Goshi khanzada

ALHAMDULLILAH FOR EVERYTHING

0 Urmăriți

18 Urmăritori

33 Apreciate

0 Distribuite

Vedeți originalul

🎁 Câștigă $BTC gratuit

Noapte bună 🌹

Cum te poți participa:

1️⃣ Repost

2️⃣ Like

3️⃣ Partajează

💬 Comentează „Noapte bună”

#BinanceSquareFamily

#ScriePentruA Câștiga #BTC #BNB $BNB $SOL

$SOL : 131.83

📈 +0.17%

Noapte bună 🌹

Cum te poți participa:

1️⃣ Repost

2️⃣ Like

3️⃣ Partajează

💬 Comentează „Noapte bună”

#BinanceSquareFamily

#ScriePentruA Câștiga #BTC #BNB $BNB $SOL

$SOL : 131.83

📈 +0.17%

Vedeți originalul

🎁 Avertizare #RedRaffle! 🎁

#DUSK 🔥 Gratuit $BNB B este în joc! 💰

⏳ Nu rata această recompensă cu timp limitat!

Cum te alături 👇

✅ Urmărește

✅ Like

💬 Comentează: Binance

⚡ Cei mai repezi primesc recompensele primii!

Reclamă acum & rămâi la curent cu alte surprize!

#RedPacket #BNBGiveaway #Binance #CryptoRewards #DuskNetwork

#DUSK 🔥 Gratuit $BNB B este în joc! 💰

⏳ Nu rata această recompensă cu timp limitat!

Cum te alături 👇

✅ Urmărește

✅ Like

💬 Comentează: Binance

⚡ Cei mai repezi primesc recompensele primii!

Reclamă acum & rămâi la curent cu alte surprize!

#RedPacket #BNBGiveaway #Binance #CryptoRewards #DuskNetwork

Vedeți originalul

$ETH $AB

## Informații despre piața de acțiuni pentru Bitcoin (BTC)

* Bitcoin este o criptomonedă în piața CRYPTO.

* Prețul este de 89618,0 USD în prezent, cu o schimbare de 563,00 USD (0,01%) față de închiderea anterioară.

* Maximul intraday este de 90804,0 USD, iar minimul intraday este de 88509,0 USD.

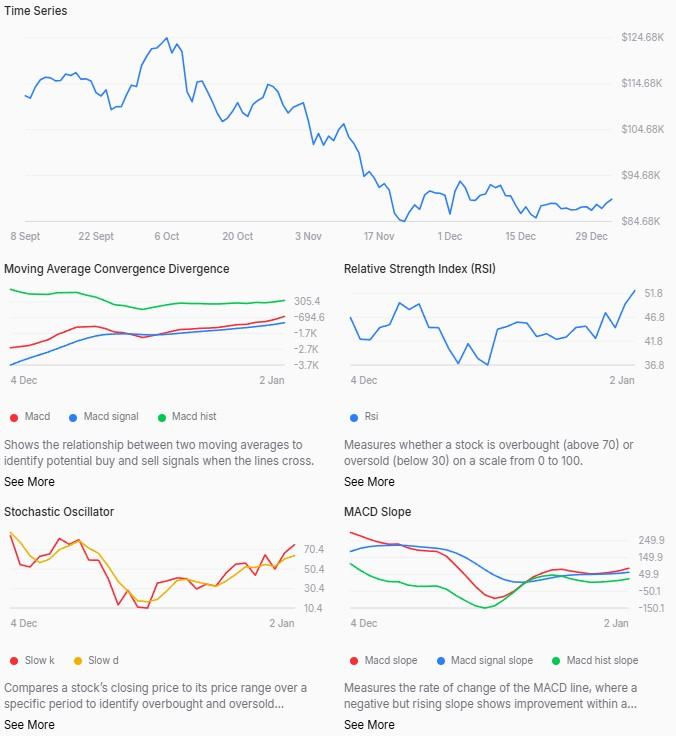

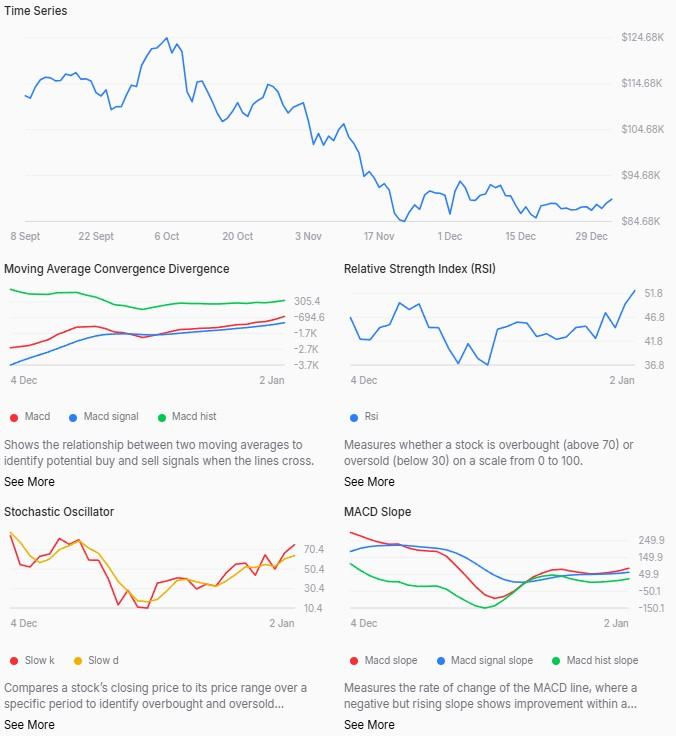

Bitcoin (BTC) se tranzacționează în jurul **~89.600 USD** și arată în prezent o mișcare limitată în direcție — un semn de **consolidare a pieței**, mai degrabă decât un nou breakout de trend.

---

## 📈 **Structura pieței: Consolidare, nu trend**

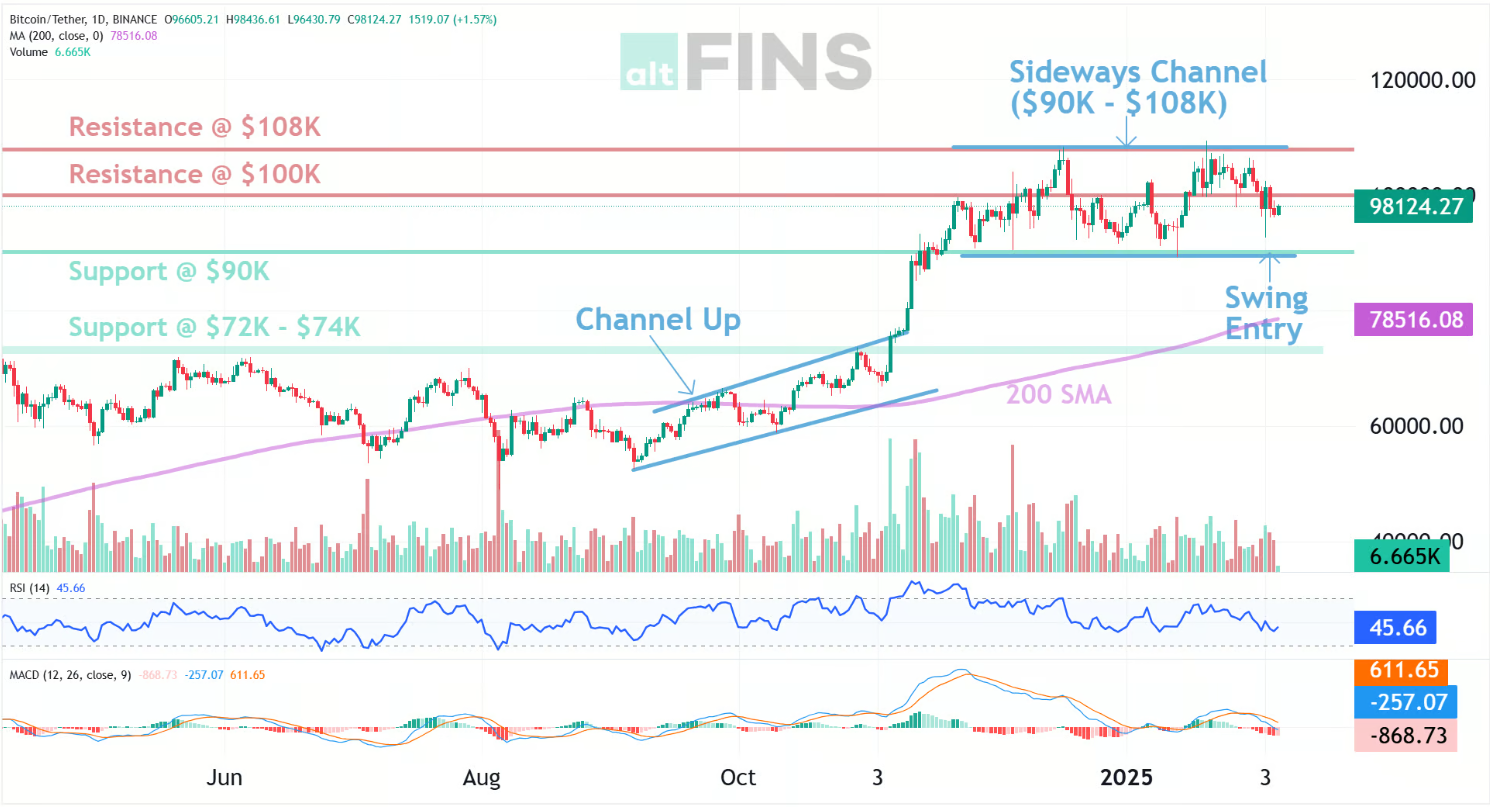

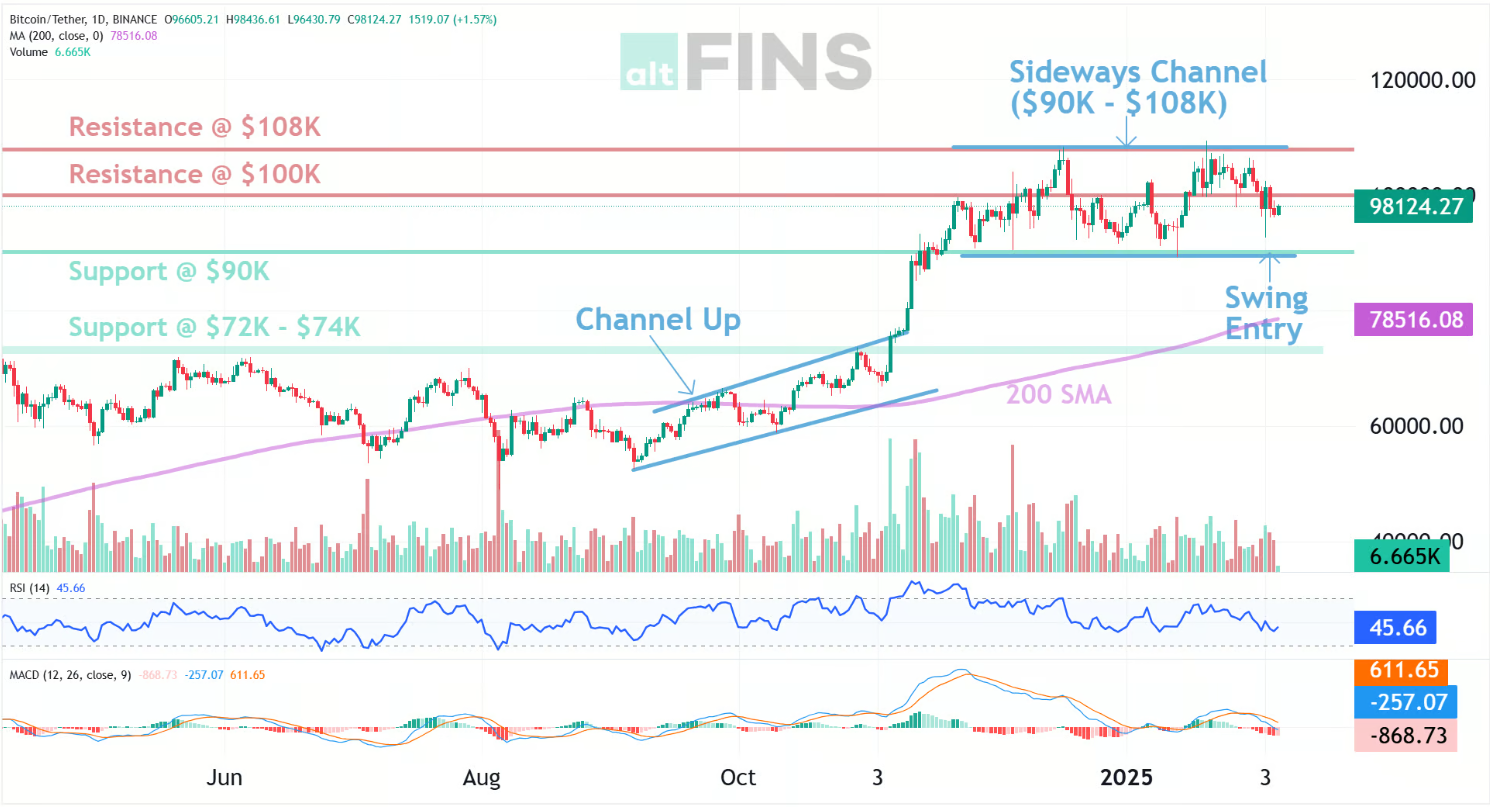

Acțiunea recentă a prețului arată că BTC a scăzut într-un **interval strâns între aproximativ 80.800 USD suport și 94.000 USD rezistență**, cu volume de tranzacționare scăzute și incertitudine care domină piețele. Analistii descriu acest lucru ca o **fază de consolidare într-un interval**, după un drawdown profund de la maximurile din 2025. ([Pintu][1])

➡️ *Ce înseamnă acest lucru:* Piața nu se mișcă puternic în sus sau în jos — tranzactionarii așteaptă noi catalizatori (date macro, fluxuri ETF, știri regulate) înainte ca direcția să devină clară.

---

## 🔍 **Semnale tehnice și modele**

* **Tranzacționarea în lateral** în interiorul unui canal sugerează lipsa de impuls și o volatilitate redusă pe termen scurt. ([ZebPay][2])

* O depășire a lui **94.000 USD** ar putea declanșa un nou rally; o scădere sub **80.000 USD** ar putea semnala o corecție mai profundă. ([Pintu][1])

* Indicatorii precum volumul în scădere și consolidarea precede adesea **mişcări mari**, dar direcția nu este încă confirmată.

#BTC90kChristmas #ETH #ab #StrategyBTCPurchase #BTCVSGOLD

## Informații despre piața de acțiuni pentru Bitcoin (BTC)

* Bitcoin este o criptomonedă în piața CRYPTO.

* Prețul este de 89618,0 USD în prezent, cu o schimbare de 563,00 USD (0,01%) față de închiderea anterioară.

* Maximul intraday este de 90804,0 USD, iar minimul intraday este de 88509,0 USD.

Bitcoin (BTC) se tranzacționează în jurul **~89.600 USD** și arată în prezent o mișcare limitată în direcție — un semn de **consolidare a pieței**, mai degrabă decât un nou breakout de trend.

---

## 📈 **Structura pieței: Consolidare, nu trend**

Acțiunea recentă a prețului arată că BTC a scăzut într-un **interval strâns între aproximativ 80.800 USD suport și 94.000 USD rezistență**, cu volume de tranzacționare scăzute și incertitudine care domină piețele. Analistii descriu acest lucru ca o **fază de consolidare într-un interval**, după un drawdown profund de la maximurile din 2025. ([Pintu][1])

➡️ *Ce înseamnă acest lucru:* Piața nu se mișcă puternic în sus sau în jos — tranzactionarii așteaptă noi catalizatori (date macro, fluxuri ETF, știri regulate) înainte ca direcția să devină clară.

---

## 🔍 **Semnale tehnice și modele**

* **Tranzacționarea în lateral** în interiorul unui canal sugerează lipsa de impuls și o volatilitate redusă pe termen scurt. ([ZebPay][2])

* O depășire a lui **94.000 USD** ar putea declanșa un nou rally; o scădere sub **80.000 USD** ar putea semnala o corecție mai profundă. ([Pintu][1])

* Indicatorii precum volumul în scădere și consolidarea precede adesea **mişcări mari**, dar direcția nu este încă confirmată.

#BTC90kChristmas #ETH #ab #StrategyBTCPurchase #BTCVSGOLD

Vedeți originalul

$XRP

---

## 🔍 **Instantaneu al pieței Bitcoin — Începutul lunii Ianuarie 2026**

📊 **Acțiunea prețului actuală:**

Bitcoin a fost **tranzacționat într-un interval strâns** în apropierea unor niveluri cheie, în jur de ~89.000–90.000 USD, reflectând o *consolidare persistentă în loc de o ieșire direcțională*. Aceasta arată o indecizie pe termen scurt dintre tranzactionari și investitori în active cu risc. ([FXStreet][1])

📈 **Structura tehnică:**

* BTC se află **într-o zonă de consolidare**, cu rezistență în apropierea **89.000–92.000 USD** și sprijin în jur de **84.000–87.000 USD**. ([Blockchain News][2])

* Mai multe indicatori de moment (cum ar fi MACD și RSI) arată **semnale amestecate**, sugerând că cumpărătorii și vânzătorii sunt echilibrați pe termen scurt. ([CoinMarketCap][3])

* Tranzactionarii urmăresc atent o **înălțare peste 90.500 USD** — aceasta ar putea declanșa o nouă creștere către obiectivele de **95.000–100.000 USD**. ([Blockchain News][2])

---

## 📊 **Perspectivă pe termen scurt: Consolidare cu o tendință bullishă**

**Scenariul bullish**

* O mișcare decisivă deasupra **rezistenței superioare (~92.000 USD)** ar deschide calea către **95.000 USD+** și posibil **100.000 USD** în această perioadă.

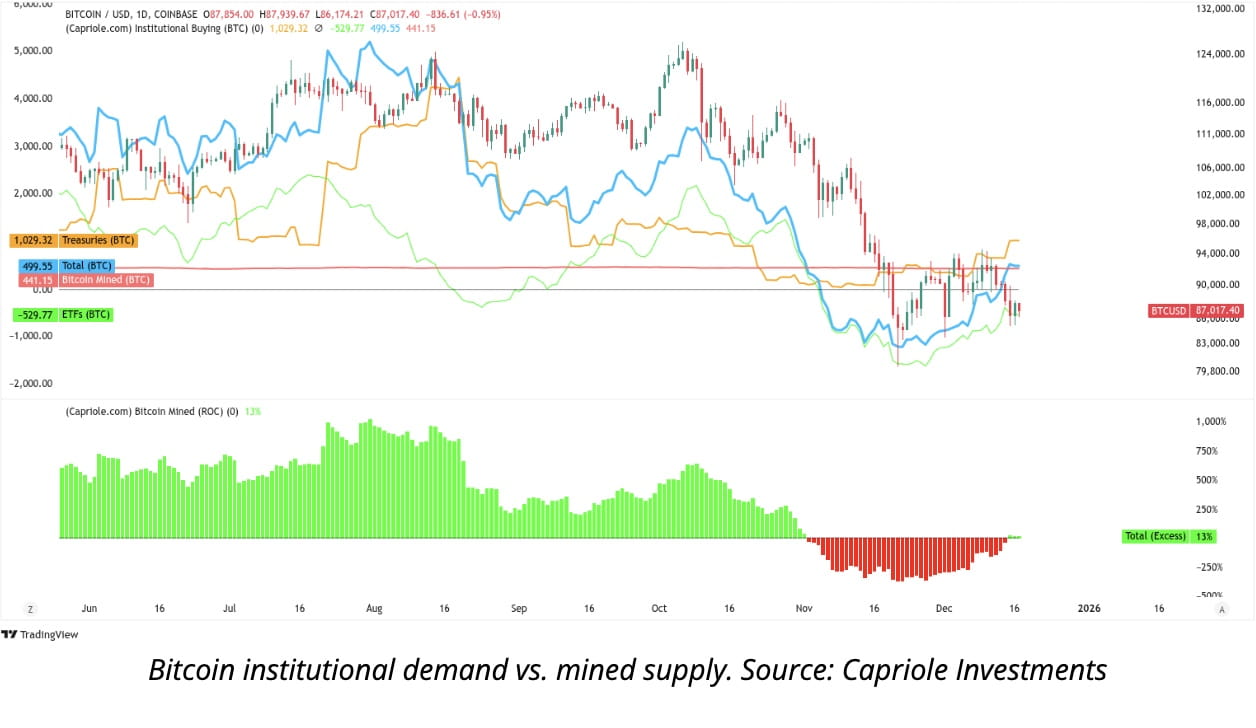

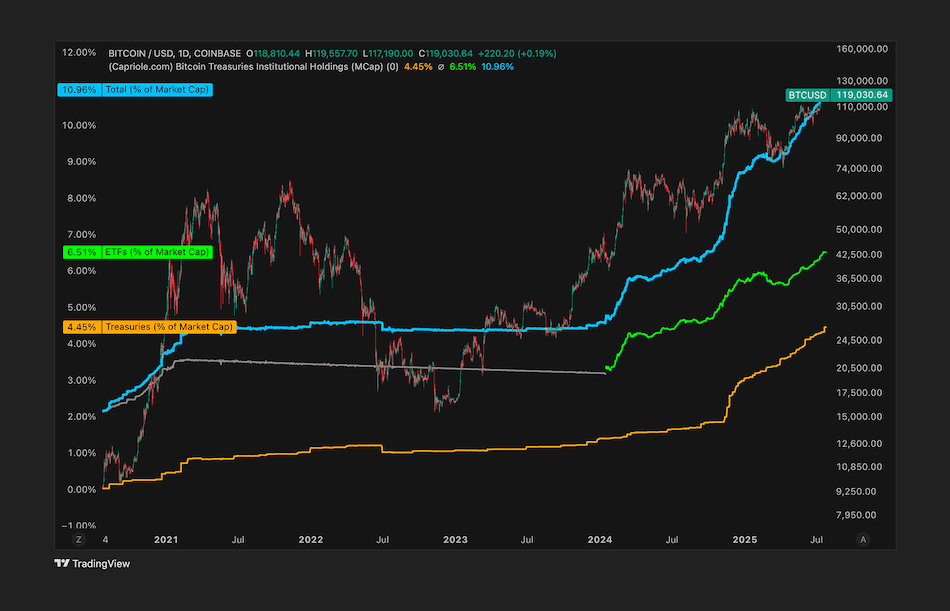

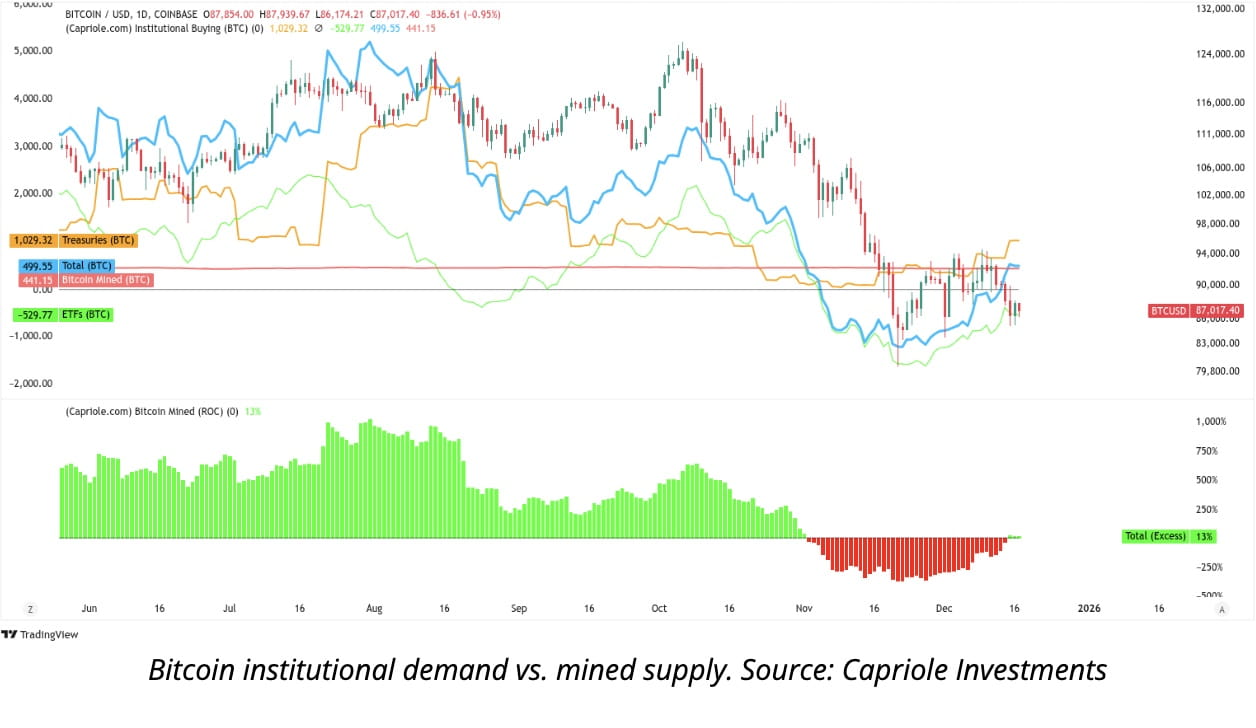

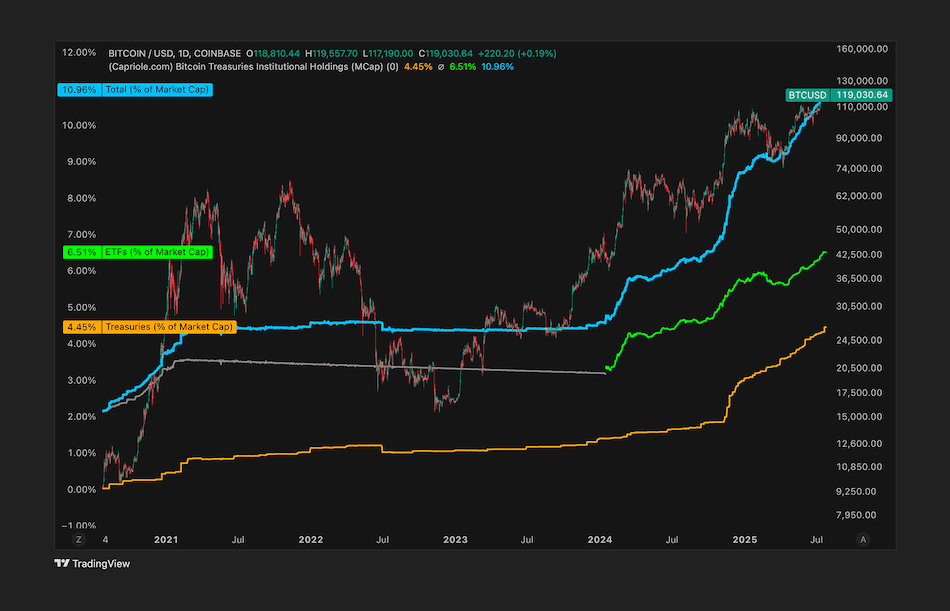

* Creșterea interesului instituțional prin ETF-uri și trezorerii corporative ar putea acționa ca *combustibil pentru continuarea creșterii*. ([CoinMarketCap][3])

**Scenariul bearish**

* Dacă BTC depășește sub **zonele de sprijin 84.000–87.000 USD**, retrageri mai profunde către **80.000 USD sau mai puțin** nu pot fi excluse.

* Factori macroeconomici de risc — cum ar fi o atitudine generală de evitare a riscului sau fluxuri mai lente de ETF — ar putea presa prețurile mai departe. ([CoinMarketCap][3])

---

## 📌 **Forțe fundamentale în acțiune**

### 🧠 **Accumulare instituțională**

#xrp #BTC90kChristmas #StrategyBTCPurchase #BTCVSGOLD #WriteToEarnUpgrade

---

## 🔍 **Instantaneu al pieței Bitcoin — Începutul lunii Ianuarie 2026**

📊 **Acțiunea prețului actuală:**

Bitcoin a fost **tranzacționat într-un interval strâns** în apropierea unor niveluri cheie, în jur de ~89.000–90.000 USD, reflectând o *consolidare persistentă în loc de o ieșire direcțională*. Aceasta arată o indecizie pe termen scurt dintre tranzactionari și investitori în active cu risc. ([FXStreet][1])

📈 **Structura tehnică:**

* BTC se află **într-o zonă de consolidare**, cu rezistență în apropierea **89.000–92.000 USD** și sprijin în jur de **84.000–87.000 USD**. ([Blockchain News][2])

* Mai multe indicatori de moment (cum ar fi MACD și RSI) arată **semnale amestecate**, sugerând că cumpărătorii și vânzătorii sunt echilibrați pe termen scurt. ([CoinMarketCap][3])

* Tranzactionarii urmăresc atent o **înălțare peste 90.500 USD** — aceasta ar putea declanșa o nouă creștere către obiectivele de **95.000–100.000 USD**. ([Blockchain News][2])

---

## 📊 **Perspectivă pe termen scurt: Consolidare cu o tendință bullishă**

**Scenariul bullish**

* O mișcare decisivă deasupra **rezistenței superioare (~92.000 USD)** ar deschide calea către **95.000 USD+** și posibil **100.000 USD** în această perioadă.

* Creșterea interesului instituțional prin ETF-uri și trezorerii corporative ar putea acționa ca *combustibil pentru continuarea creșterii*. ([CoinMarketCap][3])

**Scenariul bearish**

* Dacă BTC depășește sub **zonele de sprijin 84.000–87.000 USD**, retrageri mai profunde către **80.000 USD sau mai puțin** nu pot fi excluse.

* Factori macroeconomici de risc — cum ar fi o atitudine generală de evitare a riscului sau fluxuri mai lente de ETF — ar putea presa prețurile mai departe. ([CoinMarketCap][3])

---

## 📌 **Forțe fundamentale în acțiune**

### 🧠 **Accumulare instituțională**

#xrp #BTC90kChristmas #StrategyBTCPurchase #BTCVSGOLD #WriteToEarnUpgrade

Vedeți originalul

$BNB

### 📊 Perspectivă tendință

Bitcoin continuă să respecte tendința sa **pe termen lung ascendentă**, chiar și după consolidarea recentă. Pe cadrele temporale mai mari, acțiunea prețului pare o **oprire în cadrul unui ciclu bull mai larg**, nu o ruptură. Acest tip de mișcare laterală apare adesea după rally-uri puternice, când piața asimilează profiturile realizate.

---

### 🧱 Zone Tehnice Cheie

* **Susținere puternică:** Zona în care cumpărătorii au intrat anterior în mod agresiv

* **Rezistență majoră:** Zona în care presiunea de vânzare s-a dovedit repetat a încetini avansurile

* Prețul se află în prezent într-o **compresiune între aceste zone**, sugerând că o mișcare mai mare poate fi la îndemână odată ce direcția va fi confirmată.

---

### 😐 Sentimentul Pieței

Sentimentul s-a răcorit de la o optimizare extremă la o poziție mai **neutru / precaută**. Din punct de vedere istoric, acest lucru reduce riscul de scădere și creează spațiu pentru o creștere reînnoită dacă intră o nouă cerere pe piață.

---

## 🔮 Scenarii Viitoare

**Caz bullish 🟢**

* Depășirea rezistenței cu volum

* Interes reînnoit din partea instituțiilor

* Continuarea momentumului către noi maxime mai târziu în ciclu

**Caz neutral 🟡**

* Tranzacționare continuă într-un interval

* Volatilitatea rămâne scăzută în timp ce piața acumulează energie

**Caz bearish 🔴**

* Pierderea susținerii majore

* Presiune macro se extinde asupra activelor riscante

* Corecție mai profundă înainte de următoarea fază de expansiune

---

### ✍️ Concluzie Finală

Bitcoin pare să fie **în repaus, nu în inversare**. În măsura în care susținerea pe termen lung se menține, structura generală favorizează **continuarea, nu colapsul**. Tradersii urmăresc **extinderea volatilității** ca următorul semnal major.

#BTC90kChristmas #BTCVSGOLD #StrategyBTCPurchase #CryptoMarketAnalysis #StrategyBTCPurchase

### 📊 Perspectivă tendință

Bitcoin continuă să respecte tendința sa **pe termen lung ascendentă**, chiar și după consolidarea recentă. Pe cadrele temporale mai mari, acțiunea prețului pare o **oprire în cadrul unui ciclu bull mai larg**, nu o ruptură. Acest tip de mișcare laterală apare adesea după rally-uri puternice, când piața asimilează profiturile realizate.

---

### 🧱 Zone Tehnice Cheie

* **Susținere puternică:** Zona în care cumpărătorii au intrat anterior în mod agresiv

* **Rezistență majoră:** Zona în care presiunea de vânzare s-a dovedit repetat a încetini avansurile

* Prețul se află în prezent într-o **compresiune între aceste zone**, sugerând că o mișcare mai mare poate fi la îndemână odată ce direcția va fi confirmată.

---

### 😐 Sentimentul Pieței

Sentimentul s-a răcorit de la o optimizare extremă la o poziție mai **neutru / precaută**. Din punct de vedere istoric, acest lucru reduce riscul de scădere și creează spațiu pentru o creștere reînnoită dacă intră o nouă cerere pe piață.

---

## 🔮 Scenarii Viitoare

**Caz bullish 🟢**

* Depășirea rezistenței cu volum

* Interes reînnoit din partea instituțiilor

* Continuarea momentumului către noi maxime mai târziu în ciclu

**Caz neutral 🟡**

* Tranzacționare continuă într-un interval

* Volatilitatea rămâne scăzută în timp ce piața acumulează energie

**Caz bearish 🔴**

* Pierderea susținerii majore

* Presiune macro se extinde asupra activelor riscante

* Corecție mai profundă înainte de următoarea fază de expansiune

---

### ✍️ Concluzie Finală

Bitcoin pare să fie **în repaus, nu în inversare**. În măsura în care susținerea pe termen lung se menține, structura generală favorizează **continuarea, nu colapsul**. Tradersii urmăresc **extinderea volatilității** ca următorul semnal major.

#BTC90kChristmas #BTCVSGOLD #StrategyBTCPurchase #CryptoMarketAnalysis #StrategyBTCPurchase

Vedeți originalul

$BTC Contextul pieței:

Bitcoin se tranzacționează într-un interval restrâns aproape de ~$88,000, arătând o mișcare laterală cu volatilitate scăzută. Acest lucru sugerează că piața se consolidează după retragerea din sfârșitul anului 2025 de la maximele de peste $126,000. Consolidarea în această zonă reflectă un sentiment prudent printre comercianți și instituții. The Economic Times+1

Structura tehnică:

Limitată: BTC este blocat între aproximativ $85,000 și $90,000, cu respingeri repetate aproape de limita superioară. MEXC

Rezistența cheie: Bariera imediată în jurul valorii de $90,000 – $92,000. O închidere zilnică curată deasupra acestui nivel este văzută pe scară largă ca un declanșator optimist. Blockchain News

Niveluri de suport: Niveluri tehnice mai puternice se află aproape de $84,000–$87,000; o rupere sub acestea ar putea invita la teste mai profunde. MEXC

Momentum: Indicatorii tehnici mixte arată consolidare fără o direcție clară — cumpărătorii și vânzătorii sunt în prezent echilibrați. CoinMarketCap

Sentiment și perspectivă:

Sentimentul pieței este neutru spre optimist prudent, cu un volum de tranzacționare scăzut și o levier redus care sugerează că comercianții se poziționează înainte de o potențială rupere. Analiștii observă că compresia prelungită a volatilității precede adesea mișcări direcționale semnificative, fie în sus, fie în jos. MEXC

Scenarii potențiale (Perspectiva profesională):

✔️ Continuare optimistă: Rupere și închidere deasupra $90K–$92K cu un volum puternic → ar putea deschide calea pentru retestarea cifrelor medii de șase. Blockchain News

❌ Riscul pesimist: Închiderea sub $84K ar putea extinde consolidarea mai jos spre $80K sau mai departe înainte de a se stabiliza. MEXC

Sumar:

BTC se află într-o fază de consolidare după declinul din 2025. Deocamdată, comercianții urmăresc rezistența de $90K și suportul de $84K ca puncte critice de decizie. O rupere decisivă în orice direcție va defini probabil următoarea tendință a Bitcoin. Aceasta este o instantanee a pieței, nu un sfat financiar.

#StrategyBTCPurchase #BTCVSGOLD #USJobsData #BTC90kChristmas

Bitcoin se tranzacționează într-un interval restrâns aproape de ~$88,000, arătând o mișcare laterală cu volatilitate scăzută. Acest lucru sugerează că piața se consolidează după retragerea din sfârșitul anului 2025 de la maximele de peste $126,000. Consolidarea în această zonă reflectă un sentiment prudent printre comercianți și instituții. The Economic Times+1

Structura tehnică:

Limitată: BTC este blocat între aproximativ $85,000 și $90,000, cu respingeri repetate aproape de limita superioară. MEXC

Rezistența cheie: Bariera imediată în jurul valorii de $90,000 – $92,000. O închidere zilnică curată deasupra acestui nivel este văzută pe scară largă ca un declanșator optimist. Blockchain News

Niveluri de suport: Niveluri tehnice mai puternice se află aproape de $84,000–$87,000; o rupere sub acestea ar putea invita la teste mai profunde. MEXC

Momentum: Indicatorii tehnici mixte arată consolidare fără o direcție clară — cumpărătorii și vânzătorii sunt în prezent echilibrați. CoinMarketCap

Sentiment și perspectivă:

Sentimentul pieței este neutru spre optimist prudent, cu un volum de tranzacționare scăzut și o levier redus care sugerează că comercianții se poziționează înainte de o potențială rupere. Analiștii observă că compresia prelungită a volatilității precede adesea mișcări direcționale semnificative, fie în sus, fie în jos. MEXC

Scenarii potențiale (Perspectiva profesională):

✔️ Continuare optimistă: Rupere și închidere deasupra $90K–$92K cu un volum puternic → ar putea deschide calea pentru retestarea cifrelor medii de șase. Blockchain News

❌ Riscul pesimist: Închiderea sub $84K ar putea extinde consolidarea mai jos spre $80K sau mai departe înainte de a se stabiliza. MEXC

Sumar:

BTC se află într-o fază de consolidare după declinul din 2025. Deocamdată, comercianții urmăresc rezistența de $90K și suportul de $84K ca puncte critice de decizie. O rupere decisivă în orice direcție va defini probabil următoarea tendință a Bitcoin. Aceasta este o instantanee a pieței, nu un sfat financiar.

#StrategyBTCPurchase #BTCVSGOLD #USJobsData #BTC90kChristmas

Conectați-vă pentru a explora mai mult conținut