Main Takeaways

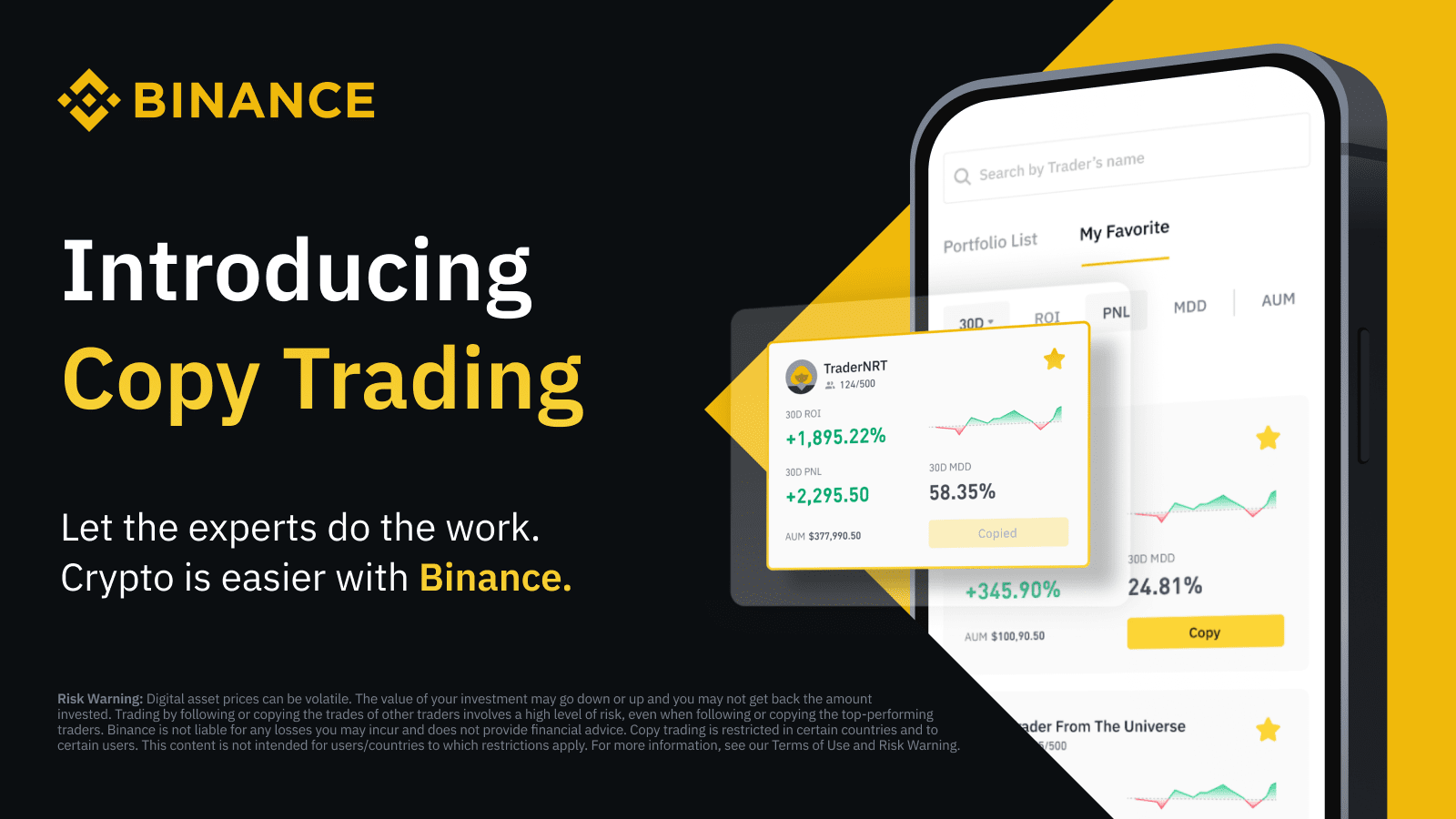

On October 9, 2023, Binance Futures introduces its Copy Trading feature in selected markets, allowing users to replicate the trades of expert lead traders.

Being a lead trader presents an avenue to monetizing your trading expertise thanks to revenue streams from profit shares and commission rebates.

Copy trading is a great way for beginners to delve into futures trading, but it's important that users also fully understand the risks so they can make well-informed decisions.

Dive into Copy Trading, the latest feature from Binance Futures, designed to revolutionize your trading experience by leveraging the expertise of seasoned traders.

Note: This is a general announcement.

Certain products and services may not be available in your region.

Venturing into the dynamic world of crypto futures trading has never been easier. The launch of the Copy Trading feature on Binance Futures in selected markets opens up the expertise of seasoned traders for novices to benefit and learn from. In this blog, we take a look at the concept of copy trading, the advantages of becoming a copy or lead trader, and the associated risks, ensuring you're well-equipped to embark on an exciting new trading journey.

The World of Copy Trading

At its core, copy trading is a form of social trading that lets users, especially those new to the markets, copy the strategies of their seasoned and more experienced peers. Ever dreamt of peeking into a pro trader’s playbook? With copy trading, you're not just peeking; you're mirroring their moves. Imagine a situation where every trading move made by a pro is automatically replicated in your own trading account – that is exactly what copy trading is about.

You start with selecting a lead trader based on various metrics such as their return on investment (ROI), trading history, and preferred strategy. Once you commit to copying, every trade they make is replicated in your account. The amount of each trade is adjusted according to your chosen total investment size. As the lead trader profits, so do you. However, note that the opposite is true as well: if they face a loss, then so will you.

A Guide for New Copy Traders: Lowering the Barrier to Entry

Copy trading offers an excellent gateway for beginner and intermediate traders to leverage the power of experts. As a copy trader, you have the unique advantage of accessing top trading strategies without needing years of experience. Beyond the potential for profit, copy trading offers an educational experience, allowing you to understand market dynamics through real-world trades. Let’s dive into the world of copy trading from a beginner's perspective to understand how to become a copy trader, what the potential rewards are, and how to extract the educational opportunities that copy trading offers.

Steps to Embarking on Your Copy Trading Journey

1. Discover Lead Traders: Browse the list of established lead traders and review their trading patterns, past performance, and areas of expertise.

2. Analyze and Follow: Don’t rush. Take your time to analyze different traders’ portfolios, risk profiles, and strategies. Choose to follow the lead traders whose strategies align with your investment goals.

3. Set Your Investment Parameters: Binance Futures offers modes such as Fixed Ratio and Fixed Amount. Understand these settings and determine the right investment amount for you.

4. Monitor and Learn: As you begin copy trading, monitor the trades being replicated in your portfolio. It's not just about potential profits, but also about understanding the 'why' behind each trade.

The Benefits of Being a Copy Trader on Binance Futures

Copy trading is more than just a passive investment tool; it's a bridge to the often challenging world of futures trading. For those at the beginning of their journey, it offers a unique blend of potential rewards and rich learning experiences. Here are some of the benefits you can get:

1. The Power of Expertise: Regardless of your training or experience, you can leverage the wisdom and strategies of seasoned traders.

2. Learning Opportunities: Copy trading is a live classroom where you learn the dynamics of markets by watching real trades in action and strategies being applied.

3. Diversified Strategies: By following multiple lead traders, you can enact a diversified trading strategy, potentially hedging risks.

4. Flexibility: Copy trading doesn't tie you down. Feel that a particular strategy isn't working for you? You can easily switch or stop following a lead trader.

5. Binance’s Liquidity: Using Binance, the world's largest digital asset exchange, for copy trading ensures that you can trade with significant liquidity and low slippage.

Becoming a Lead Trader: Benefit While Showcasing Your Skills

In the dynamic world of crypto futures trading, lead traders – the experienced individuals whose strategies are followed and replicated by others – often find themselves in the spotlight. But what does it take to be a lead trader, and what are the benefits that come with this status?

Being a lead trader presents an avenue to monetizing your trading expertise. Lead traders receive a 10% profit share and 10% trading commission rebate (capped) from users who replicate their trades. Lead traders can further create content on Binance Feed to share their trading strategies and techniques. But embracing the lead trader role is not just about strategy; it's about building trust and transparency with your followers. To become a lead trader on Binance, you have to complete the identity verification process and have an equivalent of at least $1,000 in your Lead Trading wallet.

The Benefits of Being a Lead Trader

1. Monetize Your Expertise: Gain more from your trading skills! With Binance Futures offering a 10% profit share on copied trades and a 10% commission rebate (capped), the earning potential is significant. For as long as you maintain your trading activity, the profit-sharing from your copy traders can act as a passive income, augmenting your earnings without any extra work.

2. Grow Your Personal Brand: As you build a following, your reputation within the trading community may flourish, which could create additional opportunities.

3. Feedback Loop: Interacting with your followers can also provide insights into how others perceive the market, further refining your strategies.

That said, being a lead trader has its challenges. Your decisions impact not just your portfolio but also the copy traders who follow you. This responsibility necessitates careful planning, thorough research, and a commitment to maintaining the trust your copy traders place in you.

Futures Trading: Understanding the Risks

Copy trading features are associated with inherent risks whereas you are encouraged to consider your financial position and risk appetite before you decide to use these features. You should take into consideration that copy trading can also lead to significant losses. You are solely and exclusively responsible for determining whether the signal providers whom you follow or copy the trades from, have the trading experience, skills and strategy among other key attributes that fit your risk appetite and objectives.

Knowledge is your best defense. Stay updated with market news, don't put all your eggs in one basket, and consider diversifying to potentially spread risk. Review your strategies regularly: what worked yesterday might not work today. Above all else, only invest what you can afford to lose. It's an age-old adage, but it holds. Ensure that what you're investing won't affect your financial stability if lost. Always remember: informed trading is smart trading.

Further Reading

Crypto Futures and Options: What Are the Similarities and Differences?

Six Strategies to Minimize Liquidation Risks in Crypto Futures

Disclaimer: Binance is not responsible for any trading decisions of copiers and/or traders whereas any content/material/information and/or past performance should not be construed as an indication of future results as it is used for informative purposes only. You should perform your own research and should not rely on the opinion/advice of the signal provider (s) and/or trader (s) as such do not constitute financial advice and should be treated with caution. It is further not guaranteed that what any profits and/or losses of the signal provider will be achieved by the copier whereas Binance cannot secure that a trade/position will be executed at the same time as the signal provider and/or order price and a higher amount may be lost as can be affected by numerous variants such as account balance, number of deposits/withdrawals, market, account settings and features of the signal provider’s account.

Attention must also be placed on the variations between past performance and the actual results of the copy trading as there are inherent differences such as financial risk and ability to incur losses at the time of trading. Therefore, should you decide to engage in copy trading, you agree to proceed at your own responsibility and any opinions/view expressed between traders and/or signal providers do not amount to investment advice and/or financial advice either directly and/or indirectly. All traders should seek independent financial and/or tax advice should they decide to proceed with copy trading and they remain responsible for any actions and/or trading decisions on their trading account prior and/or once they engage with the copy trading feature.