users/countries to which restrictions apply.

Main Takeaways

Crypto trading bots are automated tools that analyze market data and execute trades. Trading bots can trade 24/7 based on preset parameters.

The key benefits of using trading bots include speed, efficiency, and reduced risks due to unbiased trading decisions.

Binance offers trading bots that can cater to different goals, such as optimizing average cost and taking profit from dollar-cost averaging with Spot DCA and Auto-Invest, benefiting from volatility and sideways markets with Spot Grid and Futures Grid, or splitting bigger orders into smaller ones through the TWAP and VP bots.

Cryptocurrency trading is a fast-paced, 24/7 market that can be challenging to keep up with when trading manually. Trading bots can potentially help traders take advantage of market volatility and automate their trading strategies with ease. In this article, we will discuss the benefits and risks associated with crypto trading bots.

What Are Crypto Trading Bots?

Crypto trading bots are automated tools that analyze market data and execute cryptocurrency trades on spot and derivative markets based on preset parameters.

Similar to trading bots in traditional financial markets, they can remove emotional bias when making trading decisions. Crypto trading bots enable users to continue trading at all hours of the day.

Although cryptocurrency bots sound complex, trading bots on Binance do not require any advanced technical knowledge to operate. Binance traders have a range of trading bots to choose from, available on the Trading Bots landing page. Depending on their goals, users can choose from Spot Grid or Futures Grid bots to benefit from sideways markets, Spot DCA bot for volatile markets, Rebalancing bot for long-term holding, and TWAP bot for splitting large orders into smaller ones.

Key Benefits of Using Trading Bots

1. Less manual work: Crypto trading bots can trade 24/7 through automation, which means they can take advantage of market fluctuations even when the trader is not online.

2. Speed and efficiency: Bots can analyze market data and execute trades within milliseconds. The bot can collect and interpret market data instantly to determine whether to buy or sell a cryptocurrency asset at the price level. Speed and efficiency can make a difference when trading in a volatile market.

3. Taking emotions out of the equation: One of the most significant advantages of using a trading bot is removing emotions from the trading process. Emotions such as fear and greed can cloud an investor's judgment, leading to poor decisions. Bots execute trades based on preset parameters, maintaining unbiased, data-driven results and potentially reducing risks.

4. Managing your investments: Certain crypto trading bots, such as the Rebalancing bot, enable the automation of adjusting the proportion of your chosen assets to maintain a consistent ratio.

5. Reducing risks: Some trading bots can also be programmed to limit risks by diversifying investments across different crypto assets and setting exit positions with stop-losses, limiting potential downside.

How Can Binance Trading Bots Benefit You?

Grid Trading: Buying and selling in a sideways market

Grid trading is a strategy that involves placing orders at incrementally increasing and decreasing prices above and below a set price level. By automating the placement of orders within a predetermined price range at specific intervals, it generates a grid-like pattern of orders at progressively rising and falling prices, hence building a trading grid.

Binance grid trading bot will attempt to benefit from price volatility, by placing strategically timed buy-low and sell-high orders within a preset price range. Traders can potentially benefit from using the Binance Spot Grid trading bot when an asset’s price fluctuates within a range.

Applying the same core logic of grid trading (placing buy-low sell-high orders parameters within a price interval) to the futures market, the Futures Grid Trading aims to capture profits in both rising and falling markets by going long or short, and can magnify your position sizes with the use of leverage.

Rebalancing Bot: For a steady asset allocation

Market volatility can lead to fluctuating asset values, with the potential to significantly disrupt the distribution of assets within a portfolio. This can pose challenges for long-term holders who aim to maintain a balanced and steady asset allocation.

The Binance Rebalancing bot can come in handy, as it can sell the digital asset that is overweight while also buying more underweighted assets to restore a desired allocation.

This bot also presents potential opportunities for automating the sale of assets that have appreciated significantly while triggering the purchase of potentially undervalued coins at the same time, based on coin ratio percentage and time interval parameters.

Spot DCA: Auto-place buy/sell orders for a better average price

Dollar-cost averaging (DCA) is a strategy that involves buying an equal amount of assets regularly. It aims to achieve a better average price for the selected trading pair and reduce the impact of market volatility.

With Binance’s Spot DCA bot, you can set how much to buy, when to buy, and when to sell. Based on your parameters, it can help you:

Buy more as the price dips, or

Sell more as the price increases.

To take it to the next level, leveraging off of the DCA strategy, Binance’s Auto-Invest tool allows you to invest in over 210 cryptocurrencies with more than 20 payment options. The Auto-Invest bot also comes with several DCA plan frequencies, including hourly, daily, weekly, bi-weekly, and monthly.

Order Splitting Bots: break down large orders and minimize market impact

Traders looking to place significant trades often aim to reduce market impact and keep their orders less visible for improved execution. TWAP and VP bots assist in this by:

Enhancing liquidity: These bots divide large orders into smaller ones, potentially offering better liquidity, improved execution prices, and less market impact.

Concealing large orders: By breaking down large orders, these bots make it harder for other market participants to detect and exploit the order flow.

TWAP and VWAP work under distinct principles:

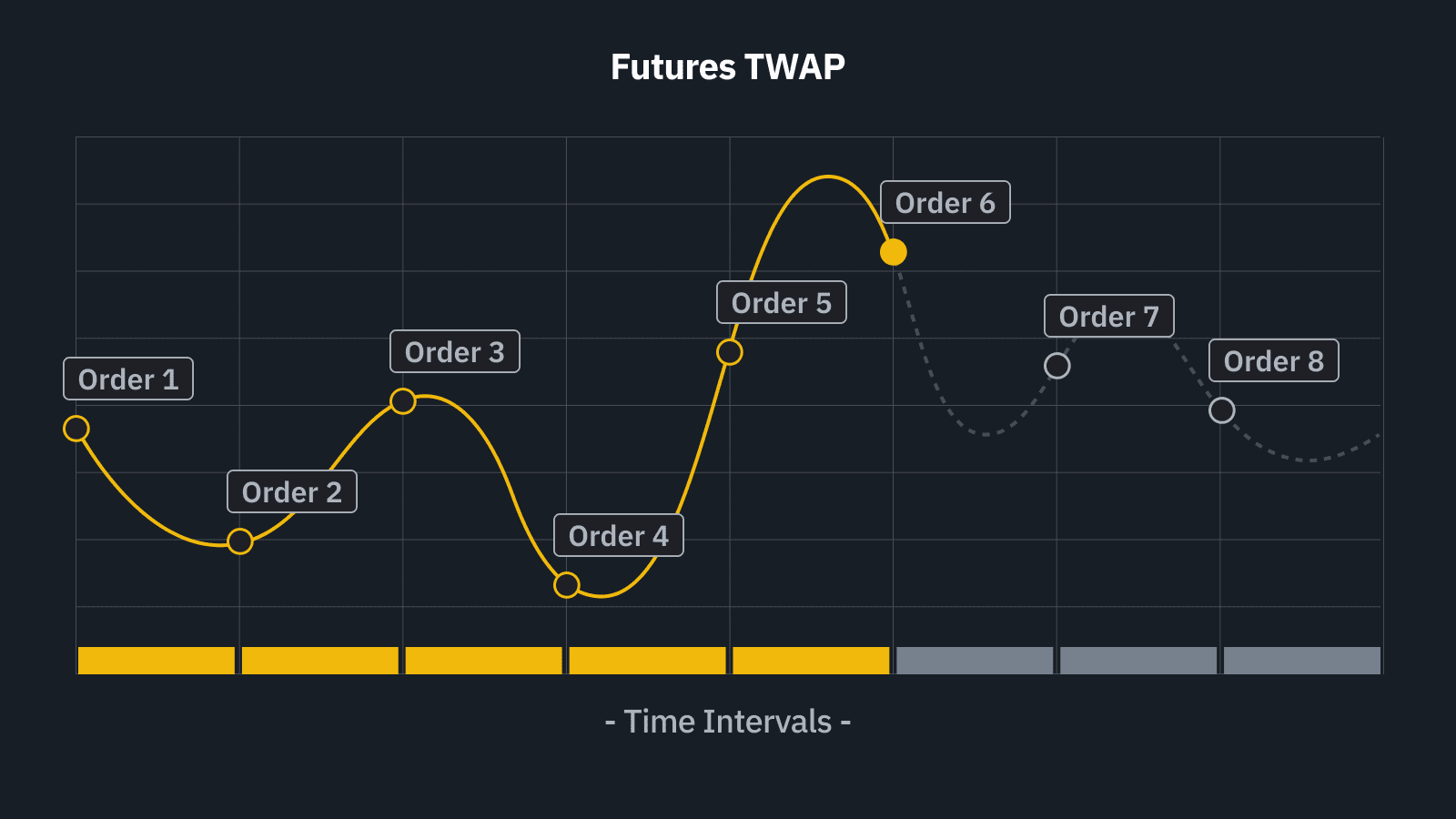

Spot TWAP and the Futures TWAP bots aim to execute an order over a specific period, dividing the order into smaller parts to be executed incrementally. This distribution is based on time, aiming to maintain a uniform trading pace. By doing so, these bots can avoid the creation of buy and sell walls, minimizing the impact of large orders in the market.

On the other hand, the Volume Participation (VP) bot focuses on volume. It executes larger orders in line with real-time market volume, helping to limit market impact and target average trading prices.

Understanding the Risks of Using Trading Bots

While trading bots can provide numerous benefits, it's essential to be aware of the potential risks involved when using them.

1. Reliance on automation: Since trading bots are automated, their efficiency and accuracy depend on the quality of the code and parameters used. A poorly designed bot may generate inaccurate signals or execute suboptimal trades, which could lead to losses.

2. Technical issues and glitches: Trading bots are software systems, and as with any software, they are susceptible to technical issues and glitches. If a bot experiences a malfunction during a critical trading decision or while executing a trade, it could result in unintended consequences, impacting your portfolio.

3. Limited adaptability: While many bots are designed to perform under various market conditions, some might have a limited range of strategies, struggling to adapt to extreme or unforeseen circumstances. This lack of adaptability could lead to poor performance and potential losses.

4. Lack of human intuition: A trading bot will strictly follow its programmed strategy and cannot apply human intuition or consider unexpected external factors not included in its original design. This rigidity could lead to suboptimal trades or missed opportunities.

5. No guaranteed profits with trading bots: It is crucial to emphasize that trading bots do not guarantee profits. While they can automate trading processes, execute predetermined strategies, and work 24/7, their effectiveness is ultimately dependent on their parameters, market conditions, and the quality of the code used. Just like with manual trading, making profits using trading bots can never be assured. It's important for traders to adopt appropriate risk management measures and thoroughly research the bot's capabilities and limitations to increase chances of success, all the while staying prepared for possible losses.

Having a diversified and well-monitored strategy, being mindful of investment goals, and never investing more than you can afford to lose can help mitigate risks when utilizing trading bots.

The use of trading bots is not a guaranteed road to profit but rather a tool that may aid traders in navigating the cryptocurrency market.

Closing Thoughts

In conclusion, crypto trading bots can be a helpful tool for crypto traders and investors. They offer numerous benefits, including 24/7 trading, speed, reduced emotions, diversification, and automation. However, users should be aware that there is no guarantee of making profits with trading bots, and that there are risks associated with cryptocurrency trading, such as unexpected volatility. It’s important to apply risk management strategies and monitor the latest developments in the crypto markets.

Disclaimer: This content is presented to you on an “as is” basis for general information and educational purposes only, without representation or warranty of any kind. It should not be construed as financial or investment advice, nor is it intended to recommend the purchase of any specific product or service. Digital asset prices can be volatile. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions, and Binance is not liable for any losses you may incur. For more information, see our Terms of Use and Risk Warning.

The products and services referred to herein may be restricted in certain jurisdictions or regions or to certain users in accordance with applicable legal and regulatory requirements. You are responsible for informing yourself about and observing any restrictions and/or requirements imposed with respect to the access to and use of any products and services offered by or available through Binance in each country or region from which they are accessed by you or on your behalf. Binance reserves the right to change, modify or impose additional restrictions with respect to the access to and use of any products and/or services offered from time to time in its sole discretion at any time without notification.