Auto-Deleveraging (ADL) is the final step in the liquidation process and occurs only if the Futures Insurance Funds are unable to accept a bankrupt futures position.

Note that coin-margined contracts are more likely to be subject to ADL than USD-margined contracts. This is because all coin-margined contracts which use the same cryptocurrency asset as collateral will share one Futures Insurance Fund, resulting in smaller Futures Insurance Funds.

Binance takes every possible step to avoid ADL and has several features such as Immediate or Cancel Limit Orders to minimize the potential impact of any auto-deleveraging when it does occur. Unfortunately, due to the volatility in the crypto markets, and the high leverage offered to users, it is not possible to completely avoid ADL liquidations. However, to provide the best user experience possible, Binance strives to minimize ADL liquidations to the extent possible.

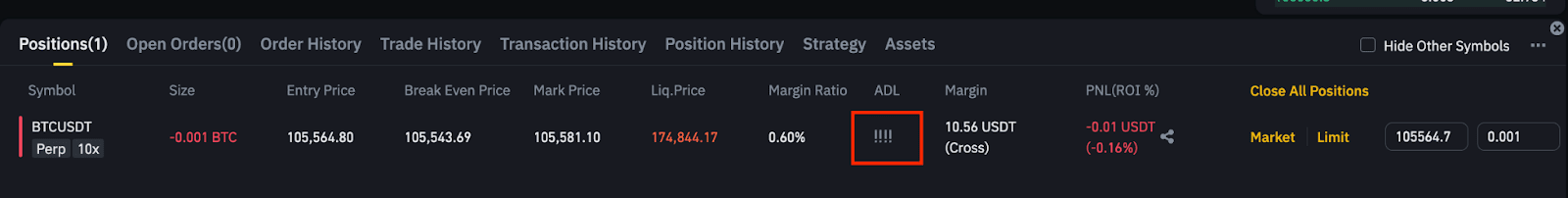

The profitable futures positions of winning traders will be subject to ADL liquidation based on a liquidation priority ranking. The interface for each futures position will include an indicator of the likelihood that the position will be subject to ADL liquidation. If a futures position is at risk of imminent ADL liquidation, this will be clearly displayed in the indicator on the interface. An example of the indicator is shown below.

A position’s ranking in the ADL liquidation queue will be calculated in accordance with the formula set out at the bottom of this page, which is based on both profit and leverage. Positions that are more profitable and more highly leveraged will be queued for ADL liquidation first, ahead of positions that are less profitable and less leveraged.

When ADL liquidation of a profitable futures position occurs, the affected trader will immediately be sent a notice setting out the amount and liquidation price. The profitable futures position will be closed at the Bankruptcy Price of the liquidated order for the losing trader subject to liquidation. No trading fee will be charged to the trader whose profitable position is subject to ADL.

The liquidation price is the price at which the liquidation of a losing position will commence. This price may be influenced by several factors including the leverage used, the maintenance margin rate, the then-current price of the relevant token and the remaining balance of the losing trader’s account.

The Bankruptcy Price is the limit price at which the liquidation order will be executed. This is the price at which a trader’s losses are equal to the collateral value deposited or the initial margin, or in other words, the price at which the margin balance of the liquidated user is equal to zero.

All open orders for all tokens (in cross margin mode) or for the same token (in isolated margin mode) will be canceled. Once the liquidation process is complete, the trader will be able to immediately re-enter new positions for the same token.

Please note: The Bankruptcy Price may be out of the contract’s market price range. Traders are strongly encouraged to pay close attention to the ADL indicator to minimise the risk of being subject to ADL.

PNL Percentage = Unrealized Profit/abs (Position Notional)

Effective Leverage = abs(Position Notional) / (Wallet Balance + Unrealized Profit)

If PNL Percentage ≥ 0, then ranking = PNL Percentage * Effective Leverage

If PNL Percentage < 0, then ranking = PNL Percentage / Effective Leverage

Leverage PNL Quantile = rank (user.ranking) / Total User Count

* For Portfolio Margin, Effective Leverage = abs (Position Notional) / accountEquity

* The PNL percentage and the abs(Position Notional) are based on symbol level. The Wallet Balance + Unrealized Profit is based on account level.