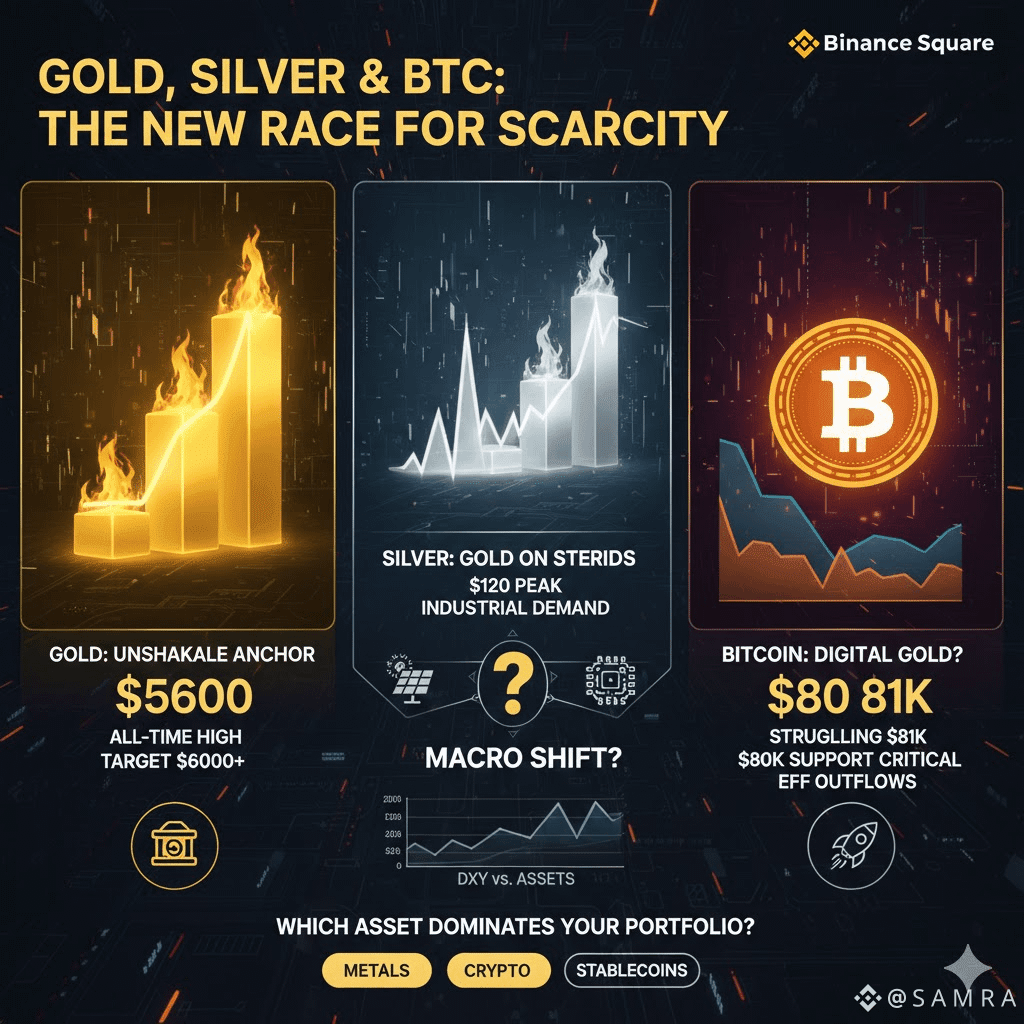

The market has been rocked by a "Liquidity Shock" in the last 48 hours. While Bitcoin is often hailed as "Digital Gold," both traditional precious metals have showcased crypto-like volatility, catching many off guard. This isn't just a correction; it's a recalibration of scarcity.

🟡 Gold: The Unshakable Anchor

Gold recently touched an all-time high of $5,600.

Current Status: Following a sharp flash crash, Gold $XAU is now consolidating between $5,160 - $5,200.

The "Warsh" Factor: Reports indicating Kevin Warsh as a leading candidate for the US Fed Chair have strengthened the Dollar Index (DXY), putting some downward pressure on Gold.

Outlook: Despite recent turbulence, continuous central bank purchases and escalating geopolitical tensions lead many analysts to project $6,000+ for Gold.

XAUUSDTPerp4,892.44-9.26%

XAUUSDTPerp4,892.44-9.26%

⚪ Silver: "Gold on Steroids."

Silver has been a standout performer this year, surging to $120 per ounce.

Why it's Surging: Silver $XAG has transcended its role as just a monetary metal. Its surging industrial demand from AI infrastructure, solar panels, and EVs has solidified its status as a "Critical Mineral."

Risk: Its market is smaller than Gold's, making 8-10% intraday crashes common. If the $107 support level holds, the next major target could be $150.

XAGUSDTPerp85.38-26.23%

XAGUSDTPerp85.38-26.23%

🟠 Bitcoin (BTC): Digital Gold or Risk-On Asset?

Bitcoin is currently struggling in the $81,000 - $83,000 range.

The Divergence: Interestingly, while Gold and Silver rallied, $BTC failed to keep pace. This suggests Bitcoin is still more correlated with tech stocks (Nasdaq) than with safe-haven assets.

Support Levels: The $80,000 mark is a critical psychological floor. A break below this could see a correction towards $75,000.

Institutional Flow: Recent outflows from Bitcoin ETFs signal that large institutions are in a "wait and watch" mode until the Fed Chair decision provides clearer macro direction.

BTC84,022.92-0.44%

BTC84,022.92-0.44%

📊 Conclusion: Where to Park Your Capital?

Safe Play: Gold (Lower volatility, long-term wealth preservation).

Aggressive Growth: Silver (Strong industrial demand + monetary hedge with higher beta).

Speculative Upside: Bitcoin (High risk, but significant upside potential post-halving and with broader institutional adoption).

👇 Which asset is currently dominating your portfolio: Metals or Crypto?