Binance Research: Key Trends in Crypto – June 2023

Main Takeaways

In this blog series, we offer concise summaries of Binance Research team’s findings, inviting you to take a deeper dive into the original reports.

This latest article previews the recent Binance Research report that retrospectively discusses key developments in crypto from the past month.

May 2023 was an eventful month for the crypto market, with broad macroeconomic developments amid a meme coin frenzy and the steepest decline in overall crypto market capitalization so far this year.

Thanks to Binance Research, you can take advantage of industry-grade analyses of the processes that shape what the Web3 space will look like tomorrow. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research. For a deeper dive, the full reports are available on the Binance Research website.

In financial markets, knowledge is power. Gone are the days when only big institutions and sophisticated financiers used high-quality research to navigate the digital asset space. Thanks to Binance Research, you can empower yourself with the latest data and insights from the field of crypto research.

Today, we will explore key Web3 developments in May 2023 to provide an overview of the crypto ecosystem’s current state. We will analyze the performance of crypto, DeFi, and NFT markets before previewing the major events to look out for in June.

Crypto Market Performance in May 2023

May saw the crypto market experiencing the effects of macroeconomic news and developments. For most of the month, financial markets were uneasy as uncertainty loomed over the US debt ceiling. Overall, crypto market capitalization decreased by 6% – the steepest fall of the year thus far.

Nonetheless, positive regulatory developments were seen in Asia. Beijing released a whitepaper for Web3 innovation and development, which could be seen as a sign of China’s increasing openness to blockchain technologies. Additionally, Hong Kong announced that it will start permitting retail trading of cryptocurrencies, with the government accepting applications from digital asset exchanges starting June 1.

Monthly change in crypto market cap (%)

Source: CoinMarketCap (May 31, 2023)

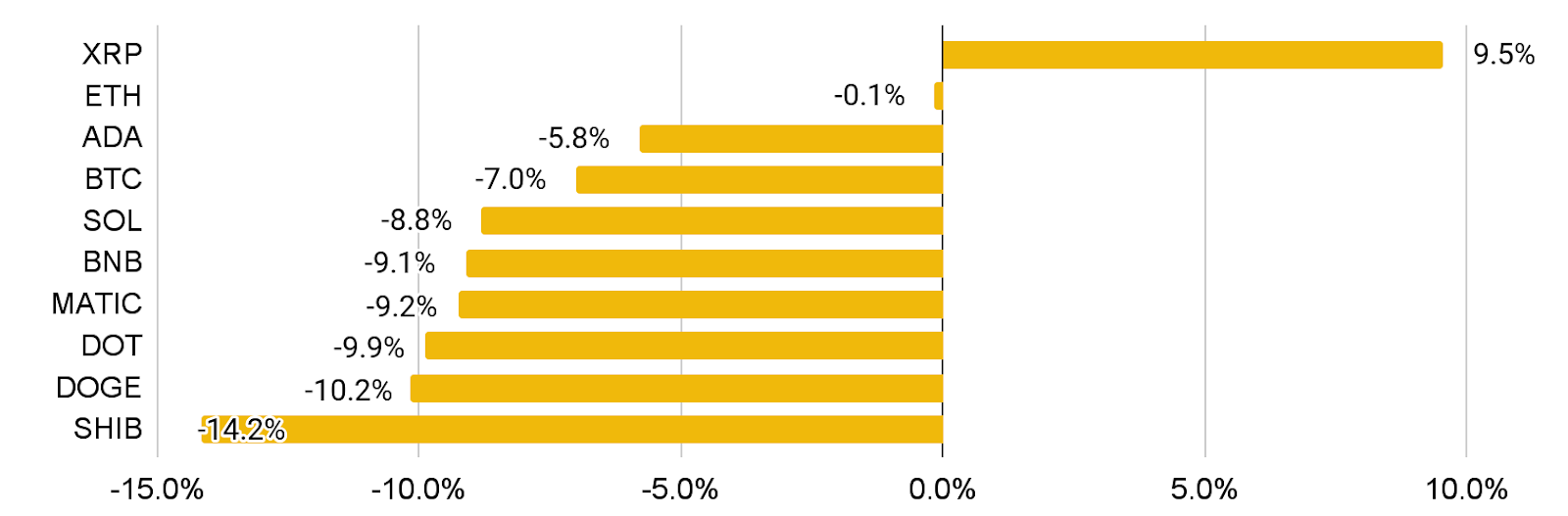

Monthly price performance of the top 10 coins by market capitalization

Source: CoinMarketCap (May 31, 2023)

XRP was the strongest performer this month. Ripple has been making moves to expand its capabilities, including the launch of a new platform to enable central banks, governments, and financial institutions to issue their own digital currencies.

DOGE and SHIB were the two weakest performers among the top 10 coins in May. Despite the meme coin frenzy unfolding throughout the month, DOGE and SHIB could not escape the broader declines experienced across the market. Daily transaction volumes of Dogecoin reached all-time highs after the introduction of so-called “DRC-20 tokens,” though it remains to be seen if this activity will be sustainable.

Decentralized finance (DeFi)

Decentralized finance (DeFi) markets fell 3.4% by total value locked (TVL) to $47.9B. The composition of top blockchains by TVL share remained generally unchanged, with Ethereum at 58.1%, Tron at 11.9%, and BNB Chain at 9.3%.

TVL share of top blockchains

Source: DeFiLlama (May 31, 2023)

Ethereum experienced a slight decline in TVL to $27.9B as part of a wider pullback in on-chain liquidity. Fantom faced the steepest drop, losing more than one-third of its TVL. These declines came amid rumors and uncertainty surrounding Multichain, which 35% of Fantom’s TVL is locked into.

Non-fungible tokens (NFTs)

Monthly trading volume for NFTs

Source: Cryptoslam (May 31, 2023)

NFT trading volume rose slightly in May, ending the month at just over $740M. The total number of buyers and sellers has reached an all-time high for the year at 1.67M, and the total number of transactions rose to 8.92M.

Meanwhile, Nansen’s NFT-500 index extended its decline as the floor prices for notable NFT collections fell. Large overnight sales of major collections – including Doodles and Mutant Ape Yacht Club (MAYC) – were observed in May. Another potential factor was the meme coin frenzy, with traders rotating from NFTs and selling them to jump on the meme coin bandwagon picking up momentum.

Upcoming Events

To help users stay updated on the latest Web3 news, Binance Research has summarized notable events and token unlocks for the month to come. Keep an eye on these upcoming developments in the blockchain space.

Notable events in June 2023

Source: Binance Research

Largest token unlocks in USD terms

Source: Twitter (@top7ico), TokenUnlocks, Binance Research

Binance Research

The Binance Research team is committed to delivering objective, independent, and comprehensive analyses of the crypto space. They publish insightful takes on Web3 topics including, but not limited to, the crypto ecosystem, blockchain technologies, and the latest market themes.

This article is only a snapshot of the full report, which contains further insights and an analysis of the most important market charts from the past month. It also features a deeper dive into meme coins, BRC-20, Ethereum layer-2 (L2) fees, USDT, and LSDfi.

To read the full version of this report, click here. Additionally, you can find other in-depth investigations of the latest Web3 developments by visiting the Insights & Analysis page on the Binance Research website.

Take the opportunity to empower yourself with the latest insights from the field of crypto research!

Further Reading

General Disclosure: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice and is not a recommendation, offer, or solicitation to buy or sell any securities or cryptocurrencies or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the laws of such jurisdiction. Investment involves risks.