Author: Shivam Sharma, Binance Research; Translation: CoinPoint News, Golden Finance

The full text is divided into 4 parts: key points, preface, 10 major narratives, and conclusion. The top ten narratives are: stablecoin supply return, NFT transaction volume increase, project fee income increase, DeFi return, Bitcoin, other L1, SocialFi, RWAs, ZK, and global central bank interest rates.

1. Key points

The total crypto market capitalization has increased by more than 110% since the beginning of the year, adding more than $870 billion. So far in the fourth quarter, the market is up 55% (about $596 billion).

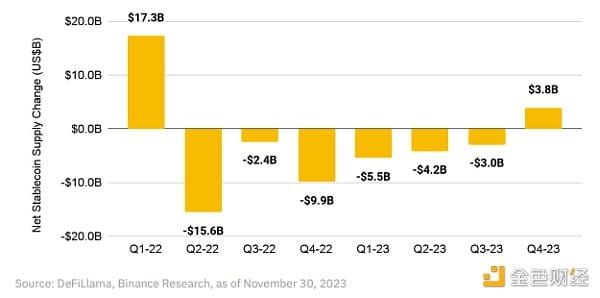

Stablecoin supply is back, with the quarterly net supply of the top five stablecoins turning positive for the first time since Q1 2022.

NFT trading volume broke the 8-month downward trend and surged nearly 200% month-on-month in November. Bitcoin became the most popular chain, with NFT trading volume on Bitcoin exceeding US$375 million, even exceeding Ethereum NFT ($348 million).

The top 20 crypto projects saw an increase in fees in November, about 84% higher than in October and more than 100% higher than in September. DeFi TVL also grew, with DeFi’s market capitalization share rising 18% month-on-month.

Bitcoin has had a turbulent year, including the emergence of Ordinals and BRC-20, and renewed interest in November. News of a spot Bitcoin ETF is exciting, and the market expects approval in January, and the Bitcoin halving in April is another important point to watch.

Several other L1 blockchains have outperformed Ethereum recently, with Solana and Toncoin being particularly strong. New protocols have emerged in the SocialFi space, such as friend.tech, while platforms such as Farcaster, Lens, and Binance Square have also seen updates.

RWA is growing in importance, and now accounts for more than 49% of MakerDAO’s balance sheet assets. Chainlink also hopes to bring TradFi, RWA, and crypto closer through its new CCIP solution.

ZK technology is in its infancy, with various ZK-rollups recently launched and increased research and discussion on ZK coprocessors.

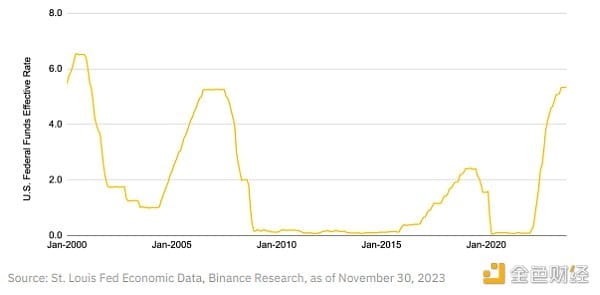

U.S. interest rates are at their highest in 22 years, with markets pricing in rate cuts next year. China has already started cutting rates, while falling inflation in Europe has investors starting to anticipate a rate cut from the European Central Bank.

II. Introduction

After a high-octane start to 2021, the cryptocurrency market has largely been a construction-focused market over the past few years. As the frenzy of celebrity-endorsed NFTs, $69,000 Bitcoin, Dogecoin on SNL, and other narratives faded, some left the industry while others doubled down on their vision. In recent weeks, we have seen an increase in market excitement and some bear market construction results are beginning to show up, reflected in crypto activity and asset prices.

While it is too early to declare that we are back in a bull market, things are certainly better than they have been for some time. As such, we have prepared this report to provide our readers with some key narratives and indicators to watch over the coming months.

Figure 1: The total market value of cryptocurrencies has increased by about 110% since the beginning of the year, an increase of more than $870 billion. The market has risen by 55% so far in the fourth quarter (about $596 billion)

3. 10 key narratives worth paying attention to

1. Stablecoin supply returns

Stablecoin supply is a measure of the amount of money available to invest in crypto assets at any given point in time. Recent data shows that the quarterly net change in supply of the top five stablecoins (by market capitalization) turned positive for the first time since the first quarter of 2022.

Figure 2: The quarterly net change in supply of the top five stablecoins turned positive for the first time since Q1 2022

Given that rising stablecoin supply is a measure of cryptocurrency inflows and an indicator of underlying buying pressure, the recent move can be viewed as a positive sign.

It will be worth keeping a close eye on how this indicator develops in the coming months and whether it is a temporary change or represents a more sustained upward trend.

2. NFT trading volume increases

Since NFTs can be considered a riskier asset in the cryptocurrency industry, NFT trading volume can be considered a leading indicator of market sentiment. For example, if we consider Bitcoin as the benchmark asset, altcoins like Ethereum are generally more volatile, i.e. have a higher beta value than BTC. If we continue to go down the risk spectrum, we will eventually reach NFTs, which have a much higher beta value than BTC.

The fact that NFT trading volume broke the downward trend and increased significantly month-on-month indicates that market sentiment is positive and NFT speculation is recovering, suggesting that NFT prices are starting to rebound after a few months of slump.

Figure 3: NFT transaction volume has broken the downward trend this year and showed a significant month-on-month increase in November.

We should also note the significant growth of Bitcoin NFTs (discussed in more detail in the “Bitcoin” section). Their growth is incredible, as shown in Figure 3, especially considering they were “invented” in late 2022 and didn’t become popular until March 2023.

Bitcoin NFTs had close to zero trading volume in January, but reached over $375 million in November, surpassing Ethereum NFTs ($348 million). This is a huge achievement for a chain that has long been considered unsuitable for applications and NFTs, and we will be watching closely how things develop in the coming months.

3. Increase in project fee income

As the industry continues to mature and protocols move toward becoming profitable businesses, the fee revenue generated by the top 20 crypto projects is an important metric to watch. Fee revenue has been rising steadily over the past year, with November up more than 88% month-over-month, compared to zero in January.

Figure 4: Revenues of the top 20 crypto projects (all tracks) rose in November, about 84% higher than October and more than 100% higher than September

In terms of accumulated fees, Ethereum has generated over $2 billion in total revenue so far in 2023, more than double any other single protocol. In second place is Tron, which generated about $880 million in revenue. Ethereum generates revenue by essentially selling its block space. The users who pay these fees can be anyone from retail traders using Uniswap to trade memecoin to L2 protocols like Arbitrum, which pay Ethereum fees to settle transactions on it.

DeFi is the second-largest fee generator after Ethereum, with Lido and Uniswap leading the way. Convex, GMX, PancakeSwap, and MakerDAO have also generated more than $100 million in fees so far this year, with Aave not far behind.

On the NFT side, OpenSea is firmly in the lead, with fees nearly double those of Manifold and more than double those of Blur. OpenSea’s lead over Blur is noteworthy as we’ve seen a back-and-forth battle for the top spot between these two major NFT players over the past year. While Blur has managed to increase its share of the Ethereum NFT market from ~40% to ~80%, and OpenSea has dropped from ~43% to ~20%, OpenSea still leads when it comes to fees.

Figure 5: The top 10 by fees are dominated by L1 and DeFi projects

Notably, friend.tech, which launched only during the summer, has made it into the top 20 protocols this year (with over $50 million in fees). This suggests that there is opportunity for products that can generate traction and hype, especially in the growing and relatively young SocialFi subsector.

It’s also worth noting that Arbitrum is the only L2 in the top 20 list (with fees over $50 million). This is noteworthy given the ongoing discussion around L2s and the narrative around the L2 sub-sector becoming increasingly important. Despite this, only Arbitrum appears on the list. This could be an interesting indicator given all the new L2s that have recently launched or come to market.

Overall, fee income is the hallmark of any truly sustainable business. It’s clear that a subset of the crypto market is able to generate meaningful fees, and it’s encouraging to see these numbers grow in 2023. Keeping an eye on which protocols and sub-sectors show the best fee growth will definitely be an important aspect of the market as it enters the next market cycle.

4. The return of DeFi

After a few months of relatively limited DeFi activity, we are starting to see some activity return to the space. DeFi Total Value Locked ("TVL") is up nearly 25% since the beginning of the year, and up 14% month-over-month in November. TVL has been confined to between $45 billion and $50 billion since December, so it will be important to monitor whether this latest trend can continue and comfortably pass the $50 billion mark in the coming weeks and months.

Figure 6: DeFi TVL regression

In terms of public chains, Ethereum remains the dominant player, accounting for over 56% of the total TVL. Tron accounts for ~16%, while BNB Chain accounts for just over 6%. Arbitrum (~4.5%) and Polygon (~1.8%) round out the top five. It is worth noting that four of the top ten public chains by DeFi TVL are Ethereum L2s (in addition to the previously mentioned, there are also OP Mainnet and Base).

In terms of categories, Liquidity Staking ($27 billion) is one of the biggest winners this year, with Lido as the leading player with a TVL of over $20 billion. The Shanghai Upgrade, which allows users to withdraw staked ETH, has been very helpful to Lido, increasing its TVL from $12 billion to over $20 billion now. Lending ($19 billion), DEX ($13 billion), and Cross-chain Bridges ($13 billion) are the next hot categories.

Another chart worth watching is the DeFi market cap share. This is measured by looking at the top ten DeFi tokens and calculating their combined market cap as a percentage of the total cryptocurrency market cap. After remaining in the 3.8% to 4.1% range since April, this number has begun to surge, rising 18% during November to 4.44% at the end of the month. Thorchain, PancakeSwap, Uniswap, and Synthetix are among the main factors driving this move.

Figure 7: DeFi’s share has increased

Some key developments worth noting:

MakerDAO will continue to advance its “Endgame” plan, with Phase 1 expected to launch in early 2024.

PancakeSwap recently launched a gaming marketplace and revamped its governance system with the launch of a new “ve” (vote lock) token, $veCAKE.

Synthetix’s new product, Infinex, will be launched soon. Infinex is an upcoming decentralized perpetual contract exchange.

The launch of Fluid, a highly capital-efficient, multi-layer DeFi protocol from the Instadapp team.

5. Bitcoin, Bitcoin, Bitcoin

2023 has been an eventful year for Bitcoin, with new developments in all aspects of the investor community, from Ordinals (Bitcoin NFT) collectors with crypto-native characteristics to more traditional institutional investors approaching Bitcoin ETFs. This corresponds to Bitcoin's market value increasing by 162% so far in 2023, surpassing most other top crypto assets on the market.

Figure 8: Bitcoin’s year-to-date performance has been very strong

Some of the most important Bitcoin narratives:

A. Spot Bitcoin ETF Approval Is More Likely Than Ever

While the possibility of a U.S.-regulated spot Bitcoin ETF has been around for a long time, 2023 has seen significant positive developments. In particular, the dispute between the U.S. Securities and Exchange Commission (SEC) and Grayscale over the conversion of its Grayscale Bitcoin Trust (“GBTC”) into a spot Bitcoin ETF essentially ended in Grayscale’s favor. This has led to a number of other players including BlackRock, Fidelity and Invesco also filing for spot Bitcoin ETFs in recent months.

All in all, there are currently 13 spot Bitcoin ETF applications under review by the SEC, with the earliest final deadline being January 2024 and the latest being August 2024. The market generally expects that these ETFs will be approved in the coming weeks or months, especially considering the outcome of the SEC's case against Grayscale and the continuous resubmission and modification of ETF applications by each applicant to maximize the chances of approval.

Figure 9: Most deadlines for SEC decisions on spot Bitcoin ETFs occur in the first quarter of 2024, starting in January

If approved, a spot Bitcoin ETF would address the two main drivers of Bitcoin adoption: convenience/accessibility and mainstream acceptance. The launch of a spot ETF will provide many institutional investors with a simple, compliant and widely accepted way to add Bitcoin exposure to their portfolios and improve distribution. The support of global asset management giants like BlackRock, Fidelity and Invesco will boost Bitcoin’s profile as a legitimate asset class and help address regulatory/compliance concerns among new investors. This is expected to result in a significant increase in capital and user inflows into Bitcoin, both from institutional investors who were previously excluded and from new retail investors who may have been cautious before.

A recent study by Galaxy puts a fairly conservative estimate of inflows into spot Bitcoin ETFs at the end of their first year at $14 billion. Additionally, we can consider the case study of spot gold ETFs. Specifically, the first US-listed spot gold ETF was launched in 2004, and investing in gold was very difficult before that. After the ETF was launched, the price of gold rose for seven consecutive years. This suggests that gold is severely undervalued due to a lack of suitable investment vehicles. While it is not possible to directly compare to Bitcoin, it is worth considering whether we would see a similar move in Bitcoin if a spot ETF is indeed approved in the near future.

Indeed, recent cryptocurrency exchange-traded product (“ETP”) data shows continued growth in inflows. While much of this data is retail-driven, the CoinShares team has also seen an uptick in institutional interest. Additionally, the rise in inflows into cryptocurrency ETPs (including products such as ProShares’ Bitcoin Futures ETF, Bitwise 10 Crypto Index, and others) also suggests that investors want to gain exposure to cryptocurrencies in a more traditional, custodial manner (versus using a centralized or decentralized crypto-native exchange). Digging deeper into the CoinShares ETP data, we can see that Bitcoin ETPs have seen inflows of over $1.6 billion this year, making them by far the most popular asset. Total assets under management (AUM) have grown more than 100% since the beginning of the year to $46.2 billion, the highest level since May 2022.

Figure 10: Global cryptocurrency ETP inflows increased significantly in October and November, with Bitcoin being the asset with the highest share by far

B. The upcoming Bitcoin halving

Bitcoin miners are rewarded through two mechanisms: block rewards and transaction fees. Block rewards have traditionally made up the majority of miners' income, while transaction fees have only recently seen an increase in transaction volume (after the launch of Ordinals). These block rewards are paid out every 10 minutes on average when a new block is mined, and are halved approximately every four years. When the Bitcoin blockchain first launched in 2009, the block reward for each block was 50 BTC. After halvings in 2012, 2016, and 2020, the block reward is currently 6.25 BTC per block. This number will halve to 3.125 BTC/block in April 2024.

Figure 11: Bitcoin’s mining reward halves approximately every four years. The next halving is expected to take place in April 2024.

Since Bitcoin is an asset with a fixed issuance cap (21 million), the halving will reduce the rate at which new Bitcoins are generated by 50%, and basic economics dictate that price increases are the natural next step. The halving essentially creates scarcity for Bitcoin and further reinforces the narrative of Bitcoin as digital gold. Historically, the halving event itself has been associated with increased market volatility, although the overall cryptocurrency market has generally performed well in the years following the halving.

C. Ordinals and Inscriptions Continue to Grow

One of the most significant developments in Bitcoin in 2023 is the emergence of Ordinals and Inscriptions. Casey Rodarmor’s “Ordinal Theory” allows tracking of individual Satoshis (the smallest unit of Bitcoin) and assigns each Satoshi a unique identifier. These individual Satoshis can then be "engraved" with any content, such as text, images, videos, etc. This creates an “inscription” or what soon became known as a Bitcoin NFT.

Figure 12: Total Bitcoin inscriptions approach 50 million after recent rally in minting in November

Inscriptions led to the creation of the BRC-20 token, which made it possible for the first time to deploy, mint, and transfer fungible tokens on Bitcoin.

After the initial market frenzy when Ordinals and BRC-20 were first launched, the market cooled off a bit. However, November saw a clear resurgence in activity in these markets. The total number of inscriptions increased by 362% from the October low and hit an all-time monthly high with a figure of over 8.3 million. In addition to the upcoming Bitcoin halving (which will also reduce miner revenue), inscriptions have generated over $140 million in fees for miners, a welcome addition to Bitcoin, which has traditionally had low transaction fees.

Perhaps most important is the potential excitement and innovation Ordinals is generating within and outside of the Bitcoin ecosystem. Many new builders are flocking to Bitcoin, many existing projects are being updated at a faster pace, and all sorts of new ideas are currently circulating within the Bitcoin community.

A recent example is the $7.5 million raise for Taproot Wizards, an Ordinals project themed after the famous Bitcoin wizard meme. The impact of Ordinals and BRC-20 on increasing transaction fees and congestion on the Bitcoin network has also helped to rekindle the discussion about Bitcoin Layer-2s (“L2s”). Notably, Bitcoin project Stacks and its upcoming sBTC solution to create a decentralized, non-custodial Bitcoin L2 is an interesting development to watch. All in all, between the spot Bitcoin ETF, the Bitcoin halving, and the innovations brought about by Ordinals, it is clear that Bitcoin is in an exciting period in its history and one worth keeping a close eye on.

6. Other L1 developments

While Ethereum still maintains its dominance by most typical metrics, alternative L1s have also shown promise over the past year.

Figure 13: Some other L1s have outperformed ETH over the past year

Solana has been the most notable standout, especially recently, with SOL market cap increasing by approximately 56% in November.

➢ Solana was deeply affected by the 2022 FTX crash, but after weathering the entire incident and continuing to release new products and improvements, the project has regained optimism. In addition, while Solana has experienced several network outages in 2022, only one such incident has occurred so far this year (in February). It is expected that with the upcoming release of Firedancer (a new independent validator client), these incidents will decrease further next year.

➢ Solana DeFi performed well in November, with TVL growing 57% from $418 million to over $650 million, more than any other major public chain. This is consistent with recent airdrop activity and attention from oracle project Pyth Network, DEX aggregator Jupiter Exchange, and MEV-associated liquidity staking provider Jito Network. In addition, several other major DeFi projects, including MarginFi and Kamino Finance, have implemented (or hinted at) point systems. User activity generates points, and many in the community believe this may be a factor in the upcoming airdrops from these protocols.

Toncoin has also been performing well, with their partnership announcement with Telegram being a major highlight recently.

➢ The partnership announced in September means Telegram will fully rely on TON as its web3 blockchain infrastructure and integrate TON Space, a self-hosted web3 wallet for all of Telegram's 800 million monthly active users. In addition, TON projects and ecosystem partners will benefit from in-app promotion within Telegram and priority placement on its advertising platform.

➢ Recently, gaming/metaverse VC Animoca Brands announced its investment in the TON Foundation and became the largest validator on the TON chain.

There were numerous other announcements and developments across all the other major L1s. Ethereum successfully enabled withdrawals of staked ETH after the Shanghai upgrade, becoming a largely deflationary asset and giving birth to huge DeFi markets like Liquid Staking and LSDfi.

BNB Chain continues to maintain ecosystem growth with important announcements such as BNB Greenfield (a next-generation data storage platform) and opBNB (BNB Chain Optimistic L2 based on OP Stack).

Avalanche continues to announce partnerships, especially in the gaming and RWAs space. Their recent partnership with J.P. Morgan’s Onyx and Apollo Global is a notable move.

Cardano continues to work hard to scale, developing Hydra and the upcoming data protection-focused sidechain Midnight.

Tron remains the public chain with the largest USDT issuance and continues to serve as an efficient way to send USDT payments between users and businesses.

7. The emergence of SocialFi

Social media apps have long been considered a potential partner for blockchain technology and cryptocurrencies. In 2023, this sub-sector of the cryptoeconomy saw product-driven growth, with friend.tech in particular attracting a lot of attention.

friend.tech, a SocialFi dApp, first launched on Ethereum L2 Base in early August. friend.tech essentially allows users to trade tokenized shares of Twitter profiles (called “Keys”). Holding a Key gives you access to exclusive content and private chats with profile owners (called “Subjects”). Users pay transaction fees, part of which goes to the protocol and part to the Subjects. friend.tech has generated over $25 million in total protocol fees since launch. They have also been running an activity-based points system, which is rumored to be related to potential future airdrops.

After huge hype in August and September, daily activity has slowed in the last two months. Still, the product is in beta and close to full launch. Perhaps most importantly, the attention and attention friend.tech has been able to gather, including from non-crypto influencers, is inspiring and indicative of the potential that web3 social applications can achieve.

Figure 14: friend.tech daily transaction volume (LHS) and daily protocol fees (RHS)

Another web3 social application worth mentioning is Farcaster. Farcaster is a decentralized social media protocol that runs on the Ethereum L2 OP mainnet. In October, the protocol opened up to unlimited registration (no longer invitation-based), and has since seen a significant increase in daily participation. Farcaster aims to promote a community platform oriented towards high-quality discussions. To this end, they have recently been hosting the Farcaster AMA series, inviting various well-known guests, including Balaji and Vitalik Buterin.

Figure 15: Farcaster’s daily unique interactions have been steadily increasing since opening the platform in October

Another notable web3 social media platform is Lens Protocol. Built by the Aave team and deployed on Polygon, the platform has shown a lot of interest in NFTs and is targeted to creators and artists to a certain extent. After its initial launch in early 2022, they announced the v2 version earlier this year. New features include "Open Actions" to help embed external smart contracts in Lens publications, improved value sharing opportunities, and a series of new profile-related updates (called "Profiles V2").

The launch of Binance Square is also noteworthy, providing crypto users with a new platform to exchange views and opinions, as well as a channel to learn about the latest news events.

8. RWAs enter the encryption system

Real World Assets (“RWAs”) is a general term used to describe assets that exist in the physical world off-chain and are tokenized and purchased on-chain. Examples of RWAs include real estate, bonds, commodities, stocks, etc. While tokenizing assets and bringing them on-chain has long been discussed, there have been some particularly noteworthy developments this year.

A、MakerDAO

Maker, the protocol behind stablecoin DAI, has been involved in RWA since at least 2020 and has experienced significant growth in 2023.

To recap, Maker allows users to deposit collateral into its vault and borrow an equivalent amount of DAI debt. While only ETH was once accepted as collateral, this has since expanded to other assets including stablecoins, wrapped BTC, liquid collateralized derivatives (“LSDs”), and more.

Maker also provides RWA collateral in exchange for DAI loans to borrowers that have passed MakerDAO review. Borrowers include Huntingdon Valley Bank, which has a $100 million RWA collateral vault with Maker.

Figure 16: MakerDAO’s RWA balance has grown over 300% this year to over $2.6 billion

RWAs now account for over 49% of Maker’s balance sheet assets, up from just around 12% at the start of the year. A large portion of these RWAs are US Treasuries, which have enjoyed high yields over the past 18 months or so due to the rising interest rate environment. This means that RWAs now account for over 60% of Maker’s revenue, which itself broke an all-time high of $200 million (annualized) in early November.

B. Chainlink and CCIP

Chainlink, best known for its oracle network, is a web3 infrastructure company that provides a range of solutions. This includes their data streams, functions (connecting smart contracts to APIs), automation (smart contract automation), and more.

A new development worth noting is the Cross-Chain Interoperability Protocol (“CCIP”). CCIP is a decentralized cross-chain messaging/data transfer protocol. The goal of CCIP is to create a shared global liquidity layer where all blockchains can connect to each other, whether they are public or private TradFi chains.

Chainlink hopes that CCIP can help bridge the gap between TradFi and crypto and improve interoperability between the two worlds. Integrating RWAs more tightly onto the blockchain is a natural part of this process.

A key advantage of CCIP is that it allows users to use their existing APIs and messaging services to define their goals, connect to CCIP, and then trade on-chain. A key integration CCIP has established is with Swift, a messaging service used by more than 11,000 TradFi institutions around the world to communicate. Given that Swift can communicate with CCIP, it helps reduce friction when TradFi connects to the blockchain and is expected to help further integrate RWA.

Figure 17: How the global banking industry uses CCIP to access web3

We have seen the launch of the CCIP’s early access mainnet, with more expected in the coming weeks. We have also seen examples of partnerships with institutions such as ANZ Bank, as well as a large group of major banks and financial institutions including Citibank, BNY Mellon, etc. CCIP and which institutions it can attract will be an important development in the coming months.

9、ZK-Everything

The growth of ZK technology has been a big topic in the crypto space for years. However, 2023 saw notable ZK-related initiatives, including a series of ZK-rollup releases. Some key developments include:

As a brief recap, there are two types of L2 rollup solutions: optimistic rollups and ZK rollups. While optimistic rollups currently make up the majority of the L2 market share, ZK rollups are gaining momentum and are widely considered the solution for future scaling. This is because they rely on zero-knowledge proofs (“ZKPs”), which are an extremely efficient way to prove the validity of a transaction and have many different applications in the crypto space.

One reason why ZK rollups didn’t become popular until this year was their previous lack of integration with the Ethereum EVM. Given that the EVM is the dominant smart contract engine on the market, early ZK rollups were unable to support it in a simple and easy way, which gave optimistic rollups an advantage (they were EVM-compatible). However, zkEVM changed this. zkEVM is a special ZK rollup that allows smart contracts to be easily deployed on the EVM, enabling developers to easily port EVM dApps to their zkEVM.

2023 saw a number of zkEVM launches, starting with zkSync Era and Polygon zkEVM in March, followed by Linea and Scroll. StarkNet, another pioneer in ZK technology, also has a ZK rollup in production, and Kakarot zkEVM brings EVM compatibility to Starknet technology. Taiko is another upcoming zkEVM, expected to launch early next year.

Growth in rollup-as-a-service (“RaaS”) providers has also been strong in recent months. While many providers initially focused on optimistic rollups, the zkRaaS sub-sector is also growing, with companies such as AltLayer, Gelato, and Lumoz being prominent. This could lead to more ZK rollups entering the market next year.

Figure 18: TVL of major ZK-rollups

In addition to rollups, there are various other applications of ZK technology. One key upcoming example is the ZK coprocessor. The basic idea of a ZK coprocessor is that it is a tool that dApps can use to move data-intensive and expensive computations off-chain. This allows dApps to keep user gas costs low while letting them run more complex functions and computations for a better user experience. Because of the use of ZK technology, dApps can still benefit from the full security of Ethereum even if part of the computation is moved off-chain.

An analogy is that in a computer, a graphics processing unit (“GPU”) acts as a coprocessor to the computer’s underlying central processing unit (“CPU”).

In web2, many of the top applications are highly data-driven, i.e. they capture previous user behavior and use data to shape the user experience. For example, consider a web2 mobile game. As users play the game, the game is able to record data, log it in a centralized database, and use it to inform future decisions, such as when to offer rewards, when to send you push notifications, what kind of rewards to give you based on your purchase history, etc.

Web3 dApps can’t really provide this kind of service because storing the data and running queries through it to use it are both expensive on-chain tasks. This is a simple example of how many current web3 dApps are limited when executed fully on-chain. Being able to move some of these expensive computations off-chain using ZK coprocessors could help unlock a new generation of web3 dApps.

Use cases include on-chain gaming, DeFi loyalty programs, variable incentive programs, digital identity and KYC, and more.

The recent Alpha release of the new ZK protocol Succinct is also an interesting development.

Succinct provides a platform for developers to discover, collaborate, and build applications using ZK technology. As part of the platform, developers can use the Succinct Protocol, an infrastructure layer designed to make ZK development more coordinated and seamless.

One notable recent collaboration is with data availability solution Avail. Other upcoming collaborations include Lido and Celestia.

10. Will global interest rates fall?

From a macroeconomic perspective, interest rates are one of the most important factors affecting asset valuations. In the United States, for example, the higher the benchmark interest rate set by the Federal Reserve (Fed), the higher the risk-free return investors can earn by investing in ultra-safe government bonds. Naturally, this reduces the interest of many investors in more volatile investment options such as technology stocks and cryptocurrencies, as they can earn a good return on capital simply through government bonds.

Figure 19: US interest rates are at their highest level in 22 years, and the US has experienced one of the fastest interest rate hike cycles in history

To encourage consumer spending during the pandemic, the Fed set its benchmark interest rate at 0-0.25%, causing inflation to start rising rapidly, and then the Fed began a historic rate hike program from 0-0.25% in March 2022 to 5.25-5.5% in July 2023. However, the Fed has kept interest rates unchanged at the last two meetings. Although inflation remains above the Fed's 2% target (3.2% in October), it is still significantly lower than the 5-8% level in 2022. In addition, the latest Fed forecasts show lower interest rates in 2024 and 2025, which means that interest rates may have peaked or are close to it.

Additionally, other countries have already started cutting rates. The People’s Bank of China has already cut banks’ reserve requirement ratios twice this year, while also cutting its one-year lending rate. Falling inflation in Europe has also prompted investors to start expecting an earlier rate cut from the European Central Bank (ECB). While this is only part of the overall macroeconomic picture, it is an important one. As global rate cuts begin to take effect, investors will naturally need to look for opportunities to earn returns outside of government bonds, and the impact of rate cuts on high-growth sectors such as technology and cryptocurrencies cannot be ignored. At the very least, this will be a positive tailwind for the cryptocurrency market, while other web3 developments are still underway in full swing.

IV. Conclusion

The past few weeks have been full of surprises, and a welcome change from the construction-centric rhythm of the previous months. As the noise gets louder, new entrants join the market, and things get even crazier, it’s critical to make sure you’re tracking the right metrics and focusing on the narratives that matter. This report will hopefully serve as a primer on some of the most relevant discussion points and numbers to reference as we look ahead to 2024.