This Page is for general information and educational purposes only. It does not constitute legal terms or any form of legal agreement between you and Binance. It should not be construed as financial, legal or other professional advice. The information on this page may be outdated. For legal terms applicable to Spot Trading Services, please refer to the Terms of Use, the Exchange Rules and the Clearing Rules. Additional terms and conditions will also be set out in the Spot Copy Trading Services Terms (as applicable to Spot Copy Trading Services).

Disclaimer: In compliance with MiCA requirements, unauthorized stablecoins are subject to certain restrictions for EEA users. For more information, please click here.

Click on each question to expand.

Spot copy trading is an innovative feature that enables users to copy real-time trades of experienced traders, also known as lead traders. This allows lead traders to showcase their trading skills and decision-making expertise, enhancing their professional reputation and credibility. Additionally, they can unlock extra rewards from ongoing campaigns and earn a share of profits from traders who copy their trades.

To use spot copy trading, lead traders must transfer their assets for copy trading from Spot Account to Spot Copy Trading Account. This prevents the assets from being withdrawn, transferred out, or used for other trading operations during the copy trading process.

Please note: You cannot withdraw assets directly from the Spot Copy Trading Account. You’ll first have to transfer the assets back to your Spot Account if you wish to withdraw the assets. This can be done once the duration of your copy trading ends.

To become a spot copy trading lead trader, you must have a verified Binance Account.

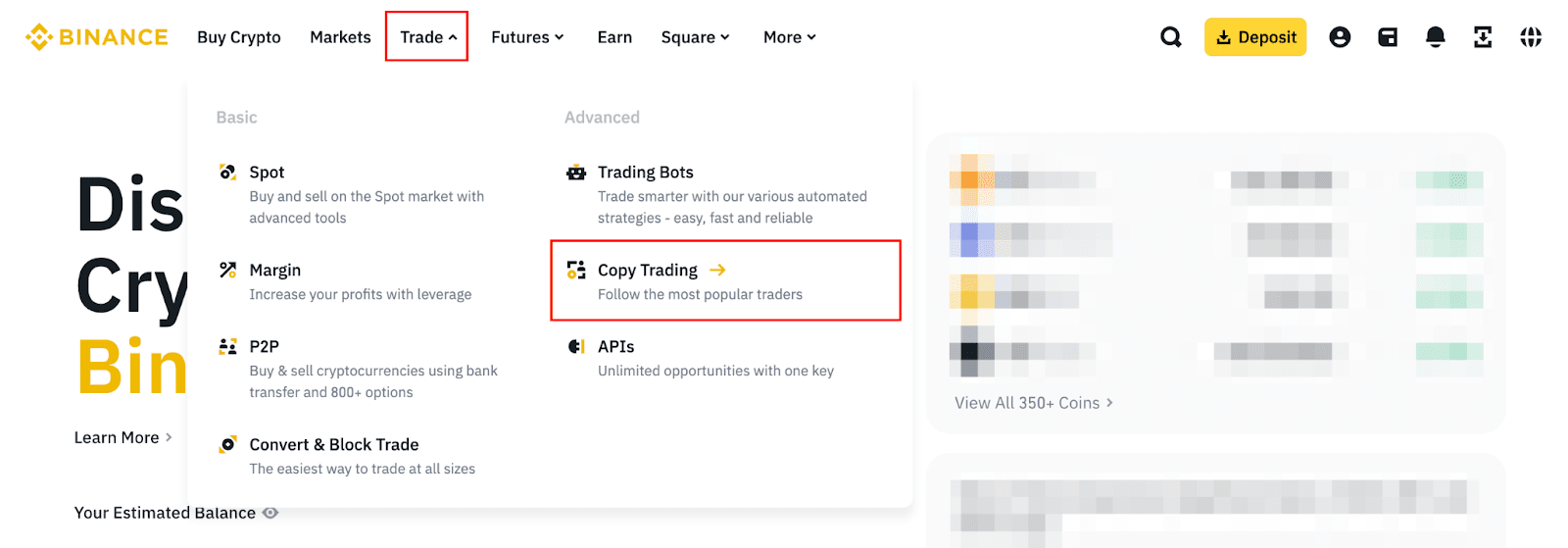

1. Log in to your Binance account and go to [Trade] - [Copy Trading].

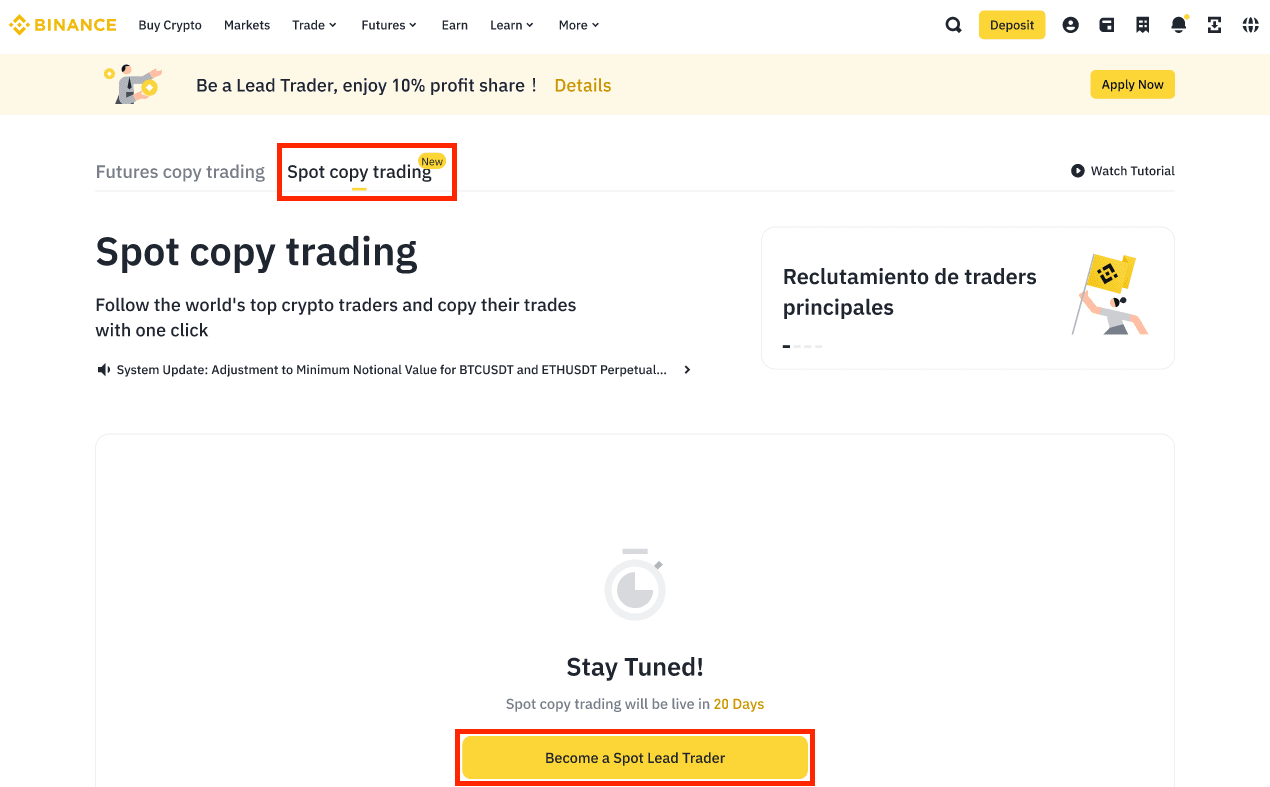

2. Go to [Spot copy trading] - [Become a Spot Lead Trader].

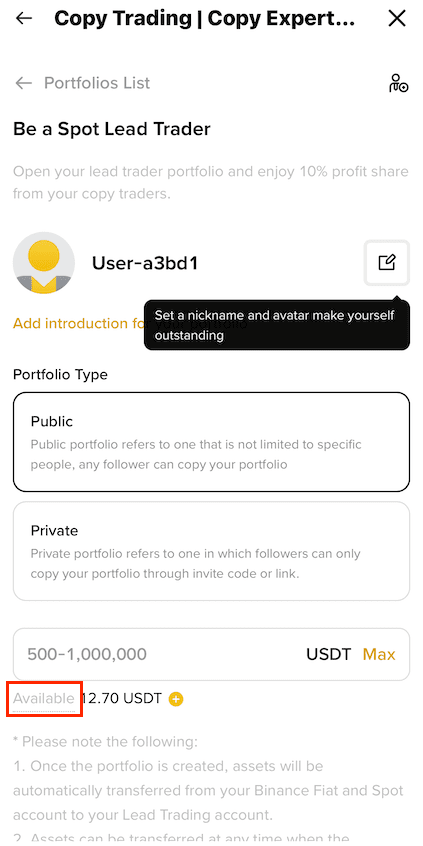

3. Set up your lead trader profile. Enter a nickname and portfolio description.

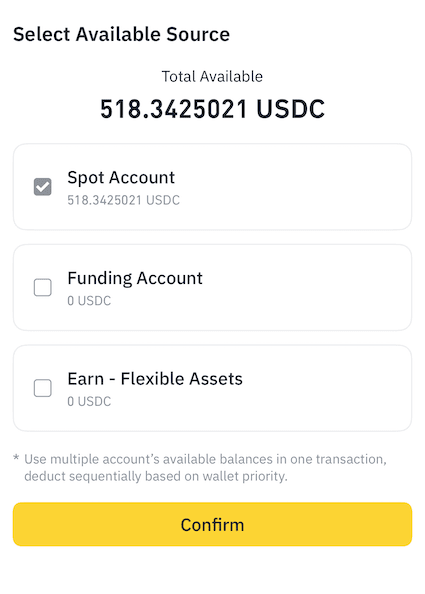

4. Enter the amount to transfer from your Spot/Funding/Earn Account to your Lead Trader Account (minimum 500 USDT, maximum 1,000,000 USDT). Read the User Service Agreement and check [I have read and agreed to the User Service Agreement] box. Click [Confirm].

Please note: By default, the source of funds may include your Spot, Funding, and Earn Accounts (if applicable). You can also choose the ideal accounts as your source of funds by clicking [Available].

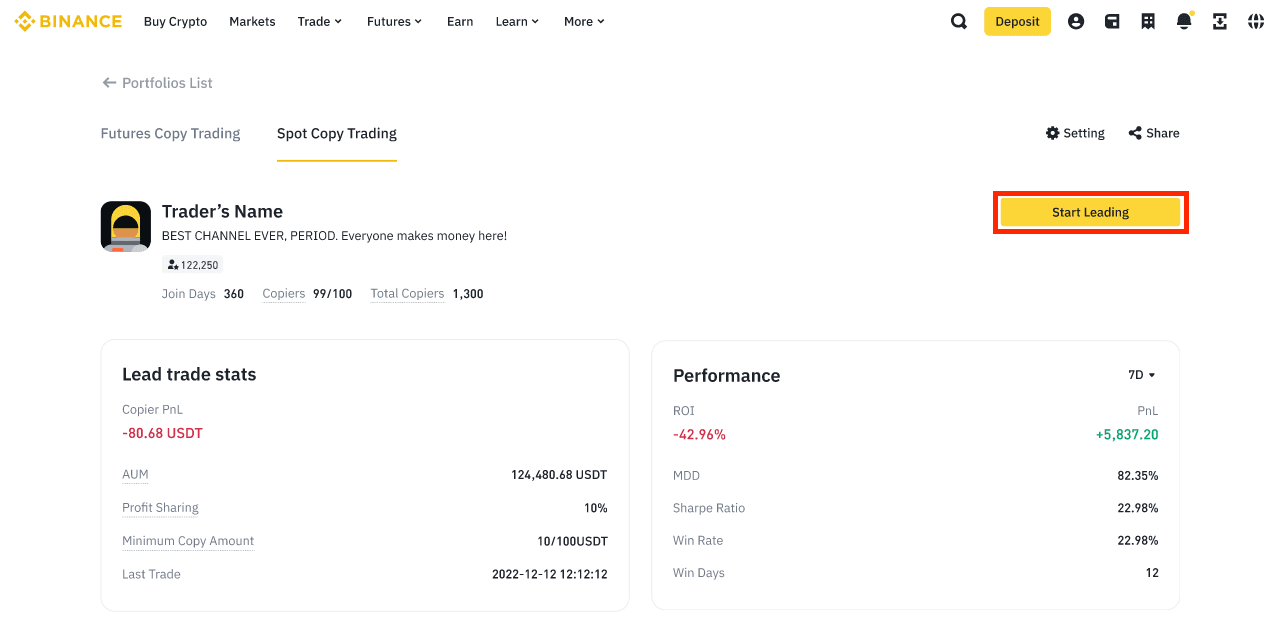

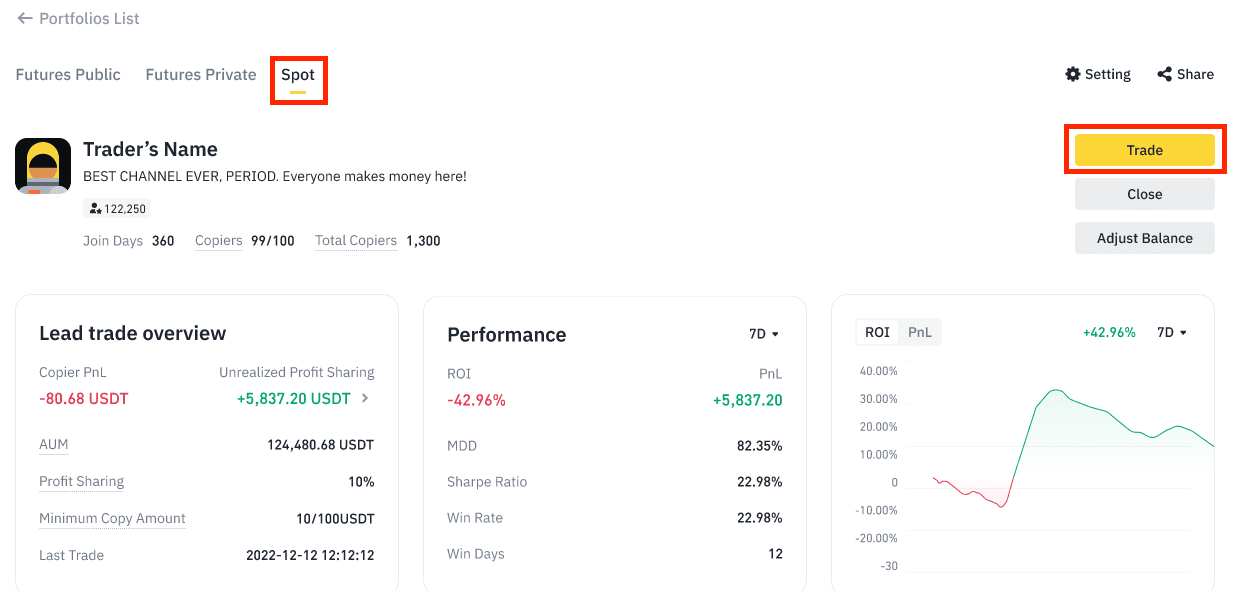

1. Log in to your Lead Trader Account and click [Start Leading].

2. Choose one of the following actions:

To enhance the user experience, the spot copy trading interface is similar to the existing spot trading interface.

1. Search for your desired trading pair at the top.

2. Enter the order details in the trade section.

3. You can choose the order type for the copy trading portfolio by clicking on the [Settings] icon.

Return on Investment (ROI) reflects the profitability or efficiency of a portfolio. It is calculated similarly to the yield rate (net asset value), which prevents the changes in capital (e.g. deposits and withdrawals).

In the following formulas, "T" represents the time after a deposit/withdrawal, while "T - 1" represents the time before a deposit/withdrawal.

When a portfolio is created, the initial net asset value is 1. When a deposit or withdrawal happens, the net asset value will be immediately updated.

T Net Asset Value = (T Wallet Balance - Deposit Amount) / (T - 1) Wallet Balance * (T - 1) Net Asset Value

T Net Asset Value = (T Wallet Balance + Withdrawal Amount) / (T - 1) Wallet Balance * (T - 1) Net Asset Value

Net Asset Value = T Wallet Balance / (T - 1) Wallet Balance * (T - 1) Net Asset Value

| Day 1 | Day 2 | Day 3 | Day 4 |

Wallet Balance | 500 | 400 | 1,400 | 1,550 |

Portfolio PNL | 0 | -100 | 0 | +150 |

Deposit | - | - | 1,000 | - |

Withdrawal | - | - | - | - |

Net Asset Value | 1 | 0.8 | 0.8 | 0.886 |

ROI | 0% | -20% | -20% | -11.4% |

Important note: ROI has its limitations. For example, when comparing two different trades, the ROI calculation doesn't factor in the time cost. ROI calculation is for reference purposes only.

Buy order:

Lead Trader Order Type | Copy Trigger | Copy Trader Order Type |

Taker (Market, Stop Market) | Immediate | Limit Order (IOC) Limit price: Slippage cap (0.3% for BTC/USDT & ETH/USDT. 0.5% for all other pairs) |

Maker (Limit, Stop Limit) | Once the order is fully filled | Limit Order (IOC) Limit price: Slippage cap (BTC/USDT and ETH/USDT: 0.3%. Other pairs: 0.5%) |

Sell order:

Lead Trader Order Type | Copy Trigger | Copy Trader Order Type |

Taker (Market, Stop Market) | Immediately | Market |

Maker (Limit, Stop Limit) | Once the order is fully filled | Market |

Notes:

[Fixed Ratio] mode

Please note: Slippage can affect the copy trader’s order price, potentially resulting in a final order size lower than the lead trader’s.

[Fixed Amount] mode

Please note: If the buy order amount doesn’t meet the minimum trade amount, the system will not place the order. For more details, please refer to Trading Rules.

Please note: When a copy trader’s portfolio balance is below the minimum copy amount and fails to copy 5 consecutive orders, it will be automatically closed. Reasons for the failure could be insufficient balance, not meeting the minimum order size, etc. The system will check and close copy portfolios that don’t meet the requirements each Friday. This measure is in place to ensure that only eligible copy traders continue to remain.

In Binance Spot Copy Trading, lead traders can receive:

Please note:

In addition, lead traders will receive profits when:

Profit to be Settled = Max [Total Realized Profit of the Copy Portfolio * Profit Share Percentage - Shared Profit, 0]

The profit amount to be settled is based on the portfolio’s PNL. The system will calculate the total profits of all copy portfolios.

For example, the investment amount for a copy portfolio is 1,000 USDT, and the copy portfolio trades multiple times a week. The profit share percentage is 10%.

Time | PNL change | Total PNL | Total Profit Share | Shared Profit | Profits to Be Settled |

Week 1 | + 200 | + 200 | 20 | 0 | 20 |

Week 2 | - 150 | + 50 | 5 | 20 | 0 |

Week 3 | + 100 | + 150 | 15 | 20 | 0 |

Week 4 | + 150 | + 300 | 30 | 20 | 10 |

For week 2 and 3, as the total profit share amount is lower than the shared profit amount, therefore, the profit to be settled is 0.

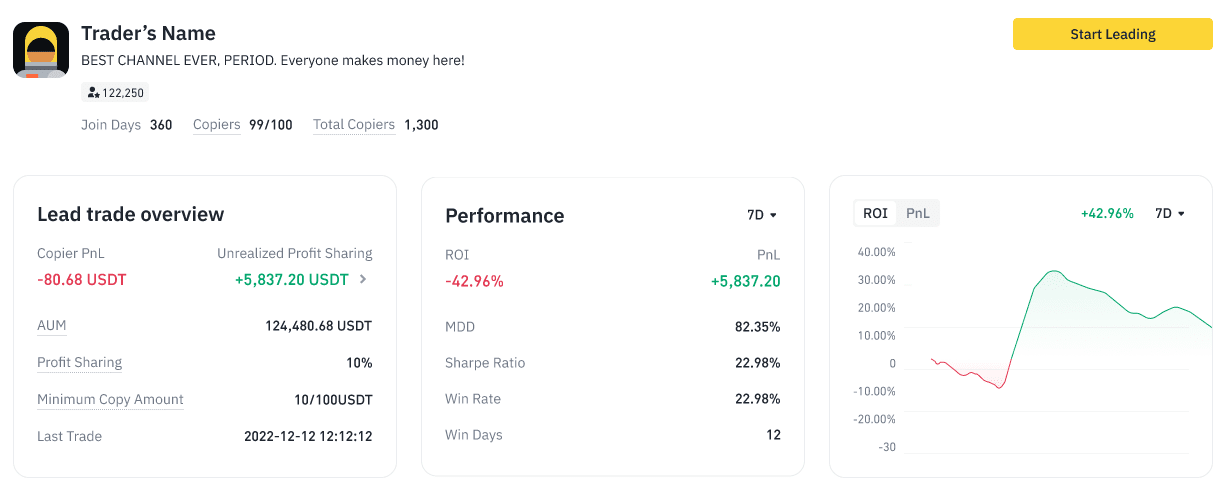

On the spot copy trading page, lead traders can see data relevant to their portfolios:

[Lead trader stats]

[Performance]

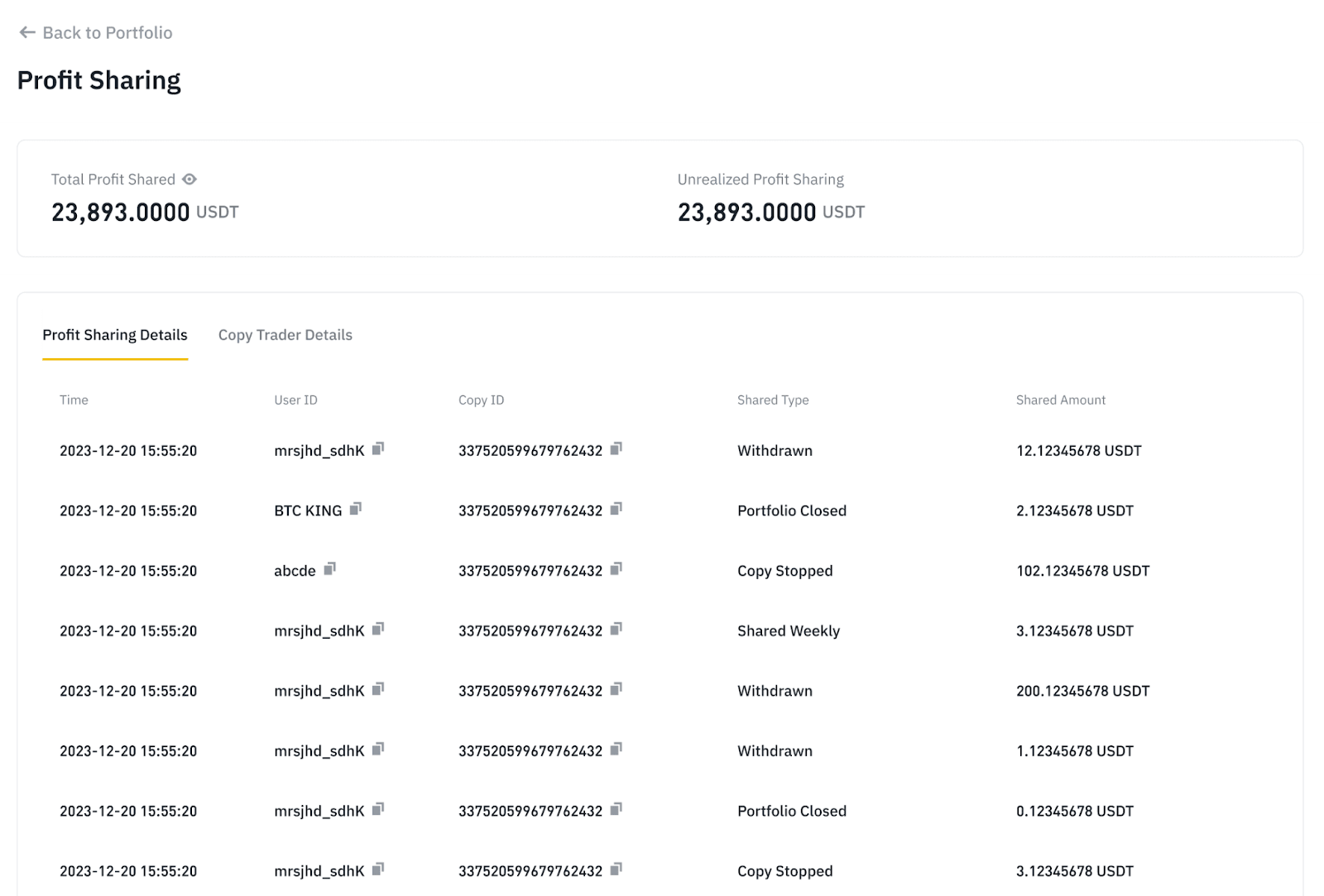

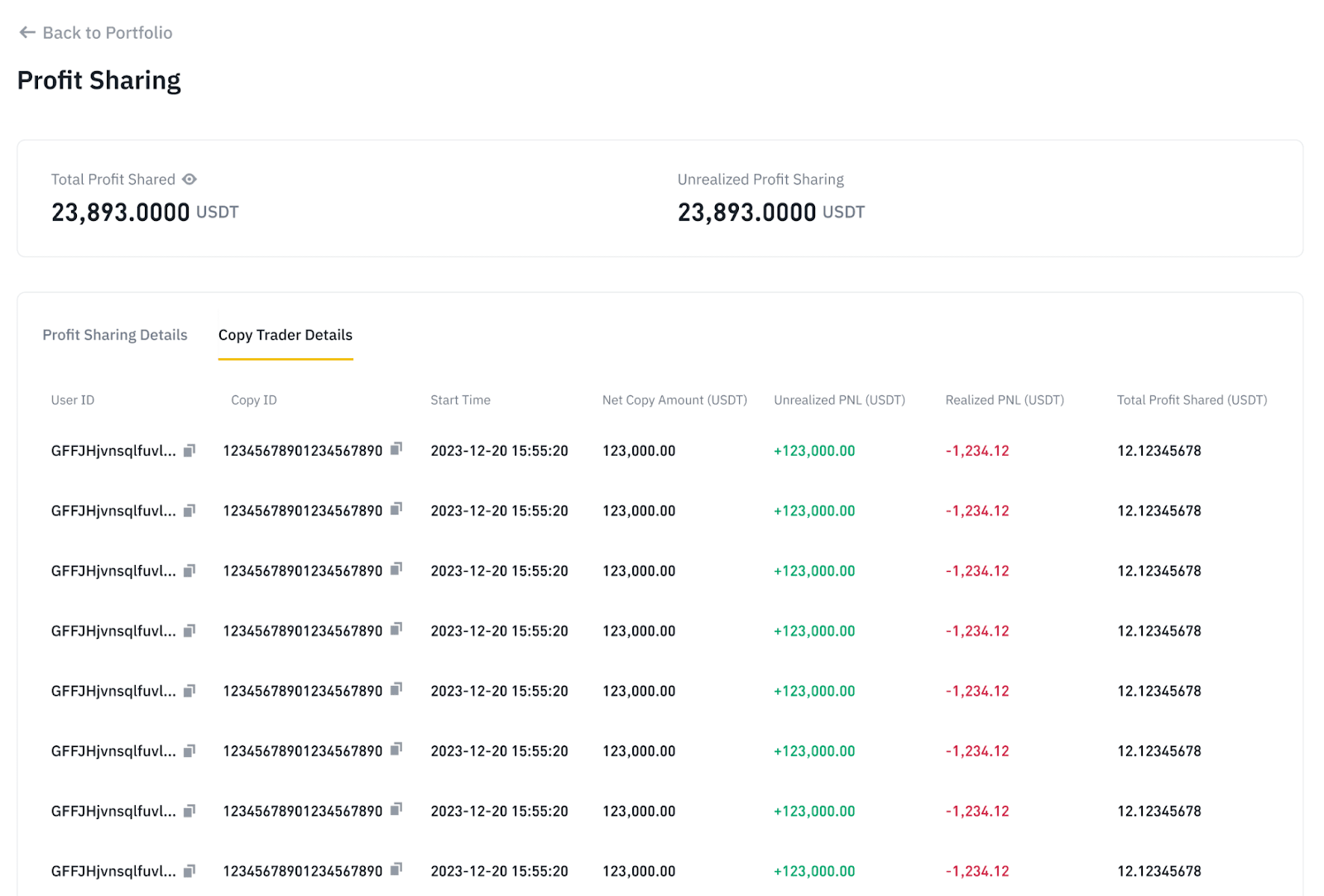

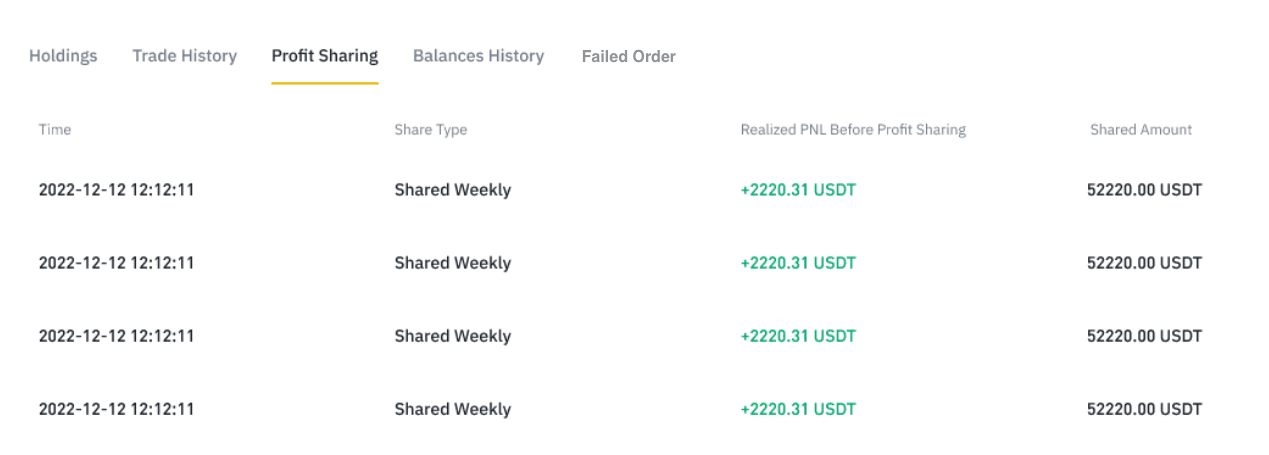

On the spot copy trading page, under ‘Profit Sharing’, lead traders can view data relevant to their portfolios:

[Profit Sharing Details] tab:

[Copy Trader Details] tab:

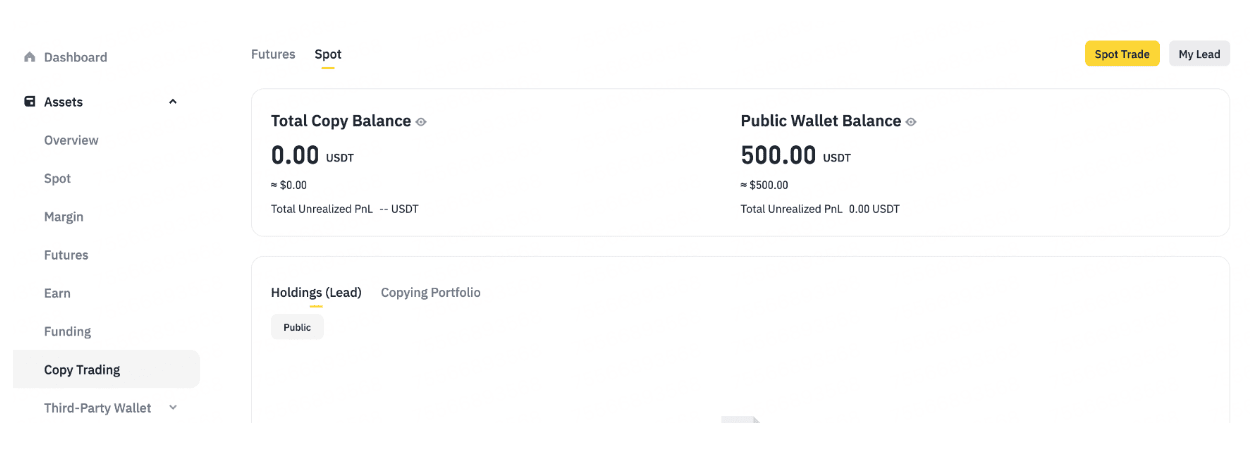

Lead traders can also check their Spot Copy Trading Account balances via the Asset page.

Total Copy Balance: Balance of the lead trader’s own copier account if they are currently copying another lead trader’s portfolio.

Public Wallet Balance: Balance of the lead trader’s lead trading account.

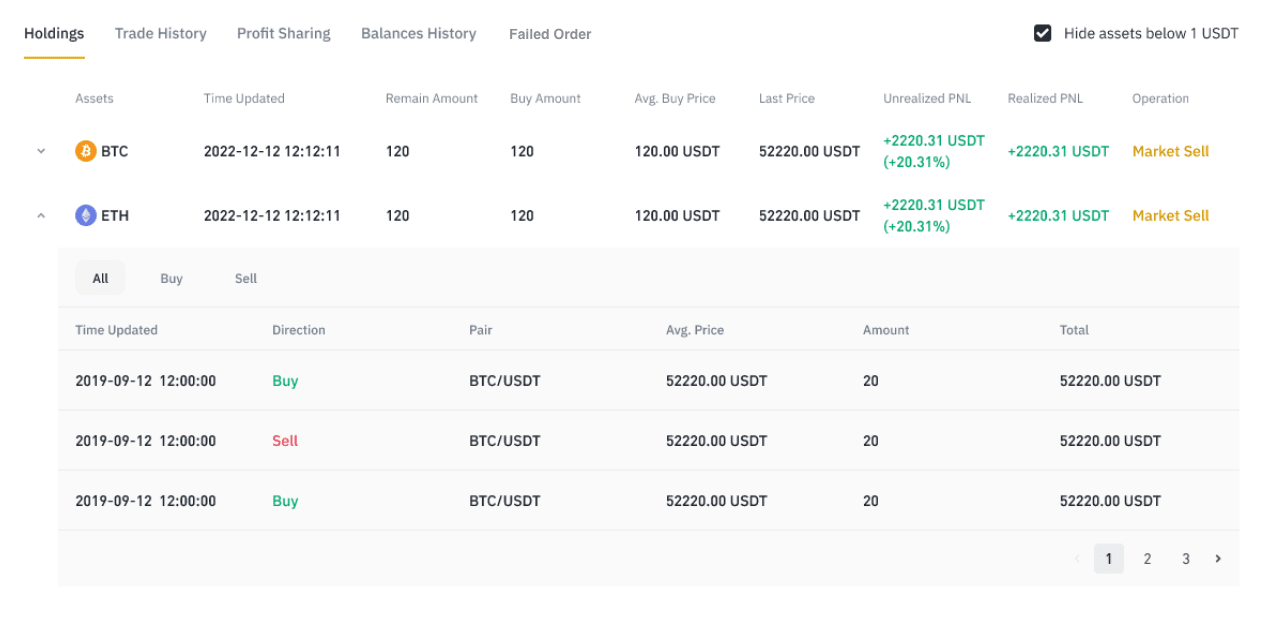

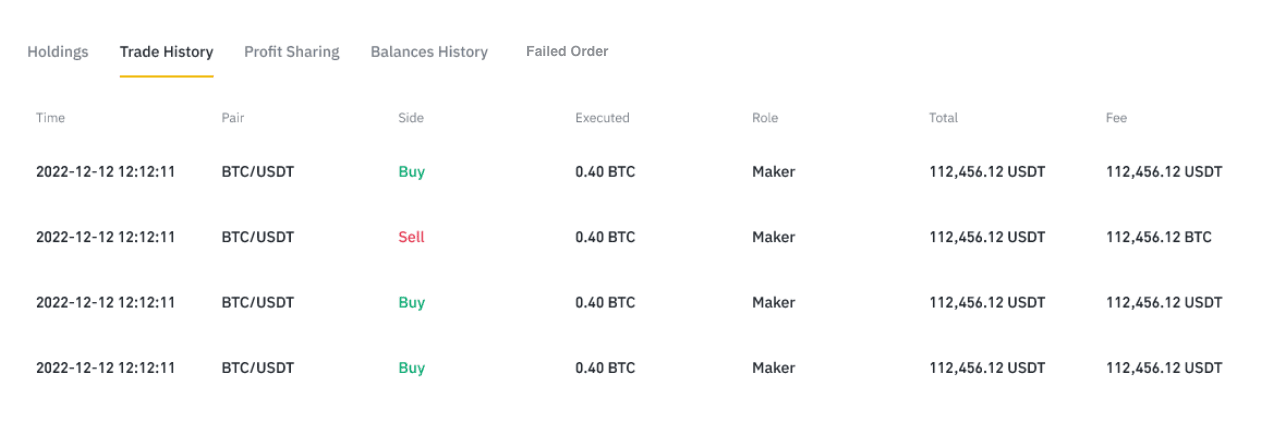

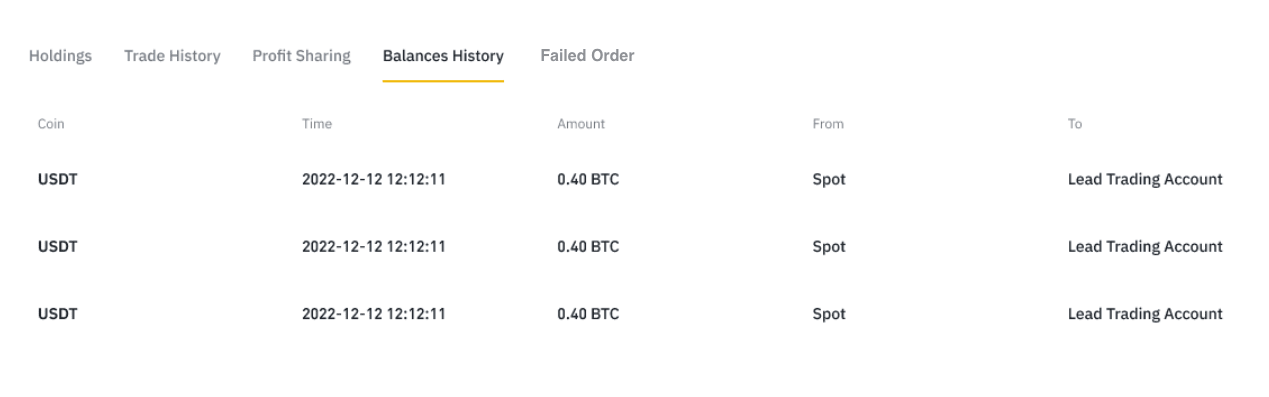

If you are a lead trader and a copier, you can view transaction details in the following tabs:

[Portfolio History]

[Holdings]

[Trade History]

[Profit Sharing]

[Balances History]

To withdraw all assets, the lead trader can cancel all pending orders and sell all tokens to USDT, then click [Close] to stop the running portfolio.

All investments carry a certain degree of risk. In copy trading, if the strategy you follow is unsuccessful, you may lose your investments. You may also face the risk of slippage during a volatile market or if the assets you trade have low liquidity. Therefore, you should take risk control and invest rationally within your financial ability.