$RAD/USDT Shows Strength: Why a 6% Upside Is Possible Even in a Bearish Market

When the broader crypto market turns red, traders usually expect most altcoins to follow. But every so often, a token decouples from market sentiment—and RAD/USDT (Radicle) is showing signs that it could be one of those exceptions.

Despite bearish pressure across Bitcoin and major altcoins, RAD is displaying technical and fundamental signals that point to a potential 6% upside, even while the overall market remains under stress.

Understanding the Bearish Backdrop

In a bearish or declining market:

Risk appetite is low

Capital flows out of high-volatility assets

Most altcoins trend downward with Bitcoin

Yet, history shows that select projects with strong narratives or technical setups can still rally, especially when selling pressure weakens.

Why RAD/USDT Can Move Against the Market

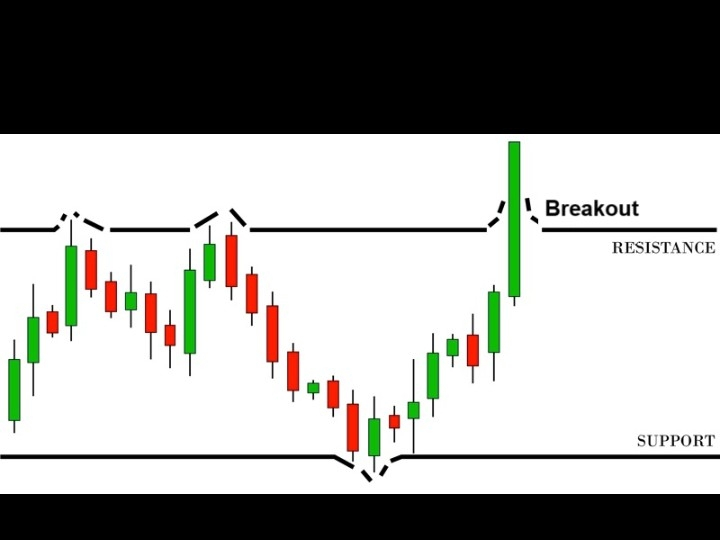

1. Relative Strength & Price Structure

RAD has recently shown relative strength compared to other mid-cap altcoins. While many assets are making lower lows, RAD is holding key support levels, suggesting:

Sellers are losing momentum

Accumulation may be taking place

This type of price behavior often precedes short-term relief rallies of 5–7%.

2. Support Zone Holding Firm

On the RAD/USDT chart, price has respected a well-defined support zone. Each dip into this area has been met with buying interest, indicating:

Strong demand at lower levels

Reduced downside risk in the short term

When support holds during bearish conditions, even a modest influx of buyers can trigger a sharp bounce.

3. Short-Term Technical Indicators Turning Up

Momentum indicators such as RSI and short-term moving averages are beginning to stabilize or curl upward. This often signals:

A local trend reversal

Potential for a quick upside move before the next broader market decision

A 6% pump is a realistic target for this kind of technical reset.

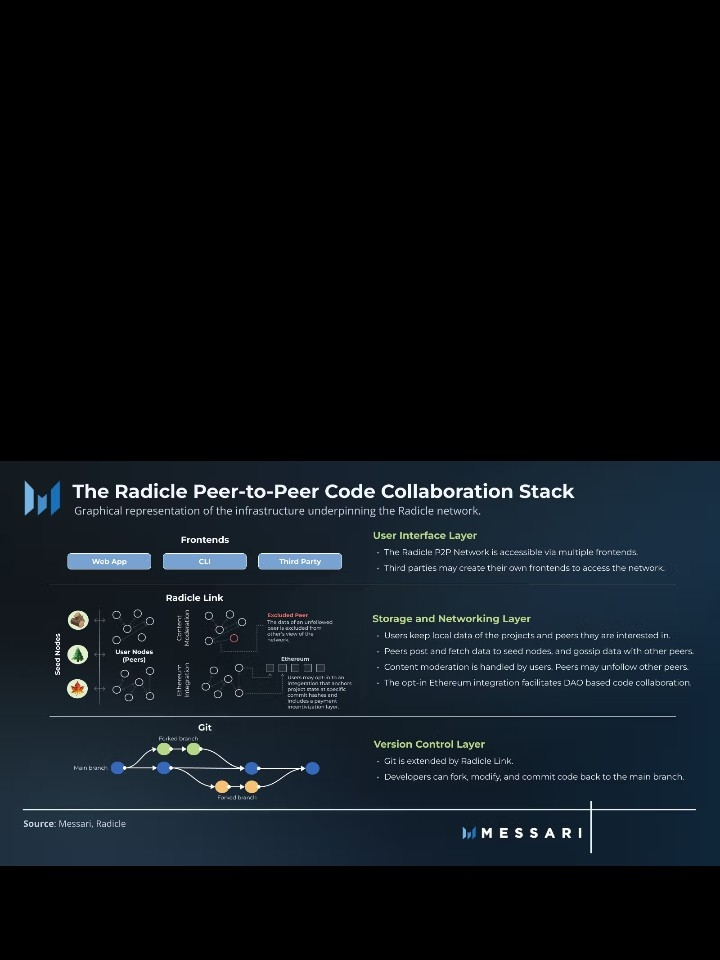

4. Radicle’s Long-Term Narrative

Radicle focuses on decentralized code collaboration and developer sovereignty, a niche but important sector in Web3. While fundamentals don’t always drive immediate price action, they do:

Attract long-term holders

Reduce panic selling during market downturns

This creates a more stable base from which price can rebound.

What a 6% Move Looks Like in a Bear Market

In bearish conditions, rallies tend to be:

Fast

Technically driven

Short-lived unless confirmed by volume

For RAD/USDT, a 6% upside would likely be a relief rally, not a full trend reversal—something traders often capitalize on while staying cautious.

Final Thoughts

While the crypto market remains under bearish pressure, RAD/USDT stands out as a candidate for a short-term upside move. Strong support, relative strength, and improving momentum suggest that a 6% pump is possible, even if the broader market continues to slide.

As always, bearish markets demand discipline. Manage risk carefully, watch volume confirmation, and remember: counter-trend moves can be powerful—but they require smart execution.

Please follow me for more and latest updates about crypto market news thanks