Know Your Scam: Money Transfer Scams in Crypto

Main Takeaways

Money transfer scams are a common threat to crypto users. They can occur in two scenarios: P2P trading or everyday transactions when purchasing goods or services.

Always ensure you’re trading on a trusted P2P platform with robust security measures and that your counterparty is a reliable person or entity.

Have you fallen victim to a scam? Report the incident immediately to relevant law enforcement authorities and the Binance Support team.

Learn how to identify and avoid money transfer scams in crypto with the latest edition of our Know Your Scam series.

Money transfer scams involve criminals attempting to deceive victims into sending them money under false pretenses. Such scams typically occur in two types of scenarios:

Peer-to-peer (P2P) trading. On peer-to-peer (P2P) marketplaces, buyers and sellers can interact directly with each other to negotiate pricing, payment methods, and the amount of crypto to be exchanged. While P2P crypto trading offers more control over the process than any other trading method, it still comes with its own risks – like scammers trying to steal your money.

Transactions involving goods or services. Exercise caution if you accept cryptocurrency as a form of payment. Scammers are singling people like you out with fabricated emails that claim delays or require a “deposit fee” to complete the transaction.

In this article, we’ll explore how money transfer scams typically unfold, look at some real-life examples, and discuss how you as a user can identify and avoid such scams.

How Do Money Transfer Scams Work?

Finding the target

Scammers usually find their victims on social media or cryptocurrency platforms. They might offer a price well above the market rate to an unsuspecting user trying to sell their crypto. Or, they’ll identify merchants who accept crypto payments in exchange for goods or services.

Gaining trust

To gain the victim’s trust, scammers will use a variety of tricks such as creating fake documents that show proof of payment or expressing abnormally strong interest in buying a merchant’s goods or services.

Inducing action

In scam P2P trades, scammers will usually pressure their target to release the crypto as soon as possible. This is backed by numerous screenshots or documents of the supposed “bank transfer.” Oftentimes, the scammer will initiate a bank transfer and revoke it immediately upon receiving the crypto from the P2P seller.

If the transaction involves goods or services, the scammer will provide victims with “proof” of a crypto transfer, followed by doctored emails claiming a delay in the transfer. The scammer will then ask the victim to transfer back the “extra cryptocurrency” or pay a “transfer fee,” promising the pending transfer will be completed soon.

Closing the scam

The victim releases their cryptocurrency to the scammer, only to discover that the screenshots or documents were fake or that the scammer canceled the bank transfer.

In the scenario that involves payment for goods or services in crypto, the scammer will ghost the victim after receiving the “refund” or “transfer fee.” By the time the victim realizes that the screenshots, documents, and emails were all fake, it’s already too late.

See Two Examples in Action

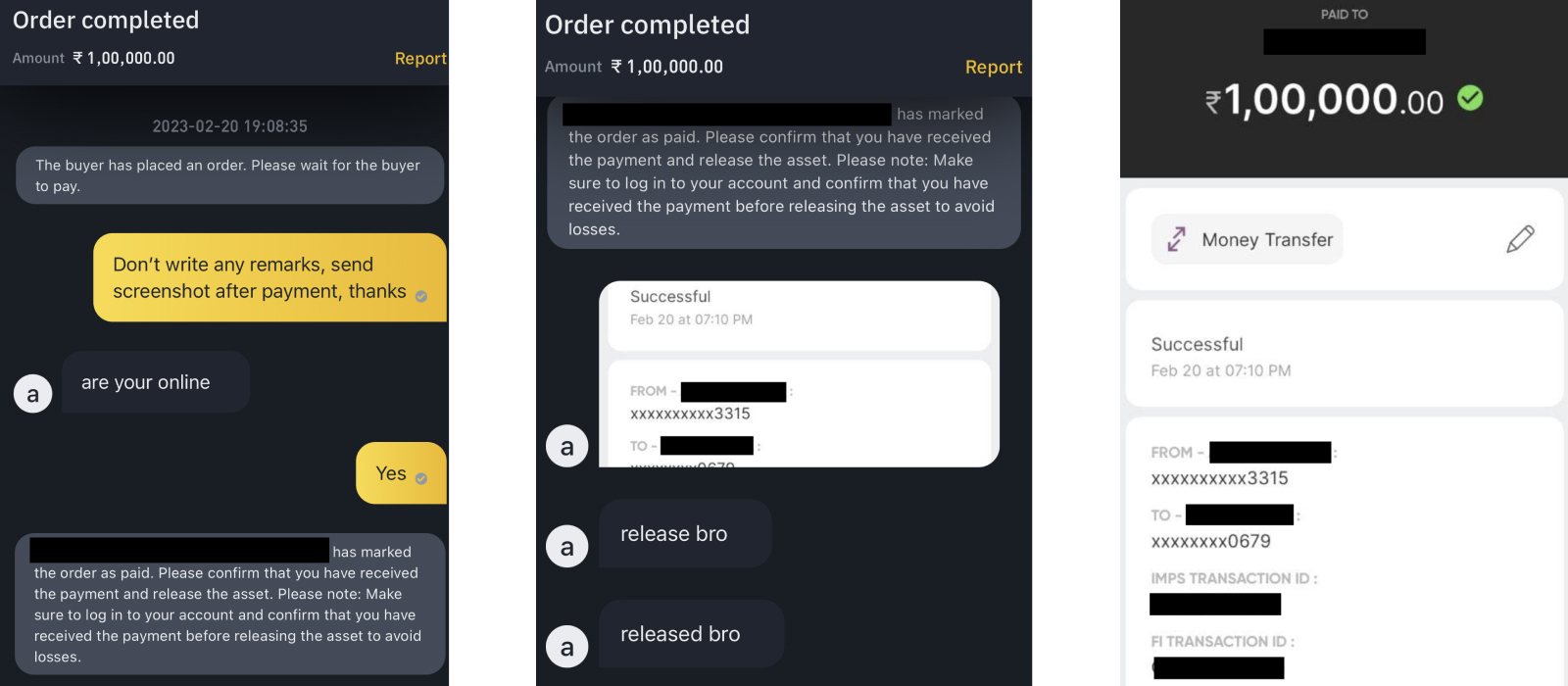

Example 1: Trading crypto

A P2P crypto trader, whom we’ll call Mark, receives an order from a potential “buyer.” The “buyer” then provides a fake bank transfer invoice, pressuring Mark to release the cryptocurrency immediately, before Mark gets a confirmation of the receipt of the money from his bank. Mark yields, only to discover later on that the bank transfer was canceled. With the crypto already sent to the scammer, Mark is left empty-handed.

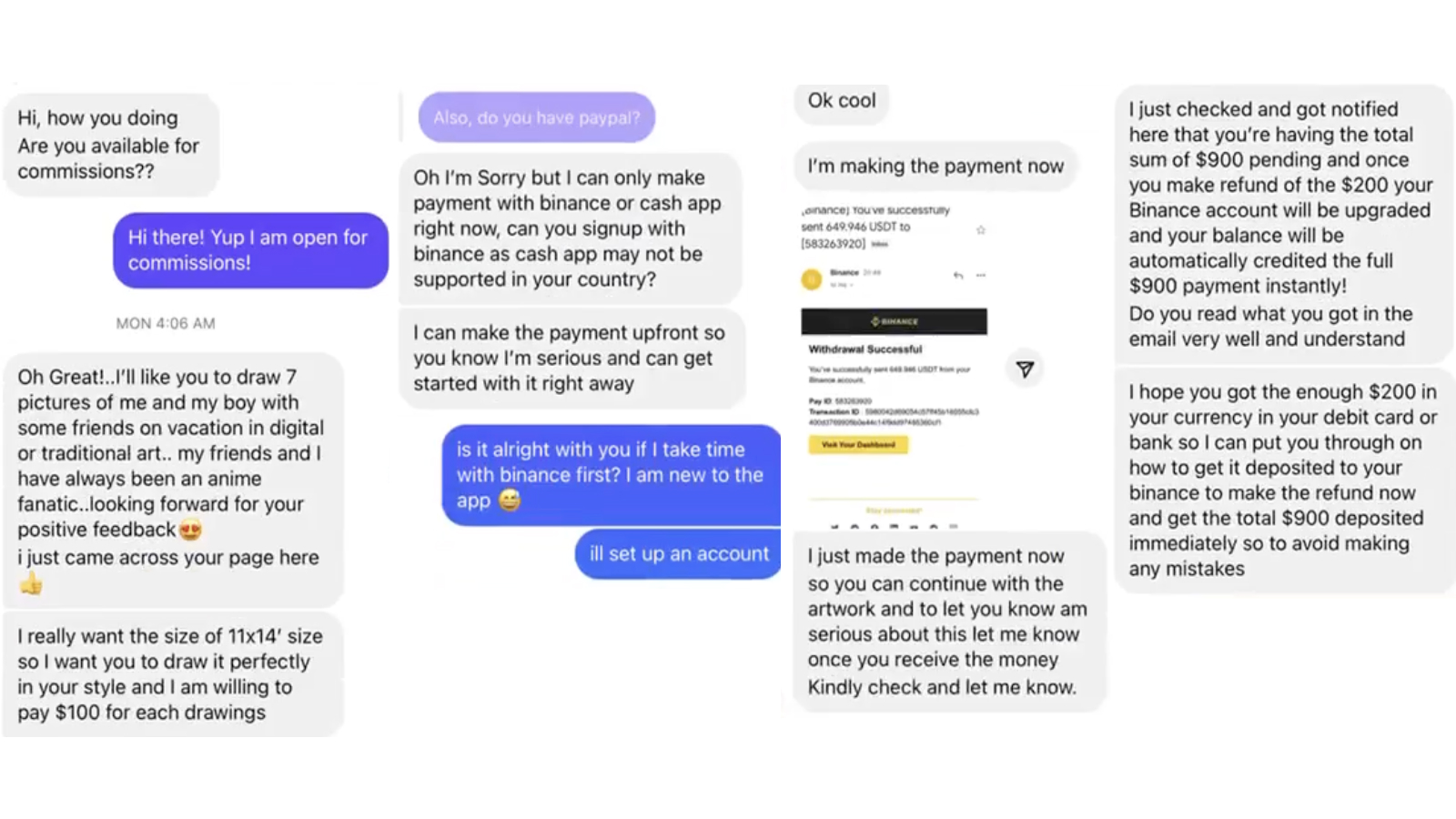

Example 2: Purchasing art

An artist, whom we’ll call James, is approached by a collector interested in his work. The two strike a deal, and the counterparty claims to have transferred $700 in exchange for a painting. He convinces James that the payment is on hold due to an “account upgrade.”

The scammer asks James to send $200 back, claiming that he needs the money while his $700 is locked in the pending transfer. Believing that he would receive the funds once the “account upgrade” is complete, James complies. Eventually, James realizes that all the “collector’s” claims were fake and that the scammer would not be sending his $200 back.

Tips to Protect Yourself From Money Transfer Scams

Check your account

Always ensure the correct amount of funds has been successfully transferred into your account before releasing crypto in a P2P transaction. Scammers often cancel the transfer after sending the screenshot.

Beware of fake screenshots, documents, or emails

Scammers often use fabricated screenshots, documents, and emails to deceive you. Carefully verify the legitimacy of evidence before releasing your crypto.

Use a trusted platform

Ensure that the P2P platform you’re using has a system in place to moderate transactions, hold money in escrow, and support users facing difficulties. Binance P2P has robust security measures in place — including stringent know-your-customer (KYC) checks and an escrow service — to protect users against scams and fraudulent activities.

Verify your counterparty

P2P platforms and general e-commerce sites often show reviews and ratings of the person or entity you’re trading with. Be wary if their profile has either no reviews or an unusually high number of perfect-score reviews. If you’re a P2P crypto trader, Binance P2P has a large selection of “verified merchants” that we’ve strictly vetted, who can be easily identified by the yellow tick next to their user name.

For more information on staying safe when trading P2P, you can read the following guide from Binance Academy: How to Stay Safe in Peer-to-Peer (P2P) Trading.

If You've Fallen Victim to a Money Transfer Crypto Scam

If you've fallen victim to a scam, take immediate action to safeguard your finances. Stop your bank and financial accounts and change passwords for all your accounts, including email and social media.

Report the incident to the police and provide all the necessary details. Share all the information you have gathered, including evidence of any interaction with the scammer such as the payment documents they’ve sent you. Binance works closely with law enforcement, and our cooperation regularly results in detections and seizures. While recovering your money is far from guaranteed, this is, in most cases, the only chance to retrieve the stolen funds.

If your Binance account is compromised, disable your account and follow the steps outlined in this guide: How to Report Scams on Binance Support. If you suspect that your trading counterparty on Binance P2P might be a scammer, contact our customer support immediately.

Be cautious of “recovery services.” While some may offer legitimate assistance, many make false promises or require upfront payments. Don’t get scammed twice.

We also encourage all users, both new and seasoned, to read through our anti-scam series to better equip themselves against common crypto scams.