The majority of the Layer-1 blockchain-related discussions reiterate the concepts of TPS, block time, and charts. I believe that this is an incorrect point of view on the part of Fogo. The more I look into it the more it is becoming apparent that Fogo is actually a market-structure project wrapped in a Layer-1.

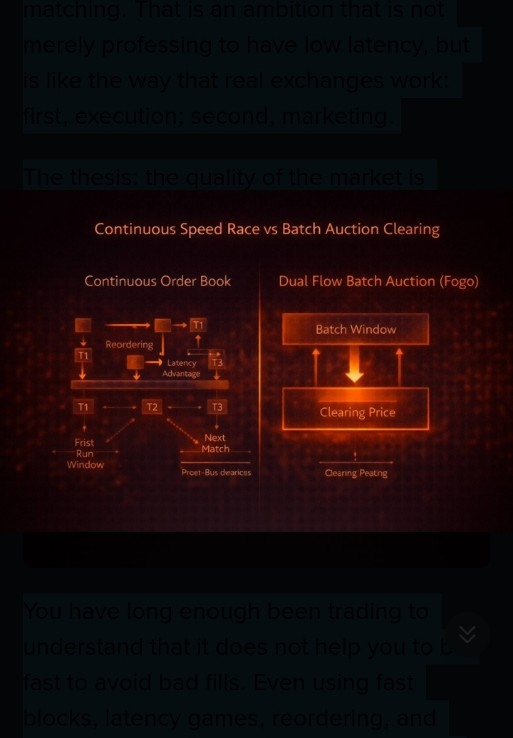

What I am trying to say is this; speed is not the objective of Fogo. It is intended to ensure that on-chain trading is more equitable and clean by transforming trade matching. That is an ambition that is not merely professing to have low latency, but is like the way that real exchanges work: first, execution; second, marketing.

The thesis: the quality of the market is better than the speed of the raw

You have long enough been trading to understand that it does not help you to be fast to avoid bad fills. Even using fast blocks, latency games, reordering, and even toxic order flow will eat you. Simply put, the construction of a high-speed chain may continue to make a market a tax.

That worldview is evident through Fogo messaging publicly. They talk about the taxes levied on traders: Friction tax, bot tax, speed tax and toxic flow. The words used are audacious, yet the underlying message is uncompromising the actual danger is not slow confirmations, it is unjust competition that takes advantage.

That is why the greatest interest to me of Fogo is not the chain itself but what it facilitates at the market layer.

Ambient and the big swing: Dual flow Batch Auctions.

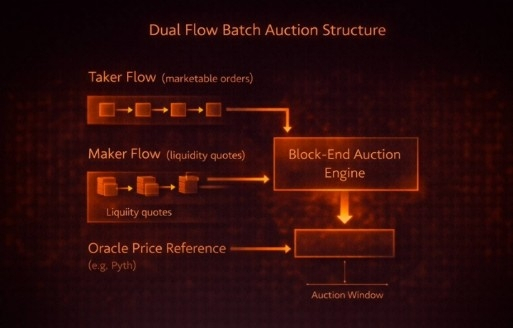

The most notable one is Ambient Finance, an everlasting DEX on Fogo that is going to execute Dual Flow Batch Auctions (DFBA).

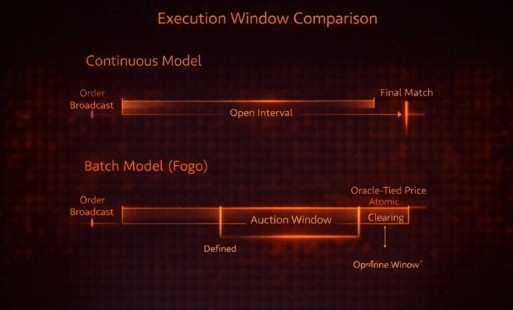

On-chain trading nowadays is likely to be in two worlds. The former is AMMs: simple and easy, but not necessarily effective in the case of fast market changes. The second one is continuous order books (CLOBs): they have smaller spreads and improved price discovery, but they are susceptible to latency games and MEV, since the first to see and trade tends to win.

DFBA is a mere combination of the merits of both worlds and elimination of the most vile flaw: the speed-based extraction. Ambient claims that DFBA combines CLOB accuracy with fairness through batching orders and clearing out the block at the end of the block, at an oracle-based price.

It is the oracle-bound marketplace that actually initiates the change of market-structure.

Why change bundling affects trading psychology.

Everyone in a continuous market is a race. The quickest users can push other users slower, jump queues, and take advantage of them. Through this reason, common traders tend to believe that they are trading with ghosts.

In the batch auction, the game changes. Orders are stacked up throughout the block and all clear at the end. According to Ambient, in contrast to continuous matching, DFBA aggregates orders and clears at block end, at a single clearing price on each side with the help of an oracle such as Pyth.

The moral of the story: the batching shifts competition on speed to price. When everybody clears simultaneously, you cannot win by being a millisecond faster, you have to quote better.

This, therefore, makes DFBA a legitimate call towards justness, rather than just another low-charge DEX.

The detail of the so-called dual flow is more important than one may assume.

Another suggestion made by Ambient is to split the orders into the maker and taker flows at the stage of batch accumulation.

Some omit this point, yet it is important since it separates the liquidity provision and consumption flows and the auction solves them to restrict reordering games.

The aim: smaller spreads and the snipers will not be advantaged.

That is quite a change to the typically DeFi story of increased leverage, increased points, and increased hype. It is a plea of integrity in the market.

Promised in crypto markets most underestimated is price improvement.

The writings of DFBA point out that price-improvement opportunities can be provided by batches. Ambient provides a simple example: when you place a buy order and the market falls, the competitors can revise the quotes atomically so that you can get a better price without the market racing.

That is a case that is prevalent in mature markets but uncommon on-chain.

Numerous DeFi casinos just claim to offer small slippage. DFBA tries to provide real fairness in the market movement.

Given that the ecosystem of Fogo can provide such on a regular basis, it is an upscale addition compared to another 10x headline TPS.

How DFBA attempts to reduce MEV without faking MEV disappears.

Most of the projects purport to eradicate MEV, and this sounds like a fairy tale. I find it appealing that DFBA aims at changing the process which facilitates front-running.

According to Ambient, front-running in the case of an unpredictable oracle final auction price is extremely hard and post-quiet-period.

Not a promise, that is mechanism design, when the clearing price is not predictable by an order placed by a bot, then the bot loses its advantage.

It will not eradicate all the MEV, but it is capable of restraining the most dangerous type of it, namely speed-based reordering which is detrimental to ordinary traders.

The solver model: Service based competition.

The description of the participants of auction is another indicator of maturity provided by Ambient. They mean external solvers and market makers providing competitive bids in the manner of solver models such as CoW Swap but made part of the batch process.

This is interesting in that it would make liquidity a competitive layer which would help in enhancing user execution, and not a mere pool.

In simple terms: the system challenges professionals to compete in the case of a better fill. It is an institutional concept as it coincides with the aspiration of Fogo of market-grade trading.

Market quality also includes resilience.

This is another angle that is not given due consideration by most hype threads, what happens when the oracle is stressed?

The DFBA write-up does not evade that. According to it, in case of oracle lag, the system can add delay to the auction. In case the oracle stops completely, oracle-pegged liquidity is switched off, and makers revert to offering fixed prices.

That is important since it demonstrates an effort of graceful degradation and not all breaks.

In actual finance the systems do not get bonus points on perfect days. They are respected because of their way of conducting themselves on bad days.

The underlying design in this story as to why Fogo will matter.

Although my angle is on market structure, it should not be ignored that the chain is important since the mechanism must be realistic.

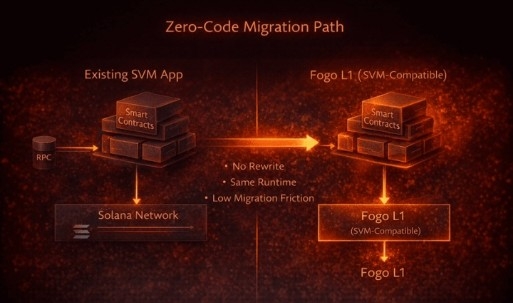

Ambient specifically states that DFBA may be fully deployed in smart contracts on the SVM of Fogo, where compute costs are minimal and no changes are needed to the consensus-layer.

That is a significant line: it implies that Fogo can now run such market mechanisms in high frequency without making each block a costly, slack event. DFBA auctions every block only works when the execution is efficient.

So yes—speed matters. In this story, it is not speed, but speed that enables it.

My lesson: Fogo is not creating the road and only the rules of trading

In one sentence, to say that Fogo is different, I would say the following: It is attempting to correct on-chain trading at the rules layer.

Most chains sell throughput. The ecosystem at Fogo is in the process of experimenting with a market structure that makes speed advantage less, uses competition that pushes towards price, and allows price improvement, all without leaving anything off the block or hidden.

Neither is that a guarantee of success. Market design is hard. But it is actually a new direction as opposed to the vicious cycle of new L1, same DEX, same MEV pain.

There are some chances that Fogo will not be another fast SVM chain in case DFBA-style execution gains momentum. It will be remembered as a chain that contributed to transitioning the on-chain markets away in the past of the fastest but the best priced. And to merchants, that is what makes the difference between a casino and a place.