In the BTCFi space (DeFi on Bitcoin), the ultimate challenge is generating yield without compromising the core principles of Security and Asset Ownership. Lorenzo Protocol ($BANK ) does not choose DeFi or CeFi; it implements a Hybrid Security Model, combining the immutability of smart contracts with the rigor of institutional governance

This architecture establishes a multi-layered "Citadel" protected by both digital enforcement and human oversight

1️⃣ Tier 1: Core Asset Protection (Multi-Signature Custody)

This is the institutional-grade layer of asset security, where funds are protected the moment a deposit transaction is finalized.

High-Level Custody: The underlying assets allocated to the vault are directly transferred to a custodial wallet or exchange prime wallet (depending on the CEX setup). This account is segregated from the trading team's operational funds.

Multi-Signature Control: Instead of relying on a single key, assets in the custodial wallet are governed by a Multi-signature (Multi-sig) mechanism.

Signing Parties: This process requires cryptographic consensus from several independent parties: Lorenzo Protocol, DeFi Partners (Liquidity Providers), and specialized Security Curators.

Benefit: This N-of-M mechanism eliminates counterparty risk and the single point of failure, ensuring no single entity can unilaterally move the capital.

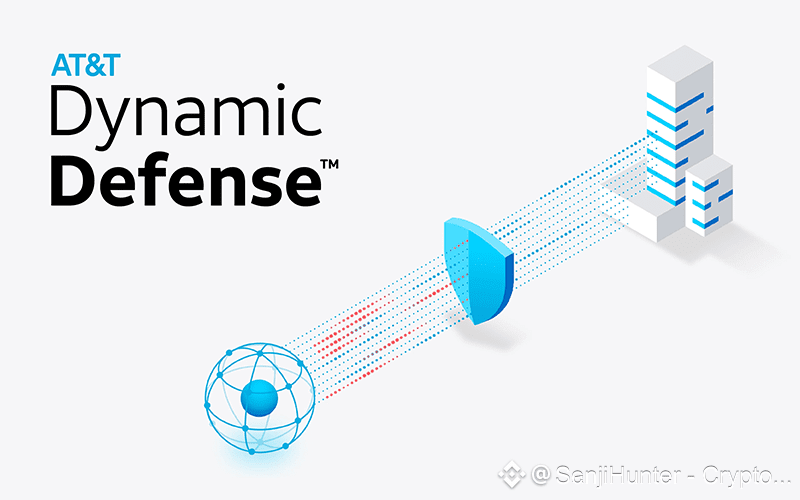

2️⃣ Tier 2: Dynamic Defense (Immediate Freeze Mechanism)

The ability to react instantly is paramount. The freeze mechanism serves as the dynamic defense layer, protecting capital from suspicious activity in near real-time

CEX Risk Notification: If Lorenzo is notified by the trading platform that a specific transaction or activity is suspicious or fraudulent, the system triggers an emergency response

On-Chain Action (freezeShares()): The Vault contract immediately invokes the freezeShares() method to freeze the corresponding LP Tokens

Effectiveness: Frozen LP Tokens cannot be redeemed for the underlying assets. This ensures the suspicious capital is detained within the vault per the CEX's request

Value Proposition: This is the crucial bridge between centralized risk monitoring (CEX reporting) and decentralized enforcement (Smart Contract logic), a feature indispensable for quantitative trading environments

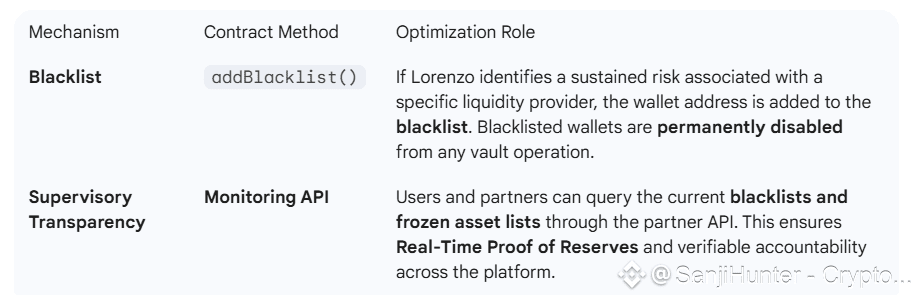

3️⃣ Tier 3: Exception Control and Supervisory Transparency

The final tier deals with long-term risk governance and the permanent exclusion of malicious actors

💡 Expert Conclusion: Security is Architecture, Not a Feature

Lorenzo Protocol's security mechanism is not an add-on; it is a holistic architecture designed from first principles

By fusing Multi-Signature Custody (asset control), On-Chain Freeze Mechanisms (dynamic defense), and Supervisory Transparency (API monitoring), Lorenzo establishes a new standard for safety. This rigor, where institutional discipline is enforced by blockchain immutability, is precisely what positions Lorenzo as an optimal solution for unlocking and managing large-scale liquidity in the BTCFi era

@Lorenzo Protocol #lorenzoprotocol $BANK