KYC in Crypto - A Comparison

The blog below was first published on July 4, 2022.

Last updated: March 7, 2023

Know-your-customer (KYC) verification is required by all regulators. It is also one of the strongest ways for platforms to protect users against hackers, market manipulators, and money launderers. As a crypto user, you should be wary of platforms with poor KYC measures.

Without KYC, financial institutions can’t effectively assess a user’s risk category. Is this user masking their identity? Are they depositing funds from a legitimate source, or could the money have been obtained illegally?

Today, Binance leads the charge with a stringent KYC process that is among the most rigorous in the industry. However, other industry players do not observe this high standard nor do they enforce it evenly across different geographic regions.

What Does KYC Look Like at Binance

Over the years, we have built a robust KYC system that is thorough, compliant in over 200 jurisdictions, and supported by industry-leading KYC companies such as Onfido, among others.

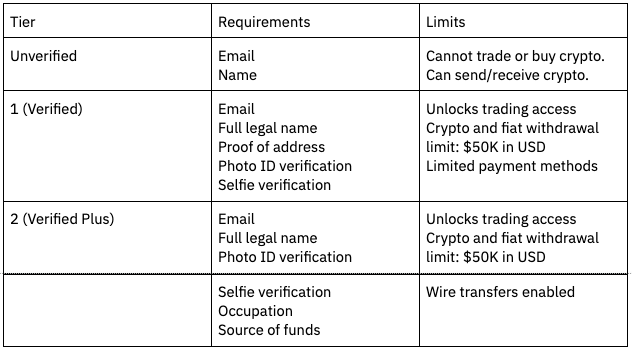

As of July 2022, our KYC process is split into three tiers — Verified, Verified Plus, and a custom limit available upon request — and requirements will vary depending on the local regulations.

For most countries, the process we require users to go through is this:

Tier 1 + 2 (Verified, Verified Plus)

Step 1: We collect and confirm the customer’s personal information. This will require a passport, driver’s license, or another valid government-issued identification document.

Step 2: To combat impersonation attempts, we employ a real-time Liveness Check that compares users’ faces with the government-issued documents they provided.

Step 3: We take all the collected information and verify users’ identities against World-Check, the largest database of high-risk, sanctioned, and politically exposed individuals.

Step 4: Users in EU countries must provide valid proof-of-address documents before they can access the Binance ecosystem. Users in non-EU countries only need to provide valid proof-of-address documents if they want to increase their daily fiat withdrawal limit from $50,000 to $2M.

Binance users must complete these checks if they want to trade crypto, deposit and withdraw funds, or access our vast ecosystem. Those who don’t complete verification will only have basic access to the Binance site. Non-verified users can explore our offerings, and claim NFTs, Fan Tokens, and Binance Gift Cards, but they will not — under any circumstances — be able to interact with any Binance trading products.

Please note: EU users can open a Binance account with lowered KYC requirements and limited access (only 1 fiat transaction below 1,000 EUR permitted) until the end of 2022. This lowered KYC process includes name, date of birth, country of residence, nationality, and a watchlist screening.

Tier 3 (available upon request)

Some Binance users may prefer a deposit and withdrawal limit that is significantly higher than the Verified and Verified Plus tiers. In this case, the user must declare their sources of wealth, source of funds coming to Binance, and whether they or their family members are classified as a Politically Exposed Person (PEP). This process ensures every request for significantly increased limits is legitimate and appropriate to the user’s proven net worth.

What KYC Looks Like on Other Platforms

At Binance, we pride ourselves on being industry leaders in building out KYC processes that are intuitive for users and in line with local regulatory requirements. We go above and beyond what the marketplace offers.

When selecting the exchange you want to trade on, KYC checks and processes in place on a platform can be seen as an indicator of how important this exchange views security.

The data on this table was pulled from competitors’ public-facing information on their KYC limits and requirements, as of this writing (March 7, 2023).

Tier 1 and Tier 2 reflect the KYC process required in most countries. However, KYC may vary depending on the user's region of residence. For example, some countries require Tier 2 KYC verification checks, such as proof of address or other jurisdiction-specific requirements, before the user can access any crypto service.

We request source of funds from users who require enhanced due diligence. For example, any Binance user who wants to increase their withdrawal limit above Tier 2 must declare their source of funds.

Huobi enforces a three-tier process unlike the other exchanges listed in this article. Their third tier, which increases user withdrawal limits to 3,000 BTC per day, only requires an additional selfie check.

Now, let’s take a closer look at the KYC process on each platform, starting with OKX. Here you will see how other platforms differ from Binance, as of this writing (March 7, 2023).

The data on this table was pulled from competitors’ publicly available information on their KYC limits and requirements, as of this writing (March 7, 2023).

Unverified users on OKX can trade, deposit, and withdraw up to 10 BTC in crypto funds — forgoing what the industry considers best practice for KYC.

Unverified users also have full access to every trading feature, including riskier products, like Futures trading, that are typically used by more experienced users.

For the step up to unlock 200 BTC withdrawal limits, OKC requires basic personal information, which is also not considered a strong KYC practice per industry standards.

OKC users are only required to verify their government-issued identity documents if they want to withdraw up to 500 BTC or cumulate up to $100,000 in P2P transactions.

The data on this table was pulled from competitors’ publicly available information on their KYC limits and requirements, as of this writing (March 7, 2023).

KuCoin eschews what is considered good KYC practice by allowing users to buy, sell and trade crypto with a basic account that has little to no need for proper identity verification.

It is worth noting that KuCoin has taken steps to enforce face and ID verification for tier 1 users. KuCoin’s previous KYC process only required tier 2 users to undergo further verification checks.

KuCoin’s strategy is simple. It blocks Chinese users (probably due to its presence in the country), and services users in all other countries, countries facing international sanctions. It ignores sanctions, rules, and local regulations, and advertises heavily, especially in countries where international exchanges have to follow local regulations.

The data on this table was pulled from competitors’ publicly available information on their KYC limits and requirements, as of this writing (March 7, 2023).

Similar to KuKoin, Bybit also eschews what is considered sound KYC practice by allowing users to trade and withdraw a significant 20K USD worth of crypto a day with only an email address for verification.

To increase that limit to 1M USD, users are only required to submit a verified government-issued photo ID and a facial recognition check. If you'd like to increase that to 2M a day, all you need is to add proof of address.

Of particular concern with exchanges Bybit and KuKoin is the fact that the unverified level of KYC could already allow bad actors to trade and withdraw significant amounts of crypto.

Bybit adopts a similar strategy to KuCoin, but has been seen as willing to negotiate with local regulators in certain countries, including a willingness to pay some fines.

The data on this table was pulled from competitors’ publicly available information on their KYC limits and requirements, as of this writing (March 7, 2023).

Huobi enforces a three-tier KYC process. tier 1 requires basic information, which users can easily falsify, to trade crypto and withdraw a significant 5 BTC per day. There is no indication the platform verifies the authenticity of its tier 1 users, who in essence, are comparable to unverified users on other platforms.

Tier 2 and Tier 3 require further checks such as ID and facial verification. Of particular concern, Huobi permits withdrawals of up to 3,000 BTC per day without asking for occupation, proof of address, or source of funds.

The data on this table was pulled from competitors’ publicly available information on their KYC limits and requirements, as of this writing (March 7, 2023).

Coinbase users must verify their identity with a valid government photo ID before they can start trading, depositing, or withdrawing crypto. And if users want to enable all payment methods, including wire transfers, they must show their source of funds.

This process is quite similar to Binance’s approach to KYC — new users must go through a series of checkpoints. There are no ifs or buts.

A Crucial Component: Identity Verification

Requiring identity verification is the first checkpoint against money launderers, who often try to obscure their source of money through small quantities spread across various accounts.

You can think of our KYC philosophy as “prevention is the best cure.” In other words, we believe it’s better to meet the problem head-on – in this case, financial crime – than try and fix it once the damage is done.

For Binance, KYC has been the most effective tool to combat hackers, hacked funds, etc.

For example, if there were no strong identity checks in place, even if the Binance security team caught an unverified user making suspicious transactions, that user would still be able to come back using an alternative email. Even worse, the user could have already moved a considerable sum of money. Document and liveness verification checks are designed to stop this from happening.

A strict KYC policy imposes a zero-tolerance approach to double registrations, anonymous identities, and obscure sources of money. While some may argue this goes against the philosophy of decentralization and anonymity, in this particular instance, we are focusing primarily on centralized exchanges. Ultimately, these measures drastically reduce the chances of illegitimate funds making their way into the larger Web3 ecosystem.

Unfortunately, not every exchange approaches identity verification with the same level of due diligence. And some exchanges may even relax their KYC measures to attract more users.

Building Stronger Defenses

According to Chainalysis’ 2021 crypto crime report, illegal transactions only represented 0.15% of crypto activity — an all-time low — with legitimate use cases outpacing the growth of illicit usage by far. However, this statistic doesn’t mean that crypto exchanges should become more relaxed.

Combine this with the fact that according to blockchain analysis firm CipherTrace , “over one-third of cross-border bitcoin volume is sent to exchanges with demonstrably weak KYC,” and it’s easy to see how a single player not acting in the best interest of its users and the industry can negatively impact the space as a whole.

The goal should always be to turn the 0.15% of illegal transactions into 0.015% or eventually 0. Implementing KYC systems on Web3 platforms should become a default, focusing on the quality and comprehensiveness of such measures. Our industry should always strive to do better.

In the long run, complete and unrestricted anonymity in crypto is unsustainable. And realistically, it won’t survive the ongoing regulatory push.

For more information, you can read our commitment to user protection. To start trading crypto with confidence, create a Binance account today.