One of the most interesting recent updates is that @Vanarchain brought in a new Head of Payments Infrastructure with decades of experience in traditional finance and payment rails. That’s not a flashy announcement, but it matters. A lot. You don’t hire someone with deep Worldpay and FIS background unless you’re serious about plugging blockchain into real payment flows, not just DeFi experiments.

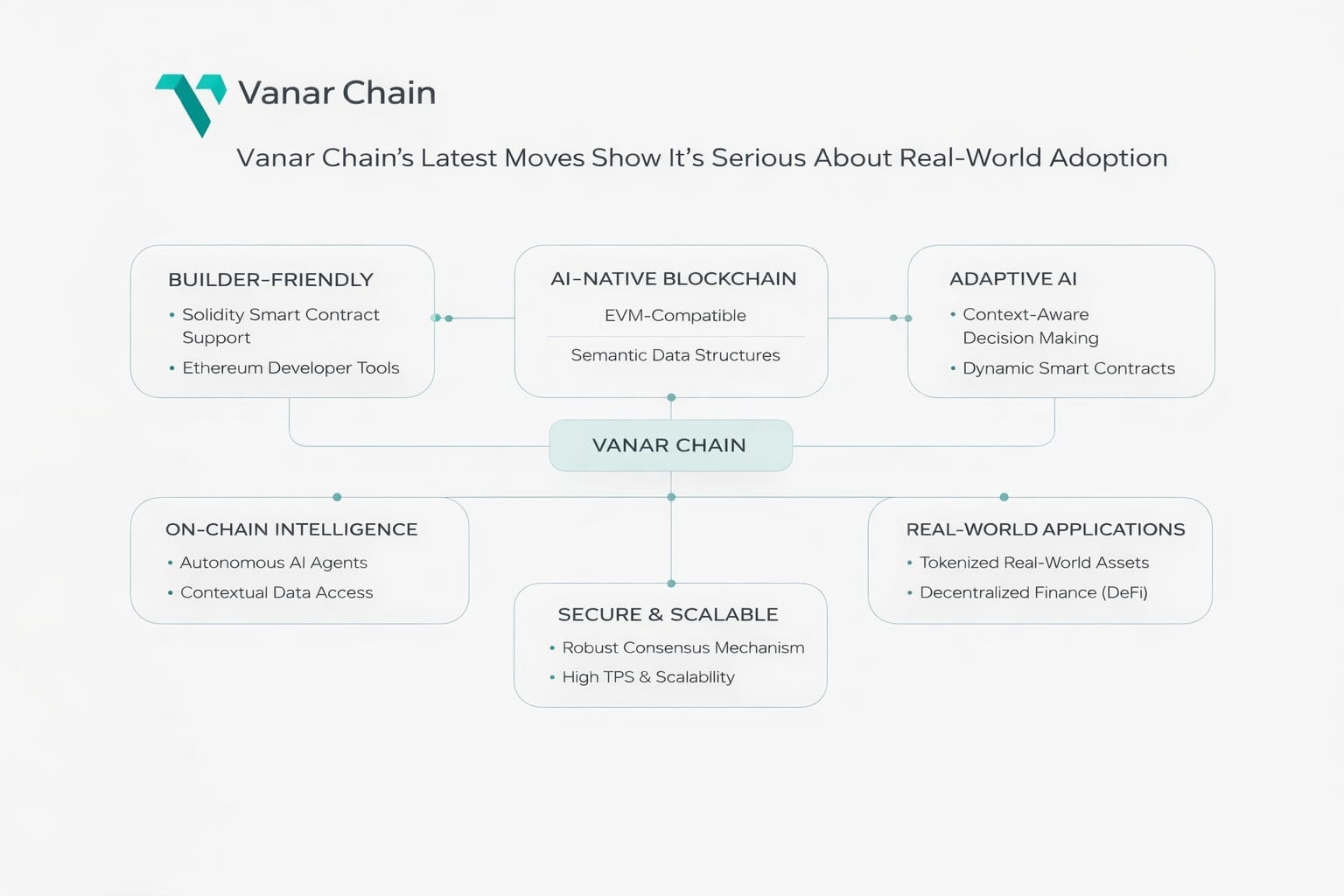

That lines up well with Vanar’s broader direction. The chain has been positioning itself as AI-native financial infrastructure, not just another EVM clone. Yes, it’s EVM-compatible, so developers can still use Solidity and familiar tools. But the difference is how Vanar treats data.

Instead of storing information as static blobs and letting off-chain systems do the thinking, Vanar’s Neutron layer turns data into semantic objects that AI systems can actually reason over. That’s a big deal for things like automated payments, compliance logic, and financial workflows that change based on context.

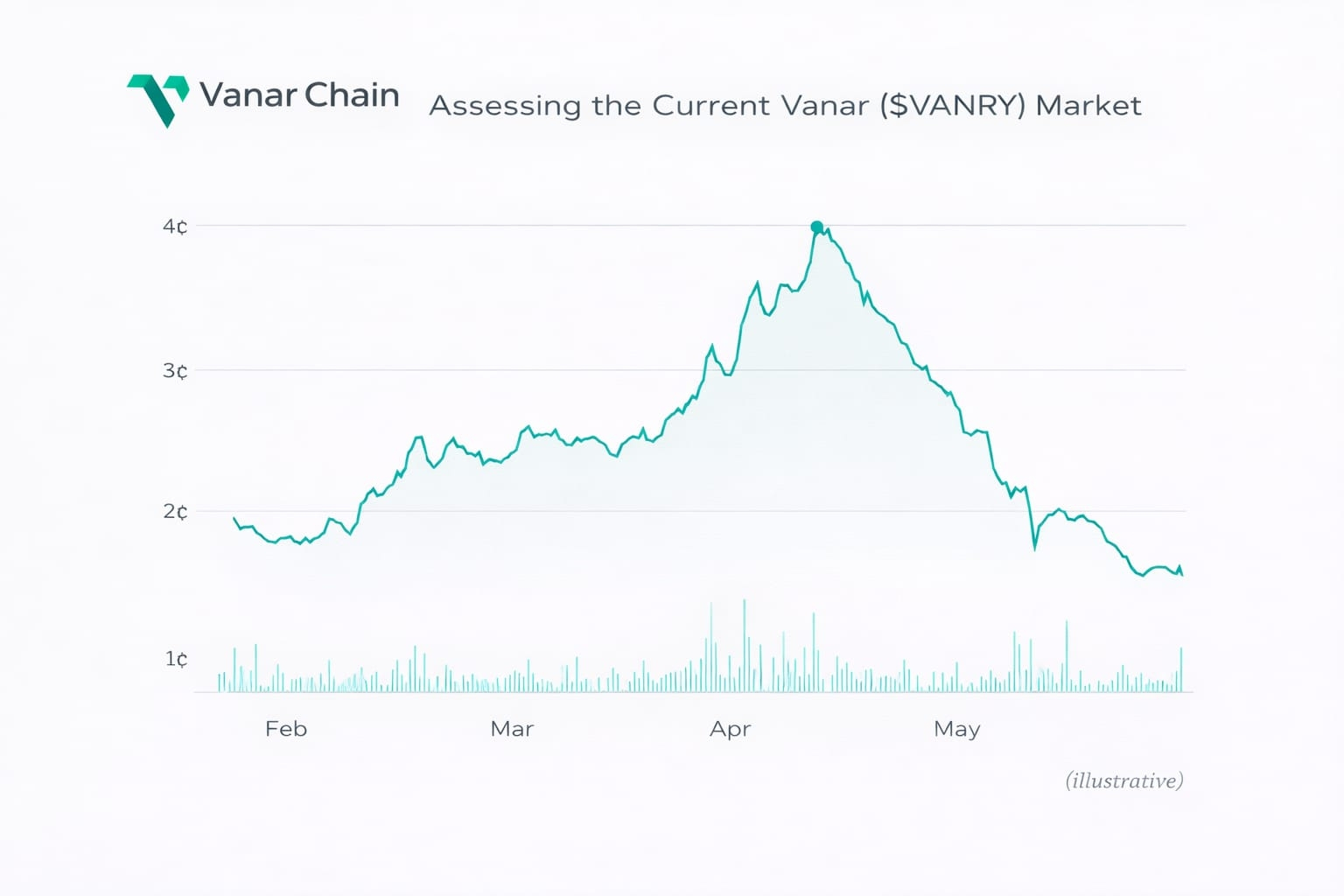

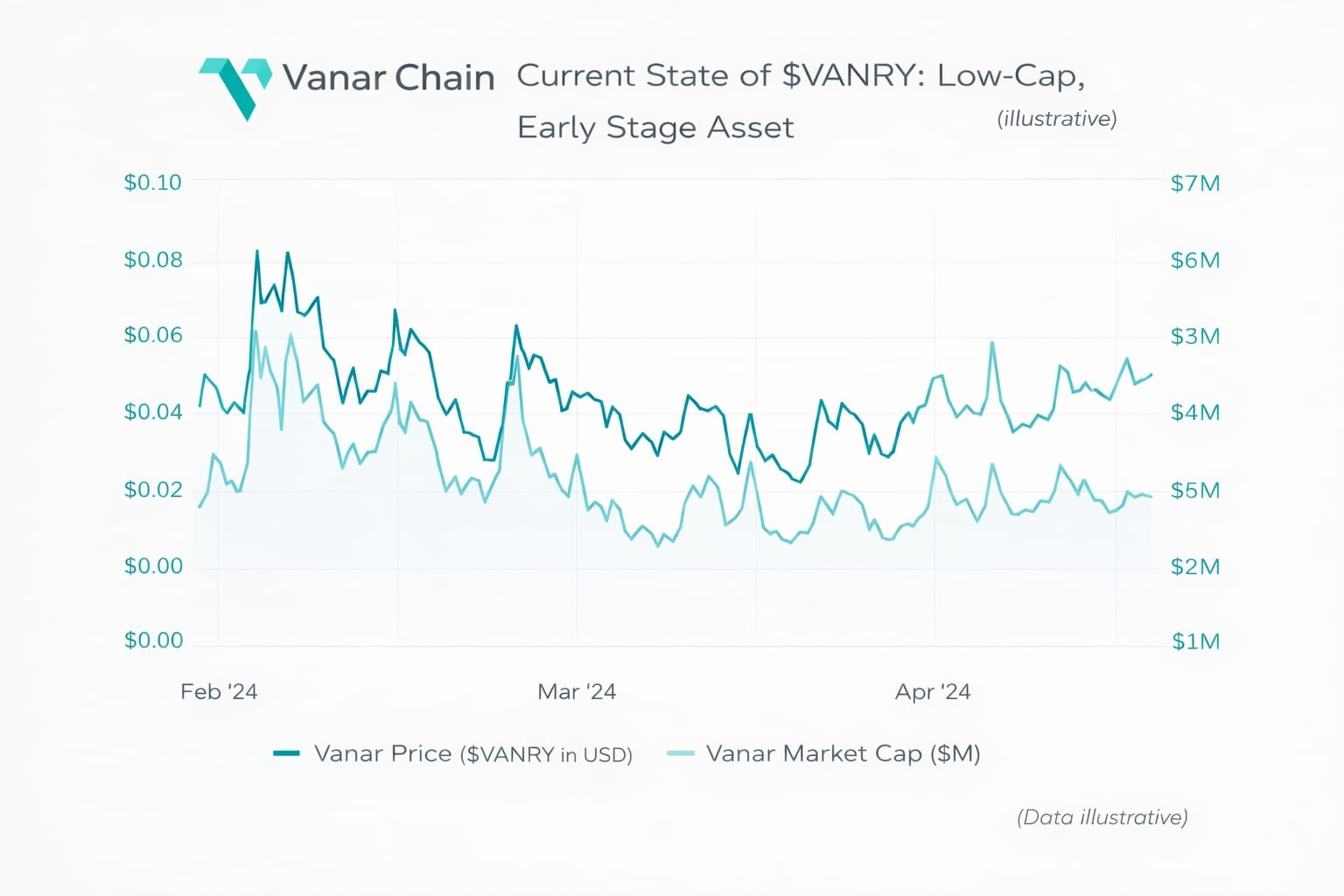

From a market perspective, $VANRY is still very much early. It’s trading around the low-cent range with a relatively small market cap and modest daily volume. Translation: volatility is real, liquidity isn’t deep yet, and this isn’t something institutions are piling into today. That’s the risk side.

But the flip side is that the market clearly hasn’t priced in long-term adoption yet either.

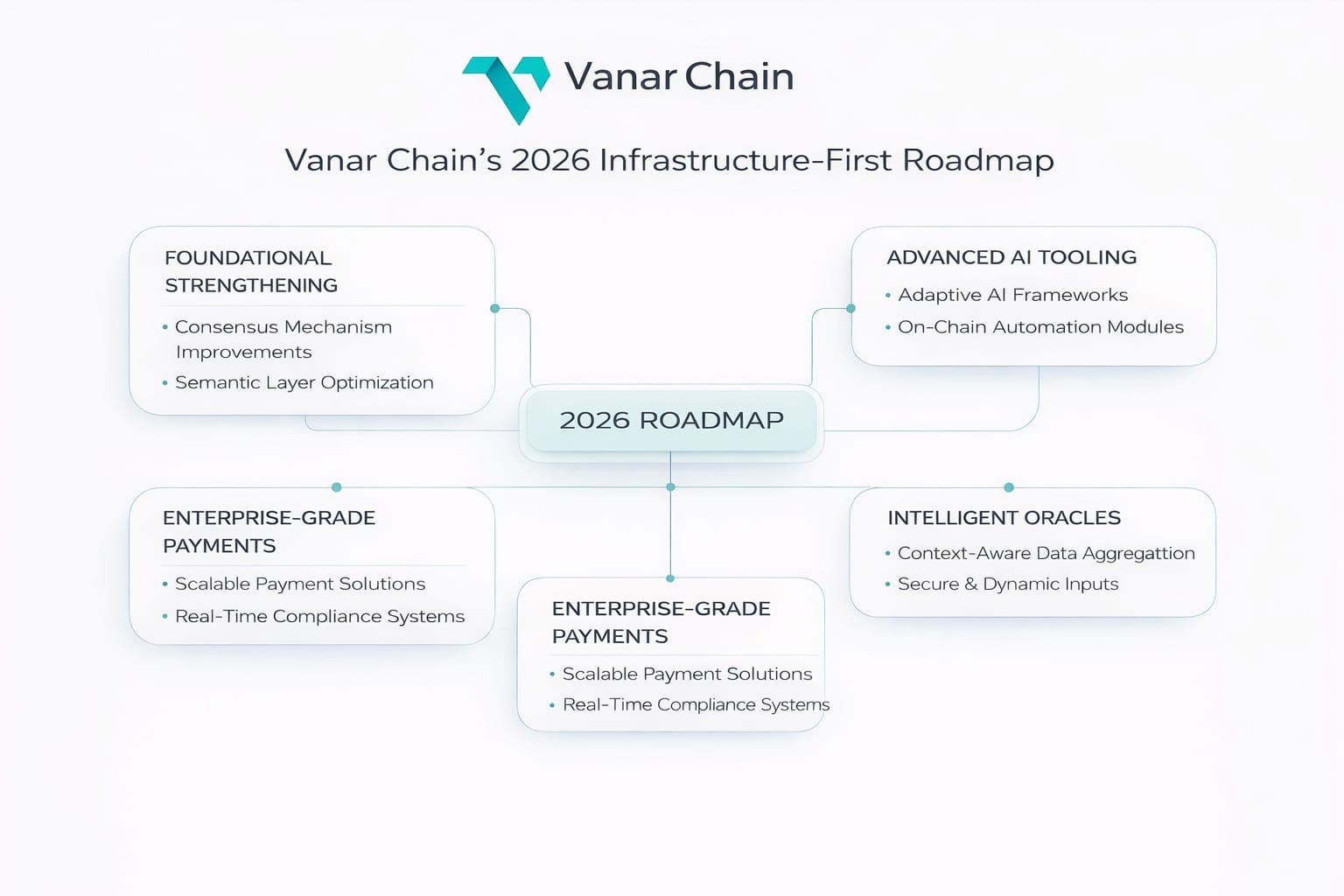

What I like is where the team is spending its energy. Instead of chasing short-term hype, Vanar’s 2026 roadmap leans into infrastructure upgrades, intelligent automation, and actual utility. Less noise. More building. That usually doesn’t pump price fast, but it’s how serious platforms get created.

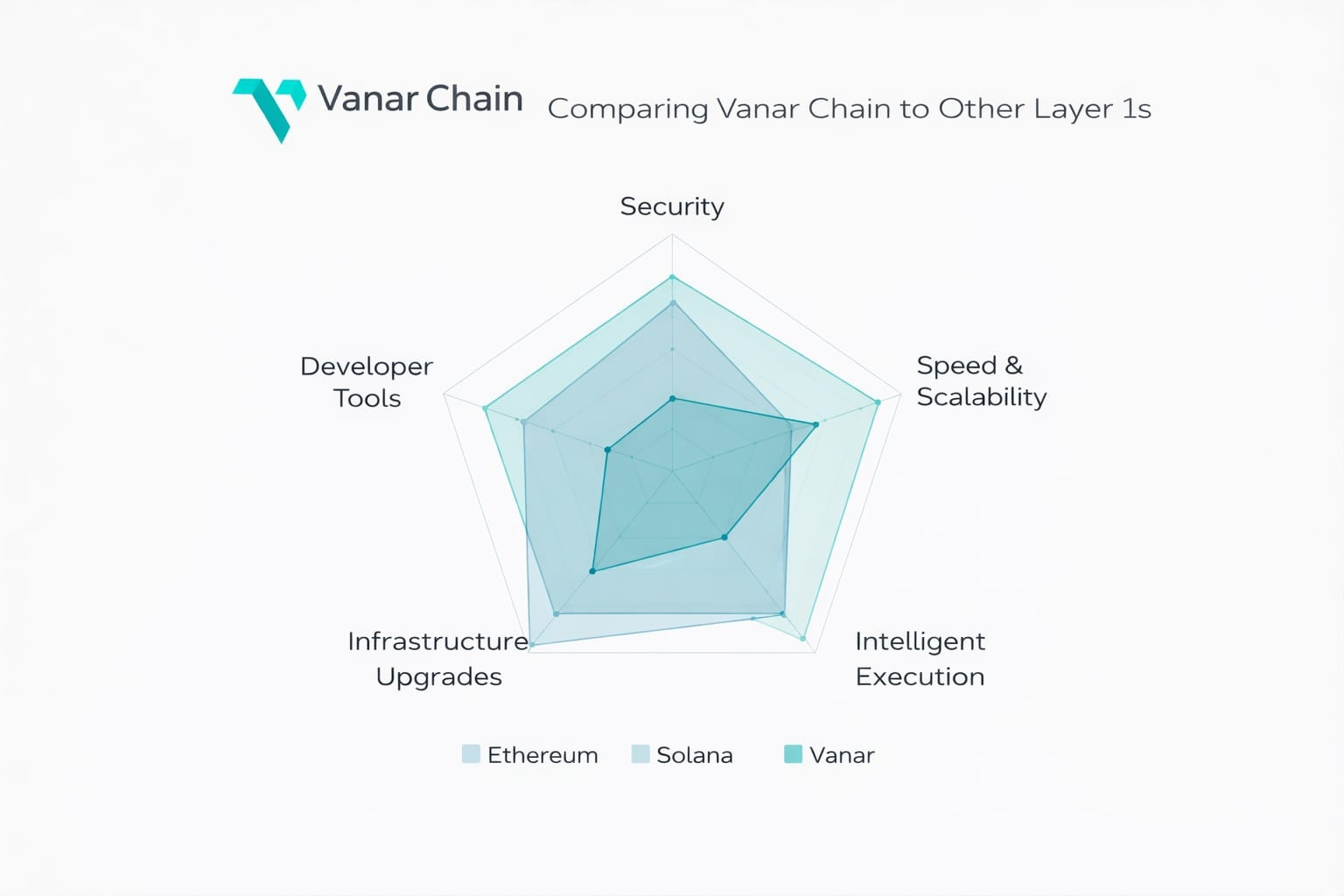

If you compare Vanar to other Layer 1s, the positioning becomes clearer. Ethereum is about settlement and security. Solana is about speed and scale. Vanar is carving out a niche around intelligent execution on-chain systems that can adapt, reason, and automate without relying heavily on off-chain middleware.

Of course, there are real challenges. AI-native blockchains come with a learning curve. Developers need time to understand what’s possible. And #vanar still needs shipped applications to prove this isn’t just architectural ambition.

But recent moves suggest the team is thinking long-term. Payments leadership. Infrastructure focus. Practical AI tooling.

That’s why Vanar feels less like a speculative narrative and more like a chain quietly preparing for where Web3 is actually heading. Not loud. Just deliberate.