A new week is upon us.

So far, the crypto market managed to pull through the weekend without any major dips in price.

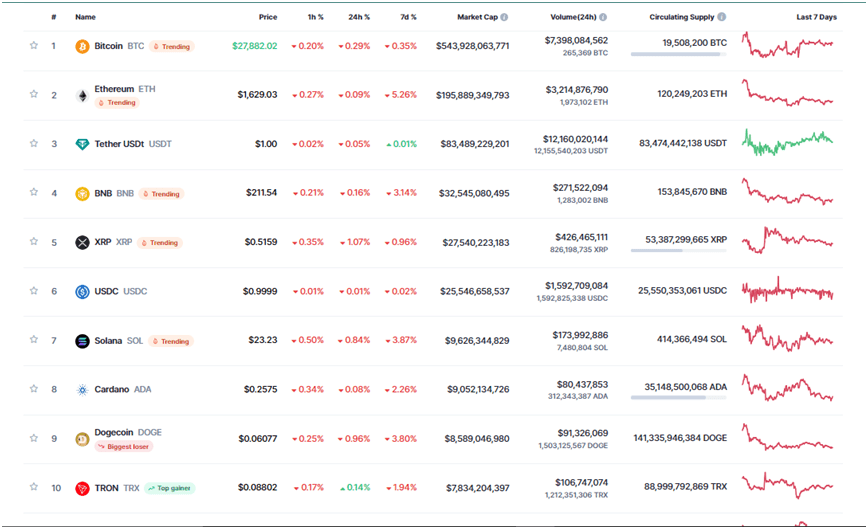

The total crypto market cap is still steady at $1.09 trillion despite the general post-weekend reds as shown below.

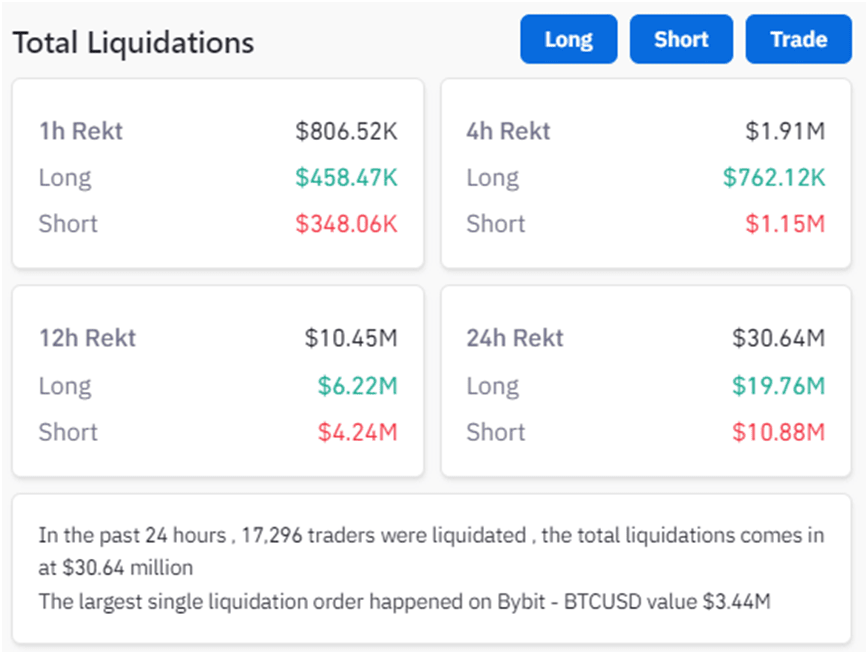

Coinglass data shows us that the weekend wasn’t so favourable for the bulls. Because while Saturday saw the Bulls take an $11.52 million beating, Sunday came in with an even harsher $30.64 million loss on the bulls' side.

Coinglass even tells us that a single trader lost a whopping $3.44 million trading BTCUSD on Bybit this Sunday.

Yikes. Sucks to be them.

Let’s go over the crypto market today again, and figure out what’s up under the hood.

Bitcoin: Almost There…

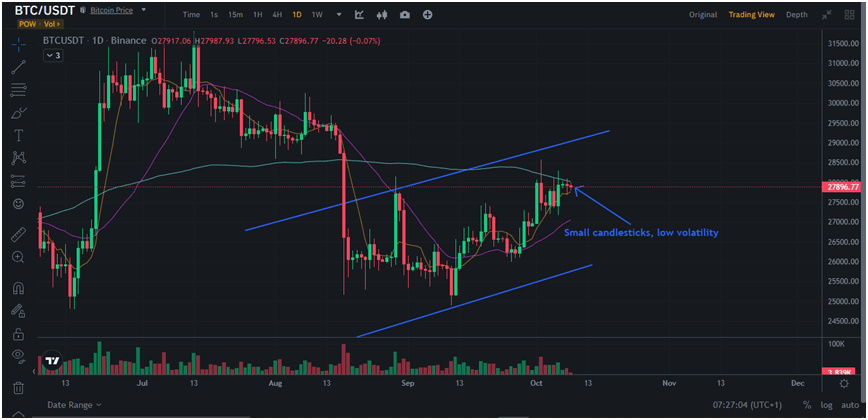

Bitcoin suffered from low volatility over the weekend. Why?

Because of the 99-day moving average.

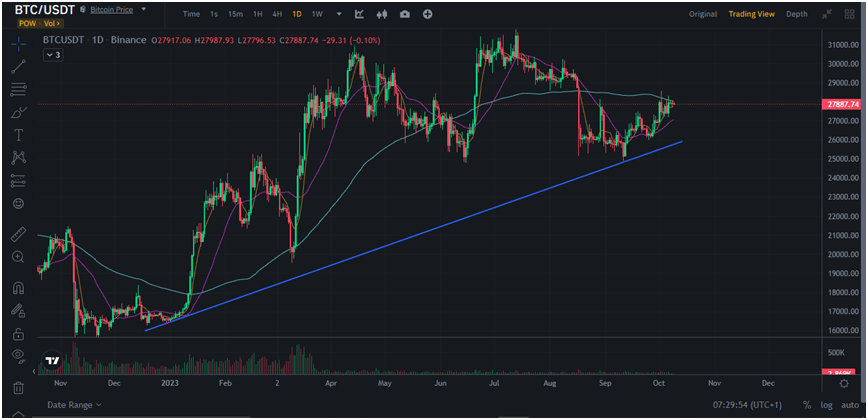

We mentioned yesterday that Bitcoin was on top of an ascending trendline, and was sufficiently bullish for the year.

However, a smaller ascending trendline continues to hold Bitcoin in place, with the 99-day moving average being a major pain in the bulls’ necks.

It turns out that the last three candlesticks on the daily charts have been small and weak. This indicates that the bulls are pushing as hard as they can, while the bears continue to defend this moving average.

Before long, however, the bears will eventually crack and $35,000 Bitcoin will come fully into view.

Do Something, Ethereum!

Ethereum is not the most bullish cryptocurrency at the moment. However, this may change soon.

Best believe that Ethereum's comeback is bound to be massive because, after the initial rejection from its 99-day moving average, the cryptocurrency reversed course for a retest of its long-term ascending trendline.

If Ethereum hits this trendline and manages to rebound, we are bound to see an explosive price movement, with nothing stopping ETH from retaking $2,000.

Bancor (BNT): What Are We Looking At Here?

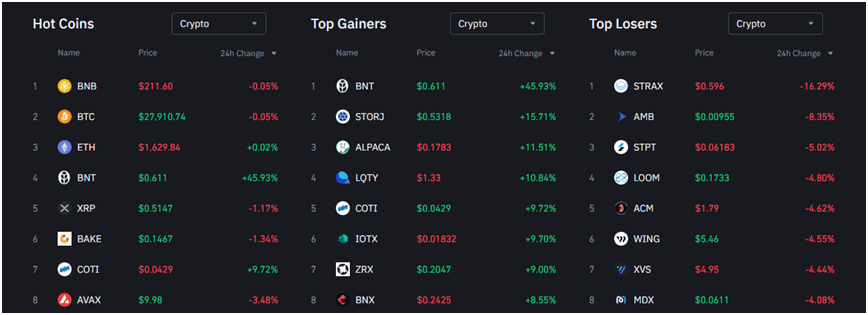

Speaking of bullishness, Bancor or BNT is the #1 top gainer on Binance, the 4th hottest, the 3rd largest by trading volume, and the #1 top futures-traded crypto.

But how does one cryptocurrency get so many medals in a single trading day? Easy: BNT is up by 45% over the last 24 hours.

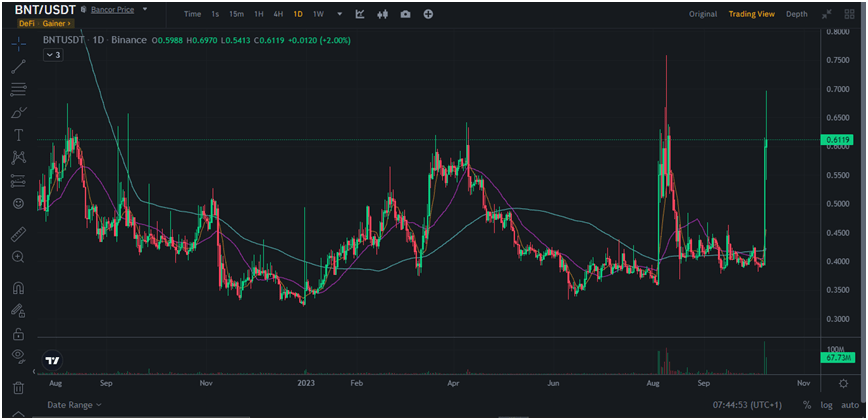

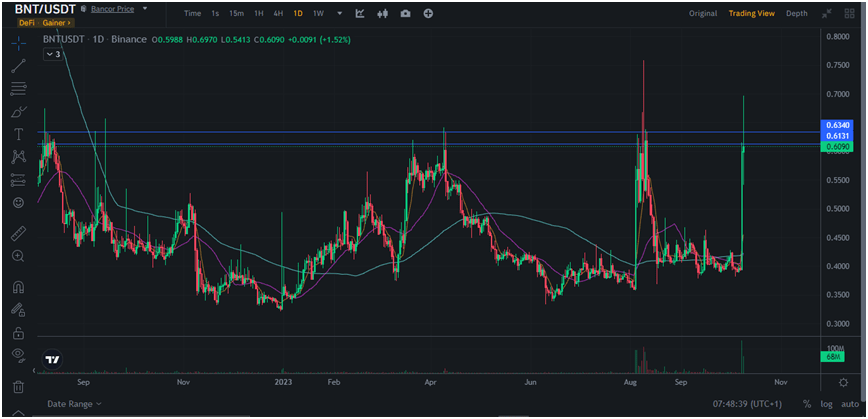

Take a look at its chart: Notice anything weird?

BNT does this thing where it simply spikes in a matter of days, and then comes right down again. It trades at $0.6132 at the time of writing, and we can easily identify the $0.6340 and $0.6131 zone relevant support/resistance.

The verdict? This cryptocurrency provides an interesting opportunity for a short trade (sell). A trader might put their stop-loss somewhere slightly above $0.6340, and ride a likely correction wave back to the 99-day MA, around $0.4181. Storj

($STORJ): Wait For It…

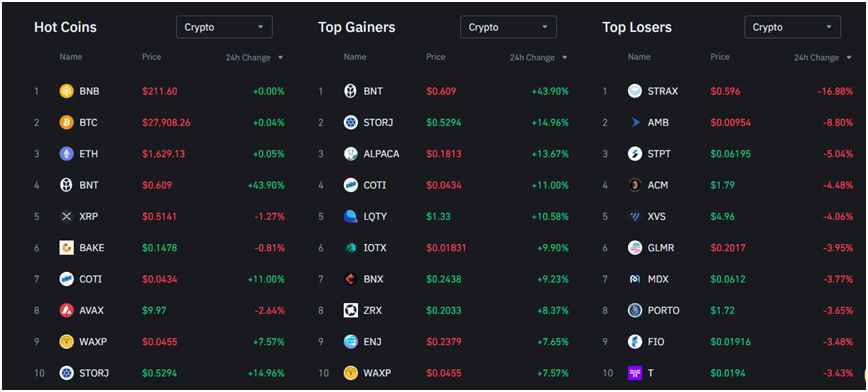

Storj is also one of the most bullish cryptocurrencies on Binance, with a 15% gain over the last day.

It is also the 10th hottest crypto on the platform and the 9th largest In terms of trading volume.

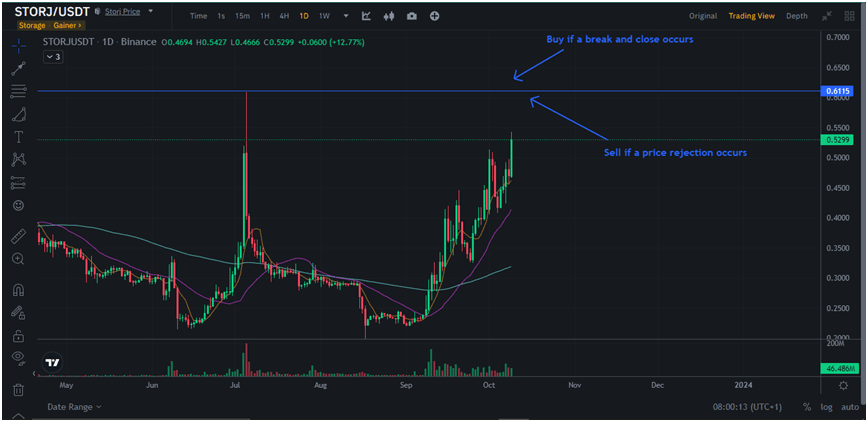

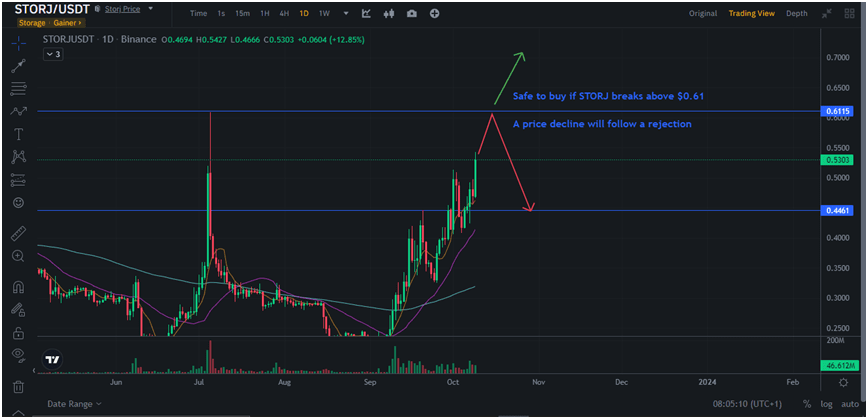

However, the charts show us some very interesting things.

For example, the cryptocurrency hit a $0.61 high in early July this year, and is now aiming for a retest at the time of writing. That’s great! We should all jump into a trade, right?

Wrong! Patience is the ultimate virtue. The smart move would be to wait this one out. Watch what happens around $0.61 to know your next move.

If a break and close above this zone happens, it is safe to buy.

However, if a break and close isn’t possible or if an outright rejection occurs at this zone, investors would have all they need to ride the wave down towards $0.445 or even lower.