Binance Research: Investigating the Rise of BRC-20

Main Takeaways

In this ongoing blog series, we offer concise summaries of our research team’s findings, inviting you to take a deeper dive into the original reports.

This article previews the recent Binance Research report discussing BRC-20, an experimental token standard enabling fungible tokens on the Bitcoin blockchain.

The emergence of BRC-20 has been met with mixed responses. We are still in the early stages and have yet to see whether it is sustainable in the long run.

Thanks to Binance Research, you can take advantage of industry-grade analyses of the processes that shape Web3. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research. For a deeper dive, the full reports are available on the Binance Research website.

In 2023, the Bitcoin ecosystem has seen a resurgence of innovation with the development of so-called ordinals. The Ordinals protocol went live at the start of the year, enabling new entities like “inscriptions” – often called “Bitcoin NFTs” – to start gaining prominence with the crypto community.

BRC-20 tokens are the latest innovation of this Ordinals-driven movement and have been a hot topic of discussion in recent months. Many are excited by the new energy this innovation is bringing, while others see it as a deviation from Bitcoin’s original purposes and are less satisfied with its impacts.

Today, we will investigate the rise of BRC-20 by exploring its background and the community’s response. We will also discuss the risks and challenges that BRC-20 tokens currently pose, giving insight into what could be improved in the future.

Background

BRC-20 is an experimental token standard that was first conceptualized in March 2023. It enables the deployment, minting, and transferring of fungible tokens on the Bitcoin blockchain. This latest Ordinals-driven innovation means that both fungible and non-fungible tokens (NFTs) have become part of the Bitcoin ecosystem.

It should be noted that BRC-20 tokens are extremely risky and in a very early stage of development. The creators themselves have been explicit about the risks of their experimental nature. This aspect should be kept in mind when reading, and this material is not intended to endorse or advise, only to educate.

Ordinals and inscriptions

The Ordinals protocol involves the tracking of individual satoshis (sats) based on what the founder, Casey Rodarmor, calls “Ordinal theory.” Sats are the smallest unit of bitcoin, and 1 BTC equals 100,000,000 sats. Ordinal theory ascribes a unique identifier to every single sat on the Bitcoin network.

Furthermore, these sats can be “inscribed” with content such as text, images, video, etc., to create an “inscription.” Effectively, this process describes the creation of an NFT on the Bitcoin blockchain. To learn more about ordinals, inscriptions, and Bitcoin NFTs, check out our Academy article: What Are Ordinals? An Overview of Bitcoin NFTs.

Where do BRC-20 tokens fit in?

With inscriptions allowing for NFTs on Bitcoin, the natural progression of development turned to fungible tokens. That is where BRC-20 comes into play. While inscriptions are the non-fungible application of the Ordinals innovation, BRC-20 tokens are their fungible counterpart.

On March 9, a pseudonymous Crypto Twitter user named @domo posted a thread theorizing a method called BRC-20 that could create a fungible token standard on top of the Ordinals protocol.

In essence, the method was about inscribing text onto sats to create fungible tokens. The initial design only allowed for three different operations: deploying, minting, and transferring.

The humble beginnings of BRC-20 tokens (@domo’s first thread on the subject)

Source: Twitter (@domodata)

The three initial operations possible for BRC-20 tokens

Source: https://domo-2.gitbook.io/brc-20-experiment/, Binance Research

The first token contract to be deployed was for the $ORDI token with a limit of 1K tokens per mint and 21M max supply (paying homage to bitcoin’s max supply). In less than a day, all 21M $ORDI tokens had been minted, and other tokens soon emerged. The total market cap of BRC-20 tokens went on to peak at over $1B, although this has since subsided and now sits around the $300M mark.

Community Response

The initial innovations of ordinals and inscriptions have already sparked heated debate in the Bitcoin community. Discussions often revolve around transaction fees, which have increased with the rise of these Ordinals-related innovations. BRC-20 has taken this debate to a new level.

At one end is the “pro-fees” crowd, who welcome the rise in transaction fees and see it as essential to the longevity of Bitcoin. At the other end is the “low-fees” camp, which is more critical of the increased transaction fees and sees it as countering the original ethos and intentions of the system.

The “pro-fees” argument

The sustainability of Bitcoin’s security model has been a key concern for many in the community. Bitcoin block rewards are halved after every 210,000 blocks have been mined, which happens roughly every four years.

Bitcoin block reward per successful block

Source: Bitcoin Visuals, Binance Research

Miners must be compensated for providing security to the system. Considering this reality, Bitcoin transaction fees need to be higher moving forward. As such, many in the community – particularly the miners – have been pleasantly surprised by the attention ordinals and BRC-20s have received. They are optimistic about their impacts on the relatively subdued Bitcoin fee market.

While the price of bitcoin has increased significantly since the 50 BTC block reward era, the issue illustrates the vulnerabilities of the BTC miner business model. With the possibility of a brighter future ahead in terms of blockspace demand, this situation looks more favorable for miners and could potentially entice more to join the network.

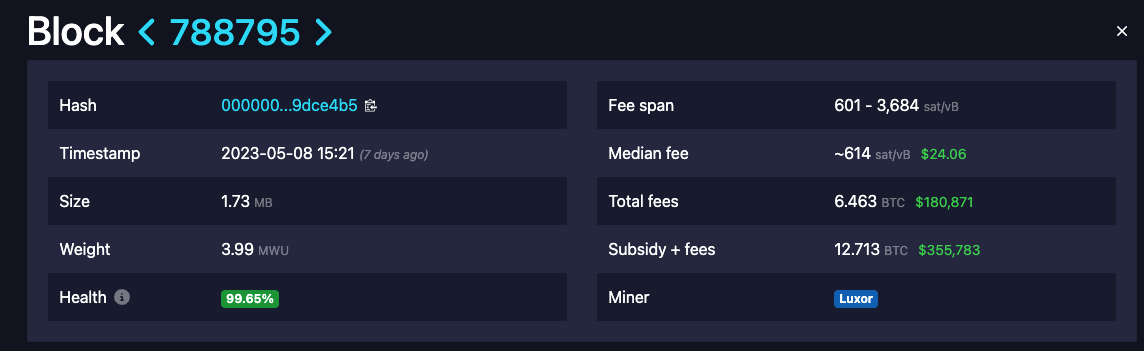

Notably, early May even saw Bitcoin blocks with transaction fees greater than the 6.25 BTC block reward. This is quite significant, considering that transaction fees averaged only 1-2% of miner revenues throughout most of 2022 and not much higher in earlier years. It indicates the growing blockspace demand that ordinals and BRC-20s have helped usher in.

Total fees for block 788795 were 6.46BTC compared to a 6.25BTC block reward

The “low-fees” argument

While many are excited by the increased activity and buzz around the Bitcoin ecosystem and encouraged by the increased fees from a sustainability perspective, others are more critical.

This “low-fees” camp believes that Bitcoin’s true purpose is to serve as a hard, non-fiat currency and that the chain should be used for peer-to-peer transactions only. They view data-intensive Ordinals-related transactions as primarily serving to congest the Bitcoin network and drive up fees, which ultimately discourages peer-to-peer transactions.

Some argue that the increase in fees is pricing out users in countries where Bitcoin is relied upon as an alternative to the local fiat system. Others are more extreme in their views and even think of ordinals and BRC-20s as an attack on the Bitcoin blockchain.

Risks and Challenges

As previously stated, ordinals, inscriptions, and BRC-20 tokens are extremely recent innovations and are very risky at this early stage. They are at the cutting edge of what is being worked on in crypto today. Correspondingly, there are a few key risks for any reader to be aware of.

1. Limited to no infrastructure

To put it bluntly, BRC-20 tokens are just an idea borne out of an experimental token standard created by a pseudonymous Twitter user. While the innovation and potential of the idea cannot be denied, it is important to understand how early we are in the story and how little infrastructure currently exists.

The token standard has been around for a couple of months and has only seen considerable activity in the last few weeks. While builders are working fast, not much exists at this stage. We have seen the beginnings of marketplaces and a DEX, but a lot of the trading is still being done over-the-counter (OTC) through Discord servers. Without the proper infrastructure, tracking tokens and their holders is difficult.

Another challenge arises from the lack of a methodological consensus. These instruments are not native to the Bitcoin blockchain but come from Ordinal theory, which essentially “associates” sats with certain characteristics. If we don’t have a social consensus on this method, some parties may not recognize certain ordinals and thus not recognize particular BRC-20 tokens.

Much work remains to be done if we are to see a market of more than a few thousand holders. While there is optimism about what BRC-20 tokens have unlocked and what they could potentially offer, the infrastructure still has a long way to go.

2. No real utility

The majority of the BRC-20 tokens currently exchanging hands are meme tokens. Almost by definition, these tokens have no utility and are largely influenced by social media and community sentiment. While this brings attention and creates hype, the lack of utility and, thus, the lack of a serious holder base means that these tokens could collapse suddenly and without warning.

This risk is something every reader should keep in mind, and also, if you see a new token offering some form of utility, you should be digging deep and questioning if this is true or just a marketing gimmick.

3. High scam risk

In keeping with the theme of how new this whole experiment is, we should remember that this creates a high risk of scams. For example, OTC token trading on Discord servers is naturally a very high-risk activity and has led to many people getting scammed out of money.

The projects building infrastructure for ordinals or BRC-20s could also pose a potential security risk at this early stage. While we are not trying to scare readers away, given how early it is in the history of these tokens and this new technology, the scam risk is high and should be taken seriously.

Closing Thoughts

Ordinals, inscriptions, and BRC-20 tokens have demonstrated that there is indeed demand for Bitcoin blockspace outside classic peer-to-peer payments. Users want to do the same things that are possible on Ethereum and BNB Chain – but on Bitcoin.

The lack of miner revenue from transaction fees has been a key concern for many Bitcoin supporters, and this recent flurry of activity has been an apt demonstration of the possibilities that exist out there. Recent developments have been encouraging and help represent a potential path to sustainability for Bitcoin in the long term.

Growth in crypto is often exponential. For example, after the first inscription was made on December 14, 2022, it took over a month to reach 100. However, between February 2 and February 15, the number of inscriptions went from 1K to 100K. By April, we had hit 1M and are now at over 7M.

While we cannot say how big this market could get, we can expect to see the number of inscriptions continue to rise. Keep a close eye on this space.

Inscriptions’ exponential growth so far

Source: Dune Analytics (@dgtl_assets), Binance Research (May 16, 2023)

Binance Research

The Binance Research team is committed to delivering objective, independent, and comprehensive analyses of the crypto space. They publish insightful takes on Web3 topics, including, but not limited to, the crypto ecosystem, blockchain technologies, and the latest market trends.

This article is only a snapshot of the full report, which contains further insights and detailed analyses of the most important BRC-20 market charts. It also features an exploration of Bitcoin layer-2 solutions and the future outlook of the industry. With so much rich content, you won’t want to miss these exclusive insights.

To read the full version of this report, click here. You can find other in-depth investigations of the latest Web3 developments by visiting the Insights & Analysis page on the Binance Research website. Don’t miss the opportunity to empower yourself with the latest insights from the field of crypto research!

Further Reading

General Disclosure: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice and is not a recommendation, offer, or solicitation to buy or sell any securities or cryptocurrencies or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the laws of such jurisdiction. Investment involves risks.