Main Takeaways

Despite the steady adoption of digital assets and maturation of the industry, there are still voices arguing that crypto is primarily a tool for financial crime, overlooking evidence of its minor and decreasing role in illicit transactions.

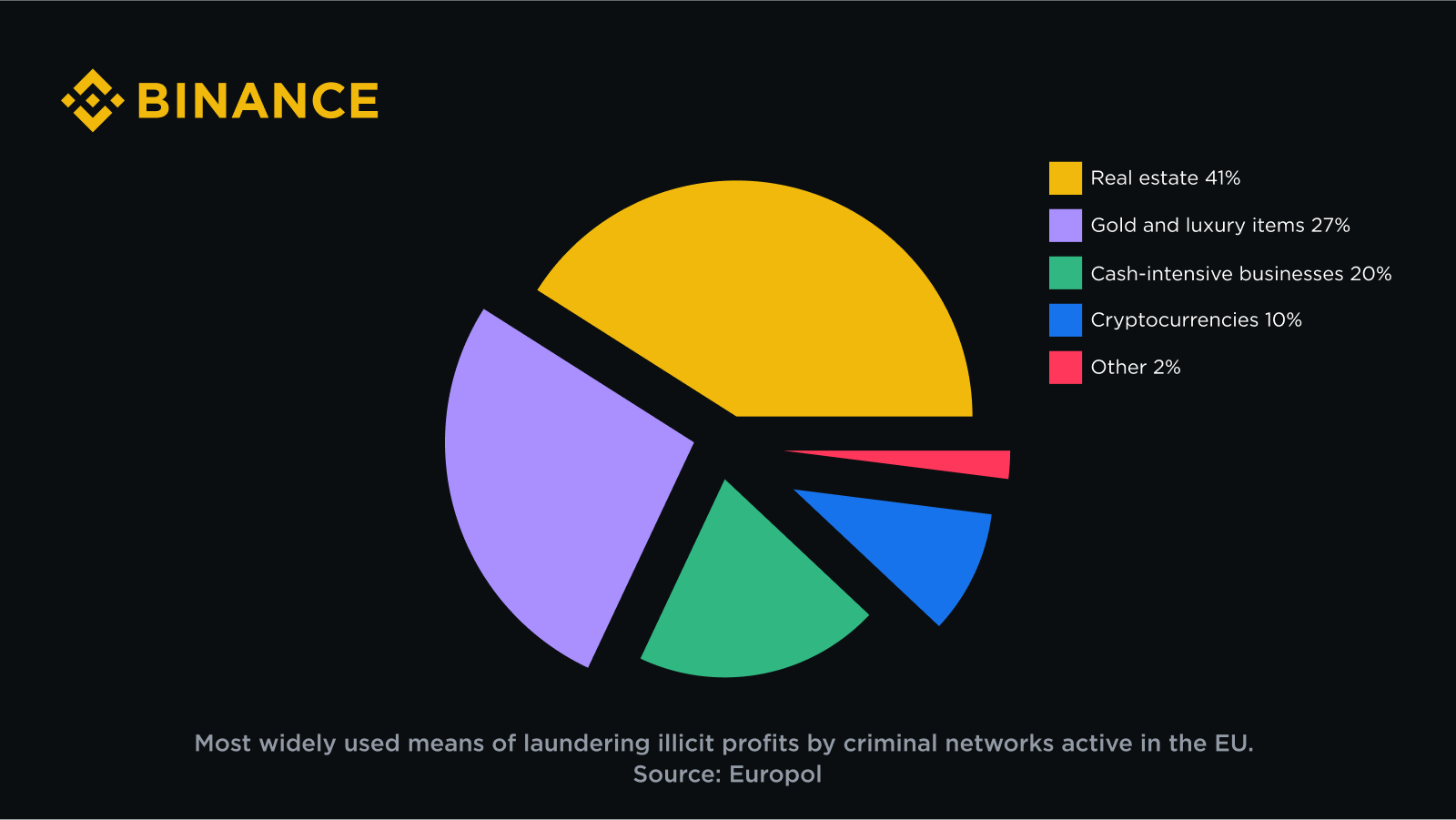

Data from Europol suggests that real estate, luxury goods, and cash-intensive businesses serve as predominant instruments of money laundering by the EU’s major criminal networks, with cryptocurrencies only contributing to a smaller percentage.

Reports from NASDAQ and the U.S. Department of Treasury illustrate the significant disparity between the volumes of illicit funds in traditional sectors and the digital-asset space – with the latter constituting a small share of the total.

It is 2024, and Wall Street firms, led by the world’s biggest asset manager, BlackRock, race to provide bitcoin exposure to mainstream investors via regulated exchange-traded products. Around the world, millions of people use digital assets to protect the value of their savings amid raging inflation and devaluation of their national currencies as well as to take advantage of low-fee and near-instant cross-border money transfers. Traditional domains from charitable giving to art are being enhanced and reimagined with new efficiencies and capabilities that the use of blockchain technology offers.

And yet, oddly enough, there are still people out there stubbornly refusing to acknowledge the strides that the digital-asset industry has made in recent years, resorting instead to tired notions that were never true or are hopelessly outdated. They argue that crypto is nothing but an online casino whose main use case is facilitating money laundering and various other crimes. This leads the most radical of these skeptics to call for digital assets to be regulated out of existence or outright outlawed.

Reliable data showing that the share of illicit crypto transactions in 2023 was a meager 0.34%, down from 0.42% the year before, or that the value of digital assets received by illicit addresses is small and declines year-to-year, is rarely enough to convince those committed detractors. After all, most robust data insights we have to show for it originate from within the industry.

The reality, however, is that even unaffiliated data sources provide enough evidence supporting the idea that crypto is far from bad actors’ top choice when it comes to facilitating financial crime. Let’s look at some stats showing that by far the most common criminal instruments are assets and tools that no one would ever suggest to ban.

Europol: EU Criminal Networks Prefer Real Estate

The European Union Agency for Law Enforcement Cooperation (Europol) is tasked with supporting the EU Member States in tackling serious international and organized crime, and as such it is concerned with large-scale criminal and terrorist networks operating across the bloc. The agency’s freshly released report offers a comprehensive assessment of the operations of the most threatening criminal networks in Europe.

What these criminal organizations, specializing in activities such as drug trafficking, online fraud, and property crime, have in common is the need to legalize the ill-gotten gains. Assessing the prevalence of various tools that the criminal networks use toward this end, Europol experts found that real estate is the predominant vehicle of money laundering (41%), followed by luxury goods and cash-intensive businesses.

While cryptocurrencies have made the list with a 10% share of the laundered funds, it is still a far cry from what crypto demonizers would have you believe. Moreover, it is reasonable to expect that the next iteration of the Europol criminal networks report will show a lower share of funds laundered via digital asset-related channels if year-on-year decline trends observed in most other criminal domains are anything to go by.

So, next time you hear someone suggesting that crypto should be banned on account of it being a haven for money launderers, retort with a suggestion to ban home sales, luxury watches, or their neighborhood newspaper stand first.

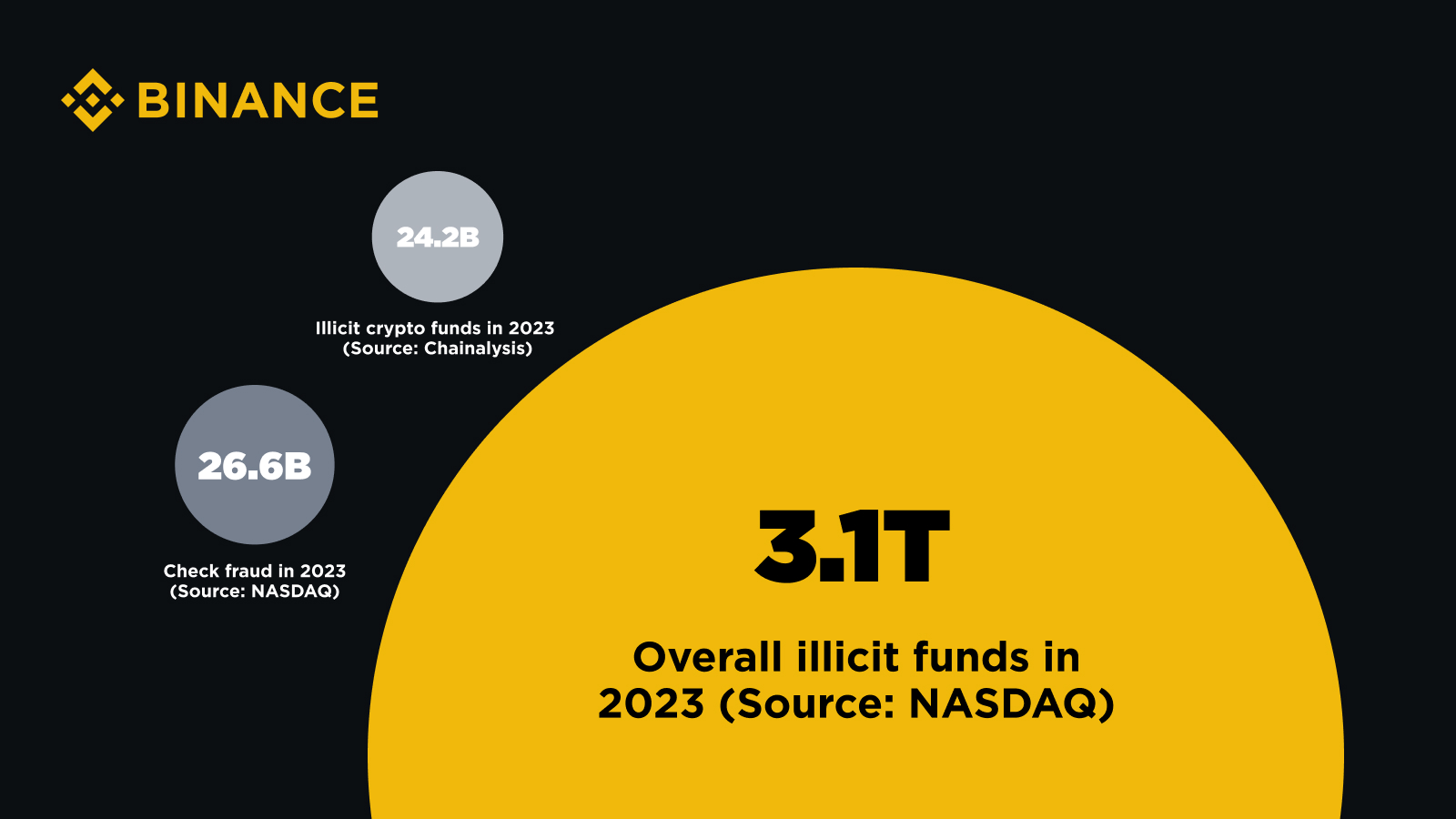

Below 1% of Global Illicit Funds

Blockchain analytics firm Chainalysis estimates that the total value of digital assets received by illicit addresses throughout 2023 was $24.2 billion, down from $39.6 billion in 2022. These numbers represent both assets stolen in crypto hacks and funds sent to wallets that Chainalysis designates as illicit: addresses associated with ransomware groups, fraud operations, darknet markets, terrorism financing, and the largest category by volume – sanctioned entities and jurisdictions. This is perhaps the most rigorous and comprehensive assessment of the scale of criminal activity associated with digital assets we have today.

24 billion dollars sounds like a lot of money, but how much is it in the context of all financial crime? NASDAQ’s recent Global Financial Crime Report puts the overall amount of illicit funds – including both crypto and fiat – that the global financial system processed last year at $3.1 trillion.

While these two numbers are not perfectly comparable since they are drawn from two distinct reports using varying methodologies, they should at least give us a pretty good idea of the relative scale of the two phenomena. 24.2 billion is less than 1% of 3.1 trillion. More specifically, the volume of illicit crypto funds as per Chainalysis constitutes exactly 0.78% of the overall volume of global illicit funds as per NASDAQ.

To add further perspective, the NASDAQ report attributes more than $485 billion of the overall 2023 losses to various forms of scams and fraud schemes. One category that generated an amount of illicit funds comparable to that associated with digital assets is bank check fraud, which resulted in individuals and businesses losing $26.6 billion last year, predominantly in the Americas where checks are still widespread.

In other words, checks, a legacy technology that still exists mainly due to the banking practices’ remarkable inertia, is responsible for more financial crime than an entire innovative asset class still wrongfully painted as criminals’ haven. Is it time to ban those clunky paper monsters yet?

Treasury: Crypto Far Behind Conventional Methods of ML

Every year, the U.S. Department of the Treasury publishes its National Risk Assessments on Money Laundering, Terrorist Financing, and Proliferation Financing, detailing key illicit finance vulnerabilities and risks threatening Americans. The 2024 Money Laundering Risk Assessment, while making note of existing and evolving trends in risks associated with cryptocurrency, explicitly states that “the use of virtual assets for money laundering continues to remain far below that of fiat currency and more conventional methods that do not involve virtual assets.”

The bulk of the report focuses on persistent and emerging money laundering risks related to conventional domains such as the misuse of legal entities; lack of transparency in some real estate transactions; lack of comprehensive AML/CFT coverage for relevant sectors, such as investment advisers; complicit professionals misusing their positions or businesses; and compliance and supervision weaknesses at some regulated financial institutions.

All these areas represent familiar structural ills inherent in the traditional financial system and corporate practices, highlighting the way in which financial crime is a systemic issue rather than something that could be blamed on a specific type of technological infrastructure or asset class.

Solution Rather Than Problem

As we look toward the future of finance and consider the direction in which the industry is headed, it is essential to continuously review and debunk outdated and entirely flawed perceptions of digital assets. Far from being the predominant instrument for financial crime, cryptocurrencies constitute a relatively insignificant portion of global illicit funds. Data show that traditional methods and tools such as real estate transactions and legacy banking practices stand as far more substantial conduits for illicit activity such as money laundering.

Instead of singling out cryptocurrencies as scapegoats for systemic financial crimes, we should pay more attention to these traditional domains and the issues ingrained within them. Despite enduring skepticism, the compelling data from various unaffiliated sources underscores the significant developments in the crypto industry and how far it is from being an ideal frontier for bad actors. A systemic issue demands systemic solutions, and digital assets should be seen as part of this solution rather than a problem.