CZ shared one of the most important investment lessons of 2025 and most people missed it.

During his interview on the All In Podcast, he said something simple that explains why most traders fail while a few build lasting wealth:

Push yourself just a little bit each day; 110% to 130% not more. Stay in that zone. Persist for thirty years.

That’s it.

Not 10x leverage.

Not chasing the next 100x altcoin.

Not trading 18 hours a day.

Just 110–130%. Every day. For decades.

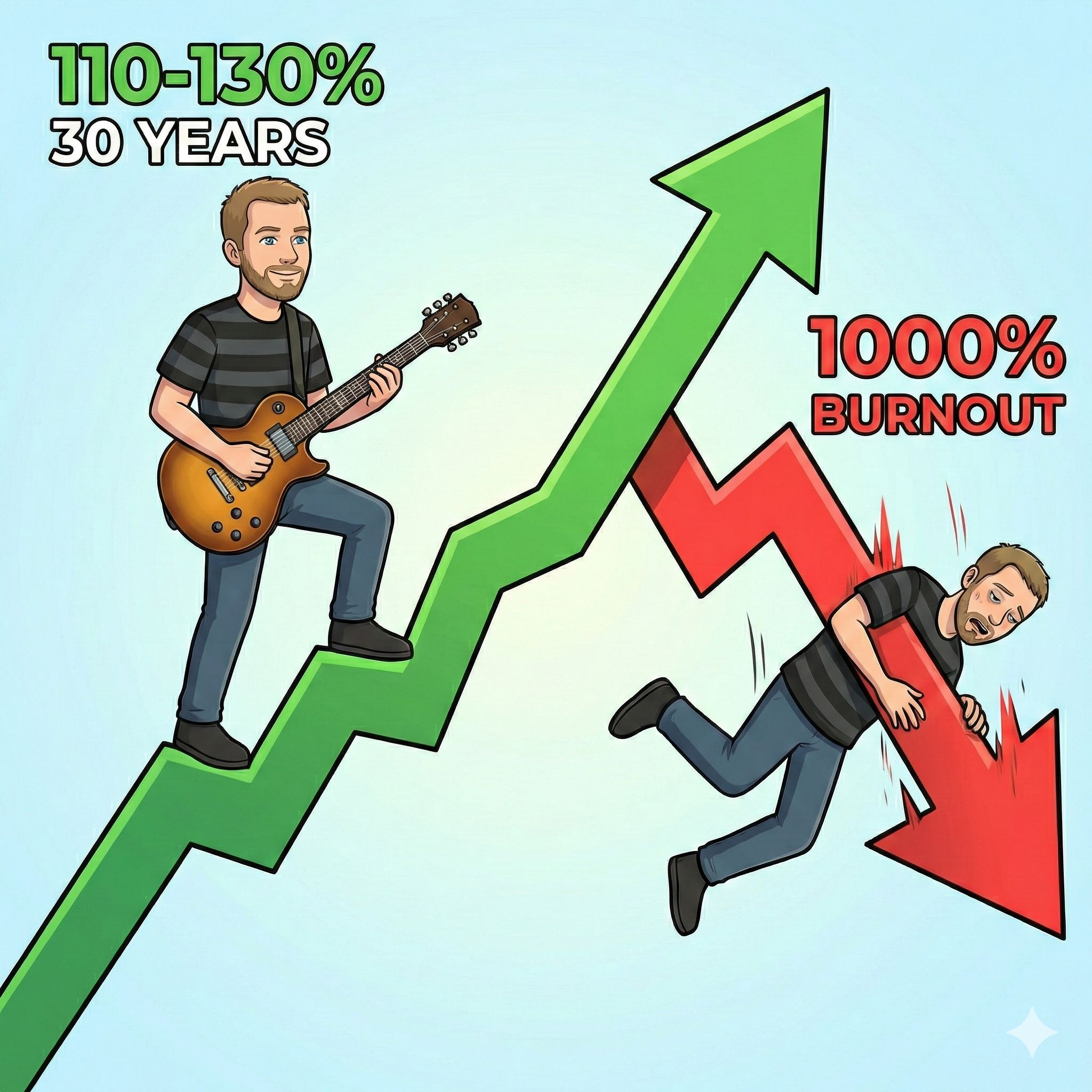

The hard truth? Most people in crypto try to do 1000% in a week, burn out in a month, and disappear within a year. Let’s break this down.

The Power of Moderate, Consistent Effort.

When CZ says 110–130%, he’s not talking about returns. He’s talking about effort.

Think of 100% as average behavior:

Checking prices randomly

Buying when it feels safe

Selling when scared

No real learning and repeating mistakes

110–130% is just slightly better:

Reading one solid article per day

Reviewing one mistake per week

Learning one new concept per month

It doesn’t sound dramatic. That’s the point.

The Math of Compounding Improvement

If you improve your knowledge and decision-making by just 10% per year, here’s what happens:

Year 1: 1.0 → 1.10

Year 5: 1.61

Year 10: 2.59

Year 20: 6.73

Year 30: 17.45

After 30 years, you’re 17 times better than when you started. Not because of extreme effort but because of steady improvement.

Now compare that to the typical crypto sprint:

Month 1: Obsession

Month 2: Exhaustion

Month 3: Emotional mistakes

Month 6: Burnout

Year 2: Gone

They tried to sprint a marathon. CZ walked it with slightly faster steps.

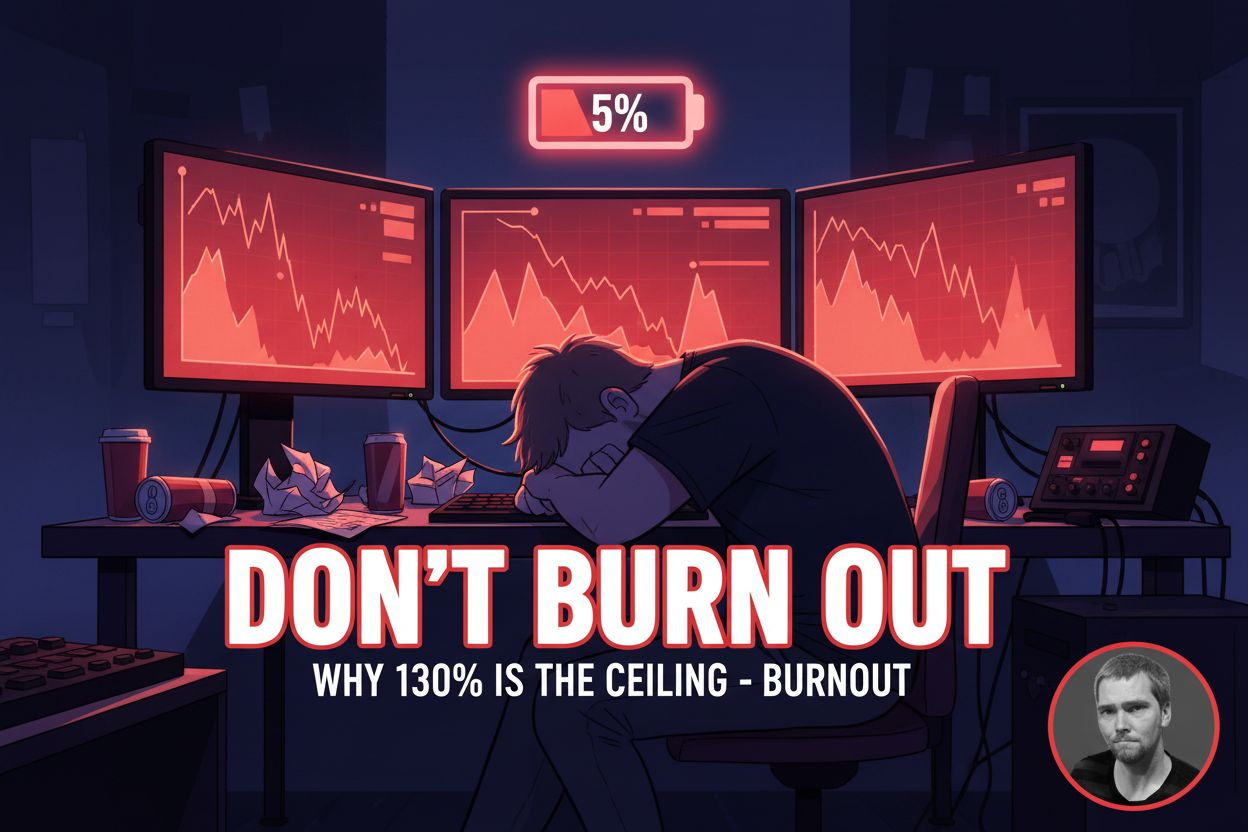

Why 130% Is The Maximum (Not The Minimum)

Here’s what most people get wrong about the 110-130% rule: they think it’s a floor. “Oh, I should do AT LEAST 130%. Better do 200% to be safe!”

No. 130% is the CEILING. Go above it and you break the system.

CZ specifically said: Over-forcing only leads to burnout.

Here’s what burnout looks like:

Checking charts at 3 AM

Trading daily without a system

Sleeping less than 6 hours

Emotional decisions

Lifestyle pressure

Eventually blowing up accounts

You can’t sustain that for years. But 5–7 focused hours per week? That’s sustainable for decades.

The Real Edge: Surviving Cycles

Crypto has crashed over 70% multiple times: 2013–2014, 2017–2018, 2021–2022.

Each time, most participants disappeared. The people who stayed weren’t the smartest. They were the most sustainable.

They:

Kept their jobs

Slept properly

Avoided leverage

Continued learning

Stayed solvent

When the next cycle came, they were ready. That’s the edge.

The Question That Changes Everything

Ask yourself:

Is what I’m doing right now sustainable for 30 years?

If the answer is no, you’re above 130%. Scale back because the person doing 130% for 30 years will outlast, outlearn, and out-earn the person doing 300% for 6 months, then quitting.

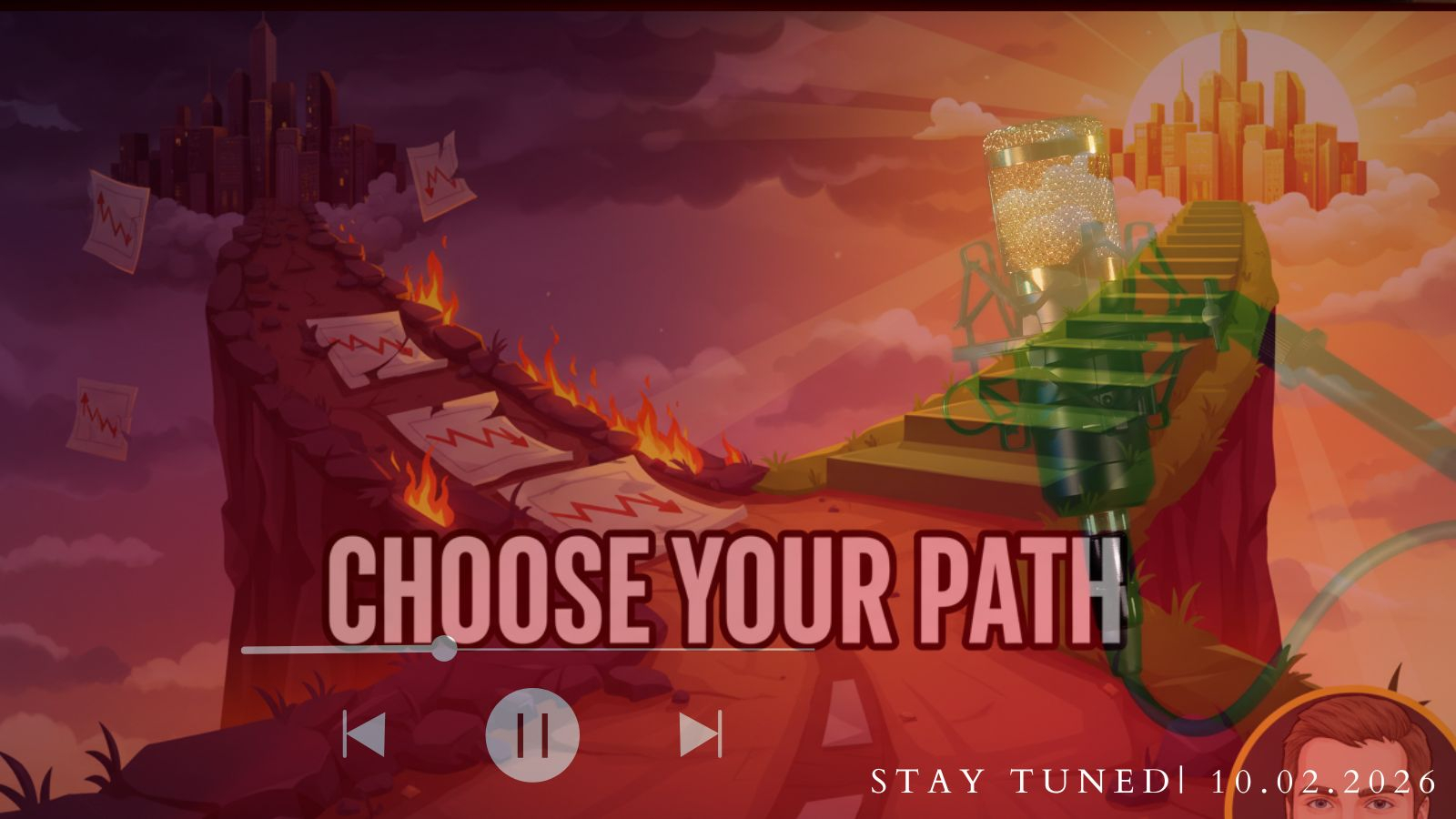

Your Two Paths

Path 1:

Overtrade

Over-stress

Burn out

Quit

Path 2:

Learn daily

Improve steadily

Stay in the game

Win by surviving

CZ chose Path 2. The question is: which path are you on?

Final Thought

The 110–130% rule isn’t about doing less. It’s about doing what you can sustain long enough to win. Survival is the strategy and Sustainability is the edge.

110–130%.

Every day.

For 30 years.

That’s the whole game.

For those who missed the podcast, you can watch it here