Disclaimer: In compliance with MiCA requirements, unauthorized stablecoins are subject to certain restrictions for EEA users. For more information, please click here.

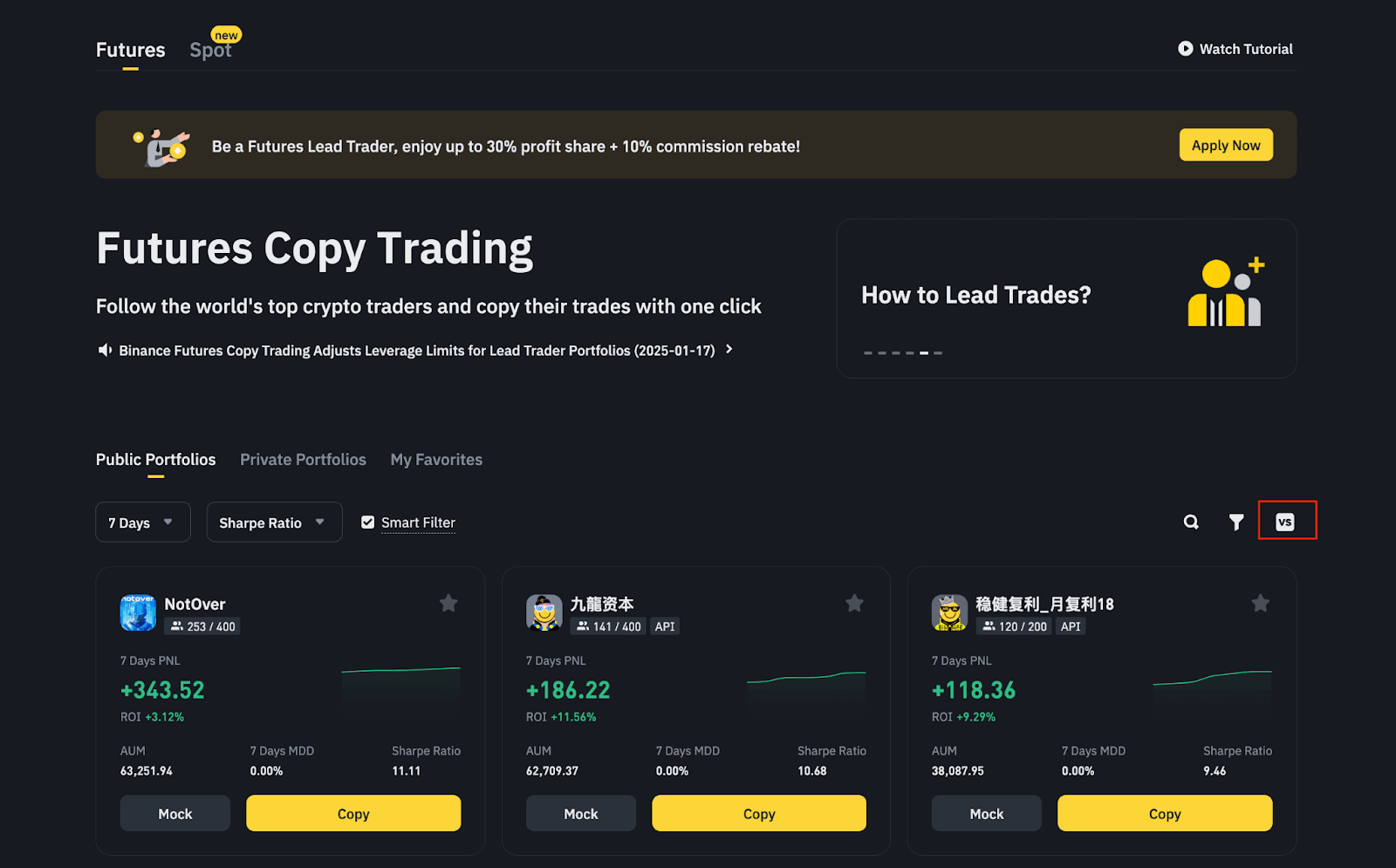

1. Log in to your Binance account and go to [Trade] - [Copy Trading].

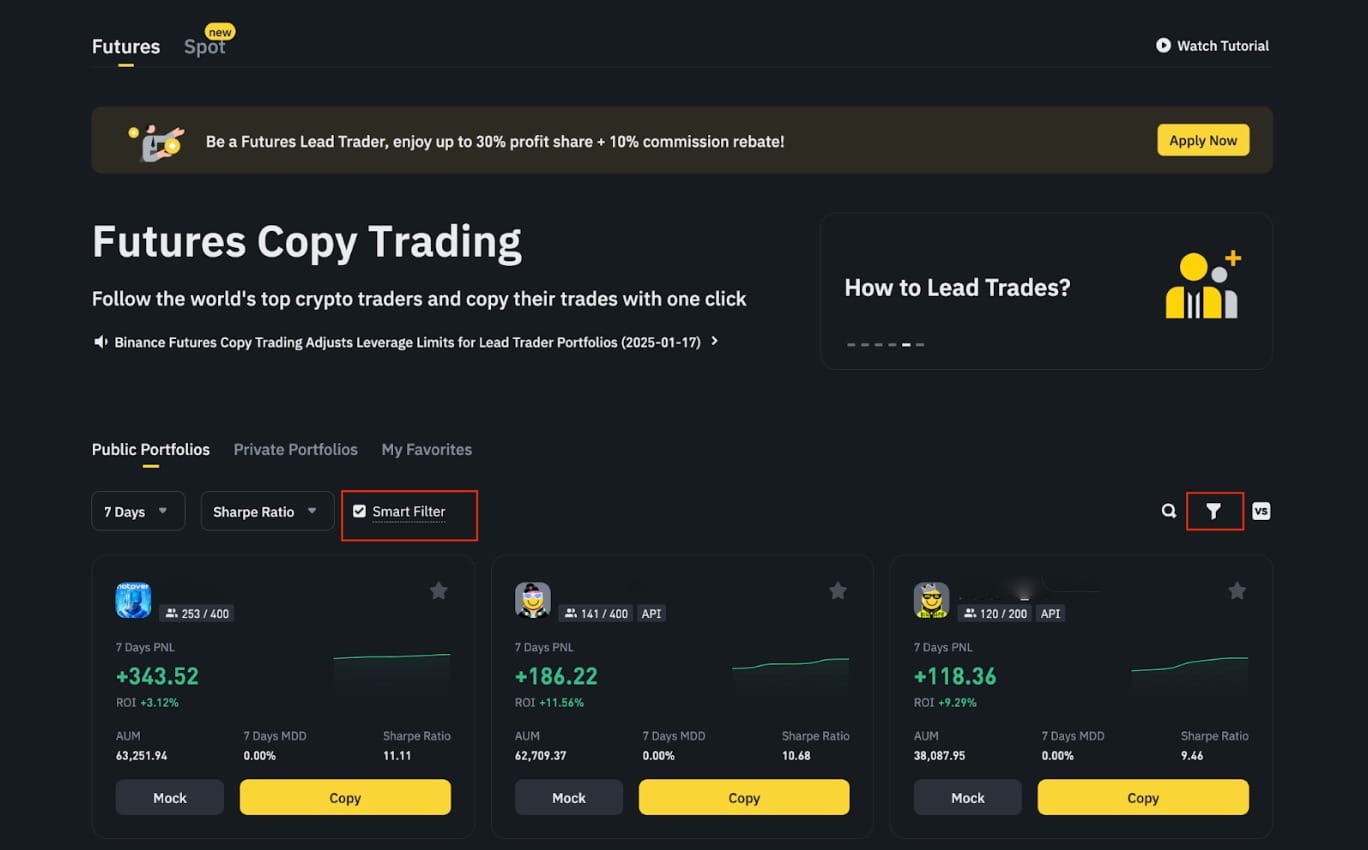

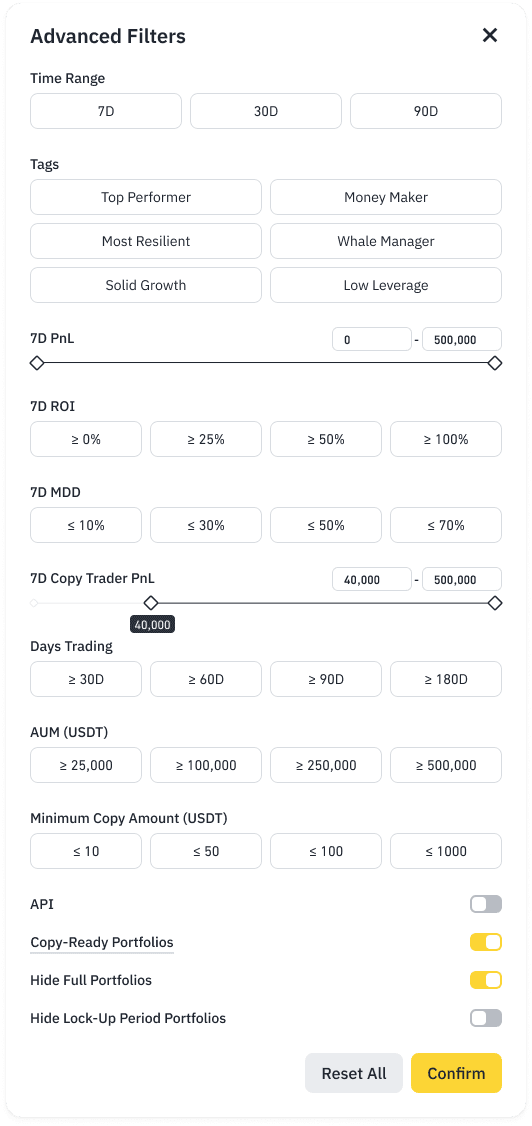

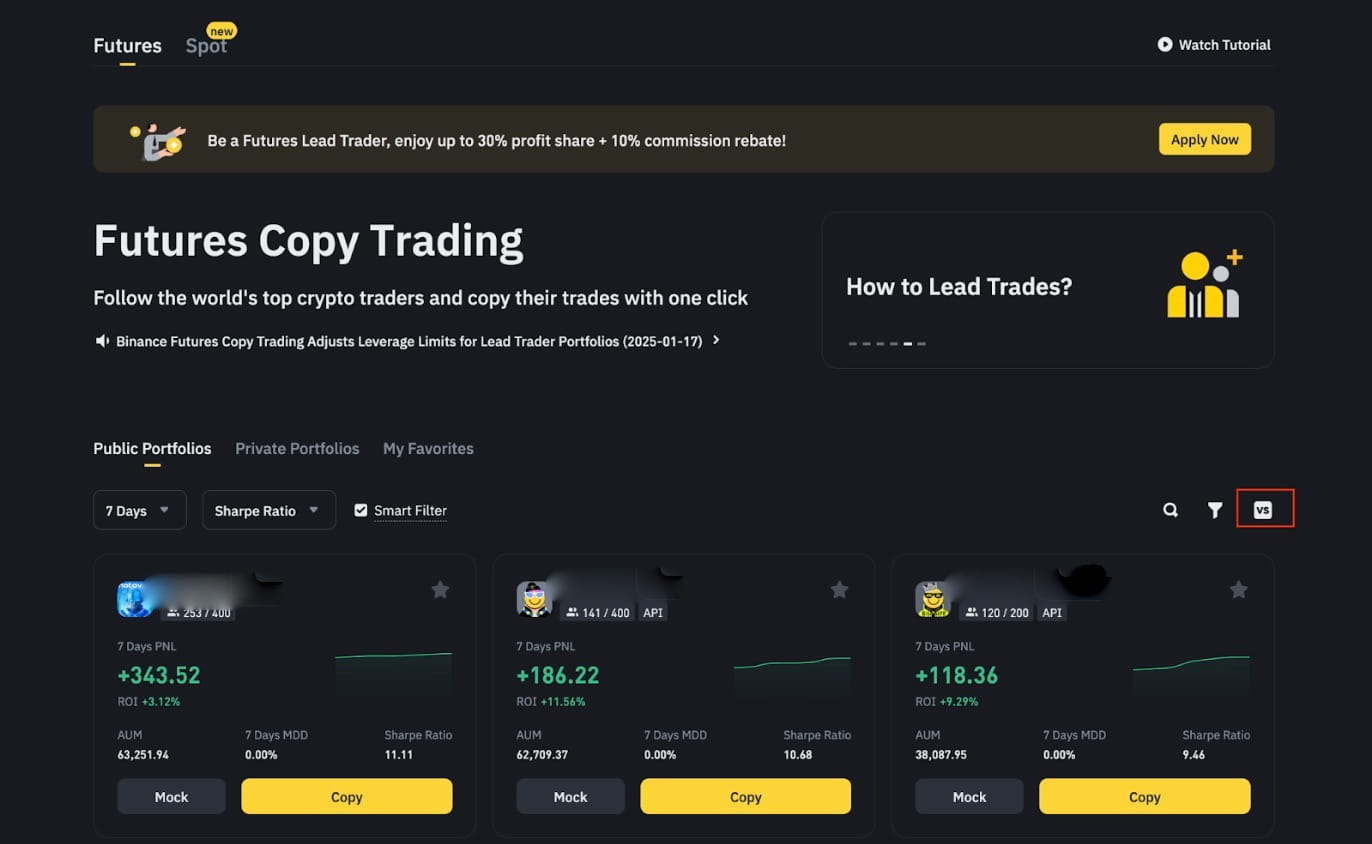

2. Select [Futures] on the top tab, choose a portfolio, and click [Copy]. You can sort and filter portfolios by:

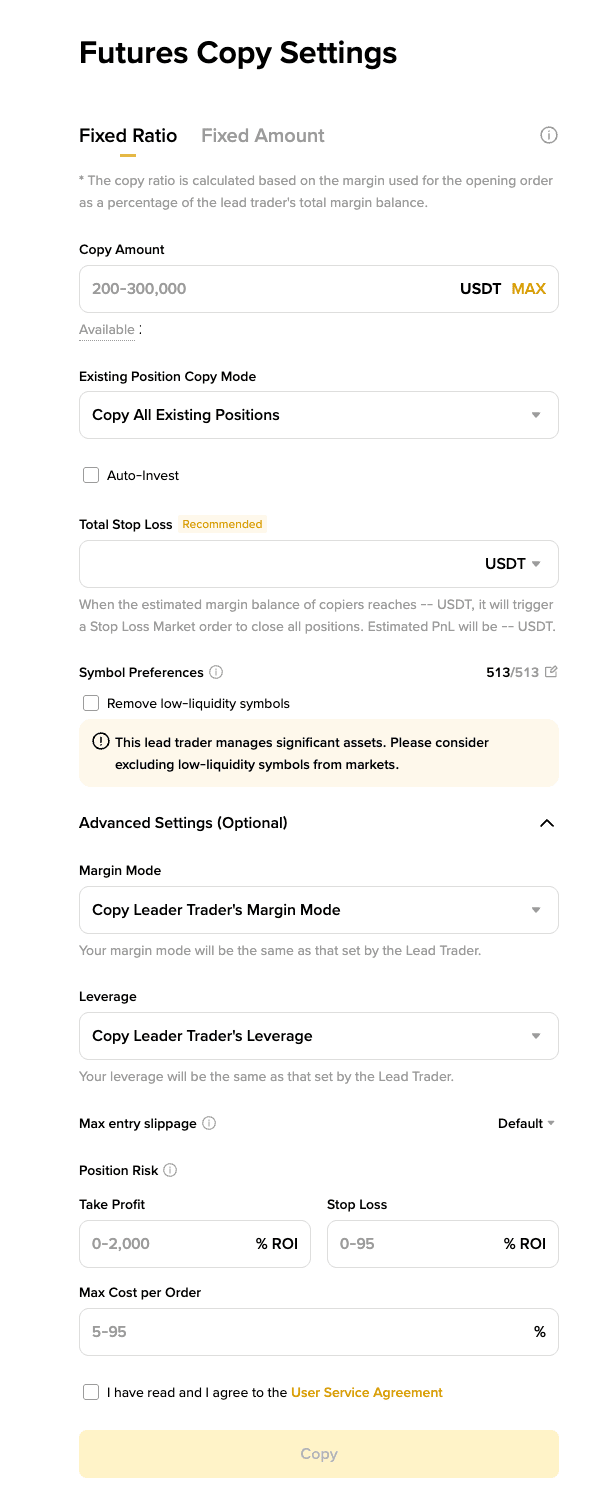

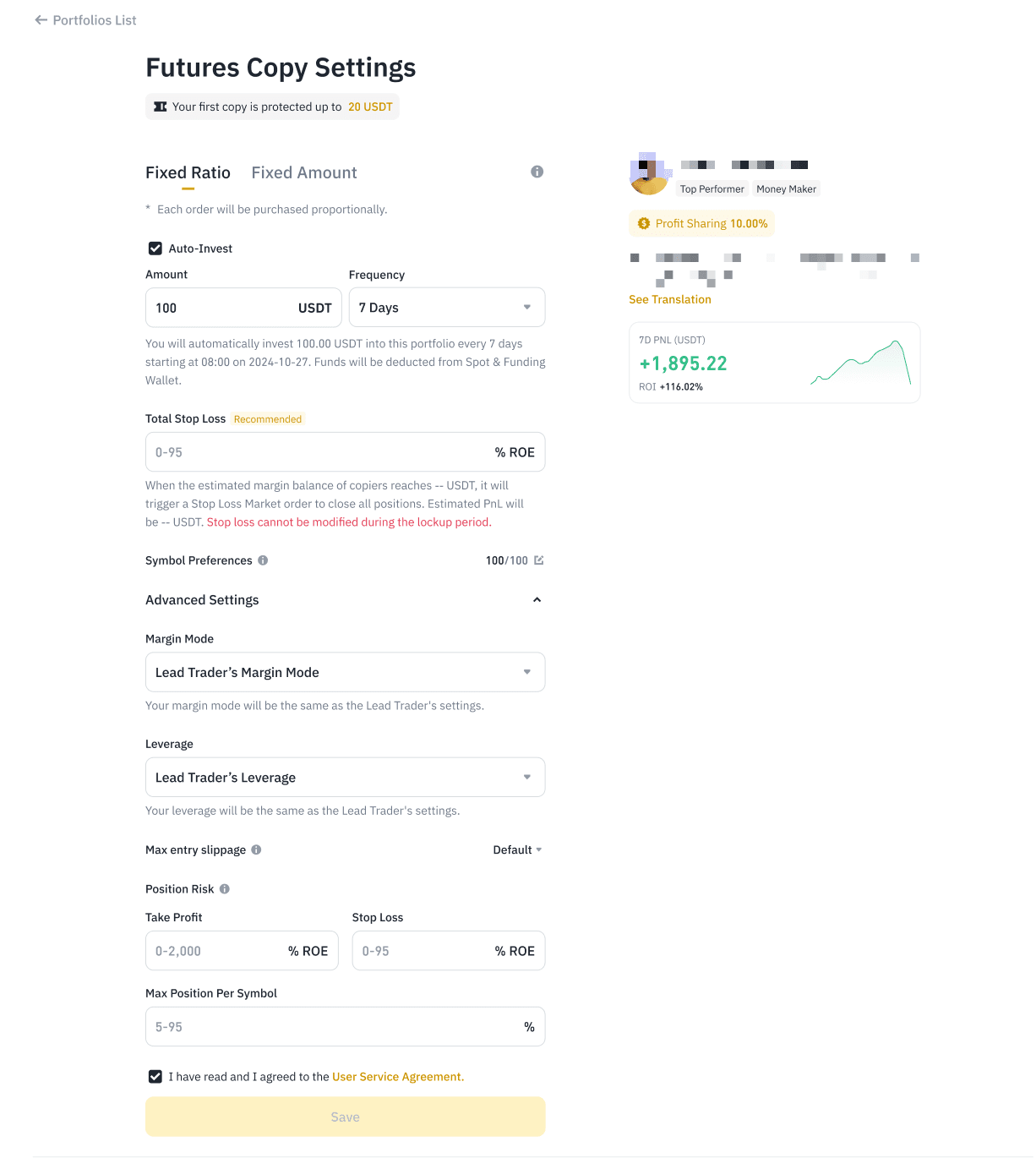

3. You can copy by [Fixed Amount] or [Fixed Ratio].

You can customize other trade settings as follows:

| Settings | Description | |

| Copy Amount | The total investment amount range is 10 - 300,000 USDT. Please note: The default minimum copy amount is 10 USDT. Lead traders can apply for the Binance Futures Copy Trading Lead Trader Growth Plan to have the option to adjust the minimum copy amount. | |

| Existing Position Copy Mode | Select whether to follow the lead trader’s existing positions.

| |

| Auto-Invest | Eligible users can set automatic investment orders on a regular basis (daily, 7 days, 14 days, 30 days) at a fixed amount. When enabled, the Auto-Invest amount will be deducted from your Spot or Funding Account and added to the selected copy portfolio based on the chosen frequency. | |

| Cost Per Order (Fixed Amount Mode) | Margin per order. | |

| Symbol Preferences |

| |

| Margin Mode |

| |

| Leverage |

Please note: When editing leverage settings during copying, the leverage might fail to adjust if there are open positions. | |

| Max Entry Slippage | Set the customized max entry slippage from 0.1% to 3%. Default slippage setting:

Please note:

| |

| Take Profit and Stop Loss | After successfully copying a position, the system will automatically place a TP/SL order for that position. Tips:

| |

| Maximum Cost Per Order | When the contract order cost reaches the maximum ratio, the system will place an order using the maximum order cost. | |

| Portfolio Stop Loss | Users can set the total stop loss amount by USDT or %. When the overall portfolio margin reaches the portfolio's stop loss point, all active positions will be closed at market price. Subsequently, the portfolio will be closed, and the remaining funds will be automatically transferred back to the user’s Spot Account. Example:

Please note: The stop loss amount (40 USDT) is only a trigger amount. When the stop loss amount is even lower than the maintenance margin, liquidation will still happen. The final amount of USDT to be received is subject to market conditions. It is possible that the user’s total margin would be lost in extreme market situations. The stop loss amount will be updated based on the percentage of the margin balance when a transfer or edit portfolio action is conducted. For example, if User A transfers out 50 USDT and the margin balance remaining in the copy portfolio is 160 USDT, the stop loss amount will be adjusted to 160 * (1 - 60%) = 64 USDT. | |

4. Read and agree to the service agreement, then click [Copy] to start copying trades. The investment amount will be transferred from your Spot Account to your Copy Trading Account.

Please note:

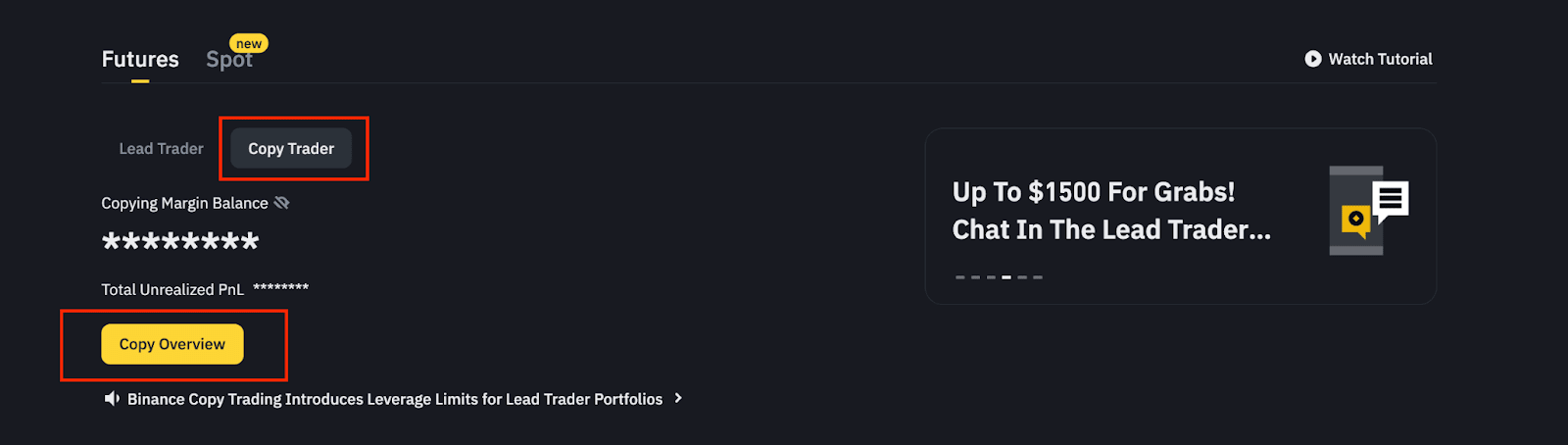

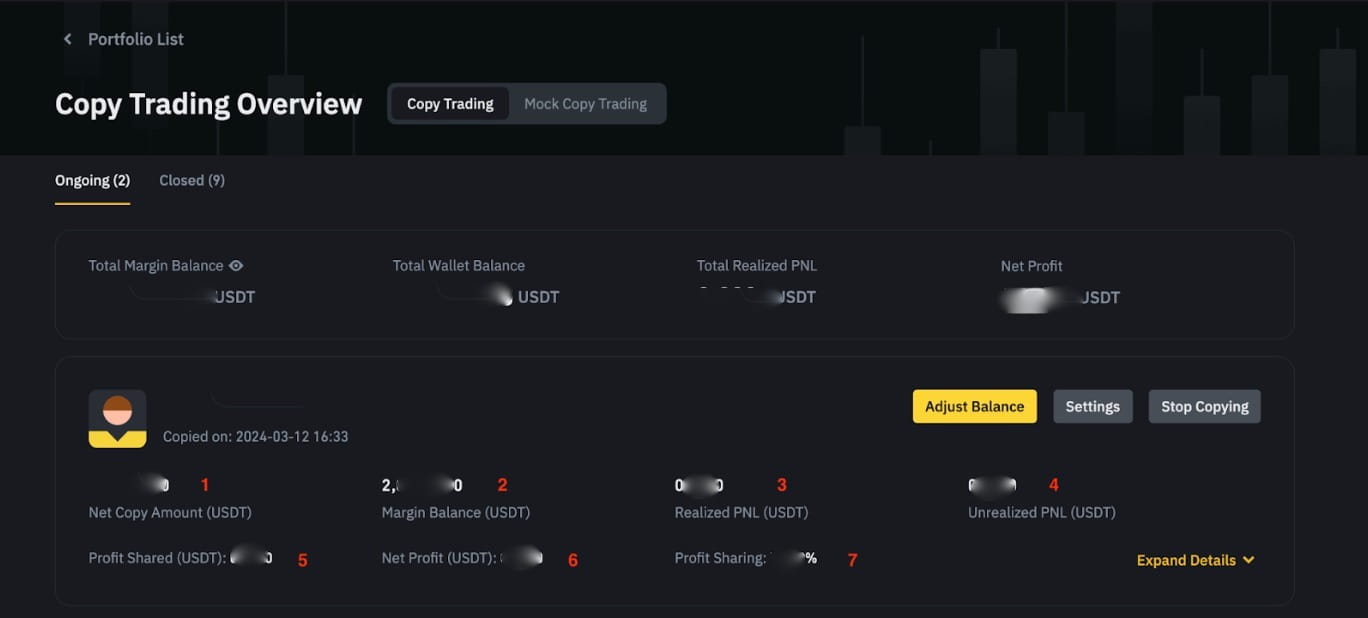

1. Click [Copy Trader] - [Copy Overview].

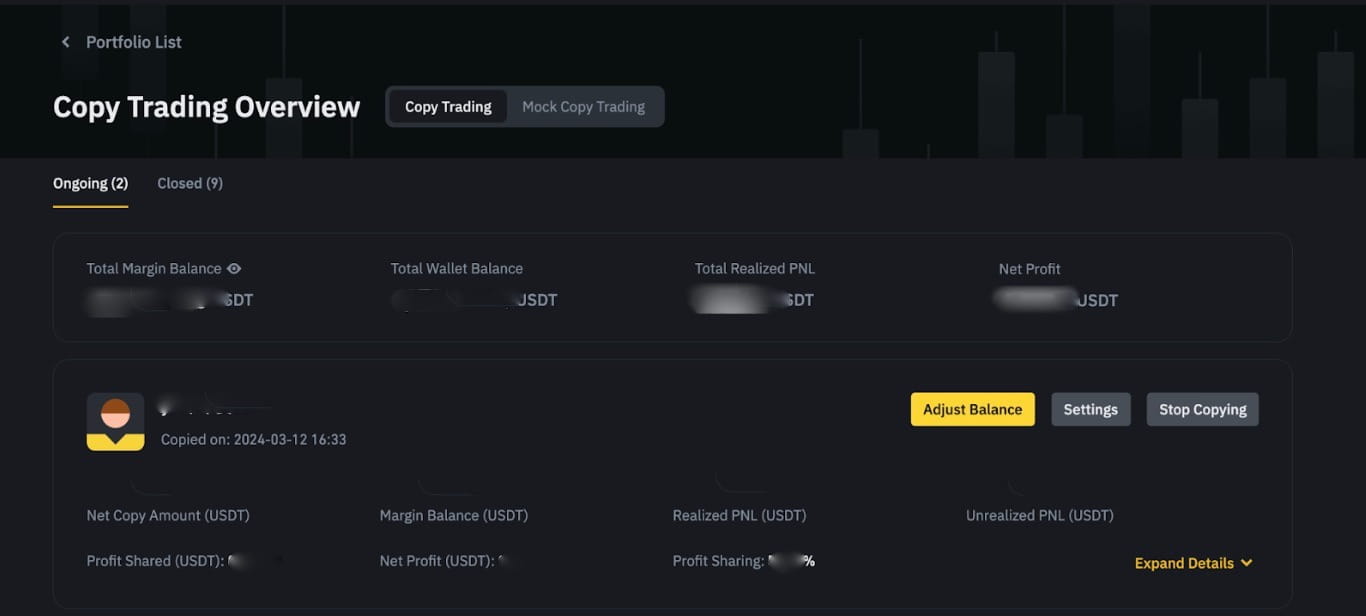

2. Here you can view your current and closed copy portfolios.

Ongoing copy portfolios:

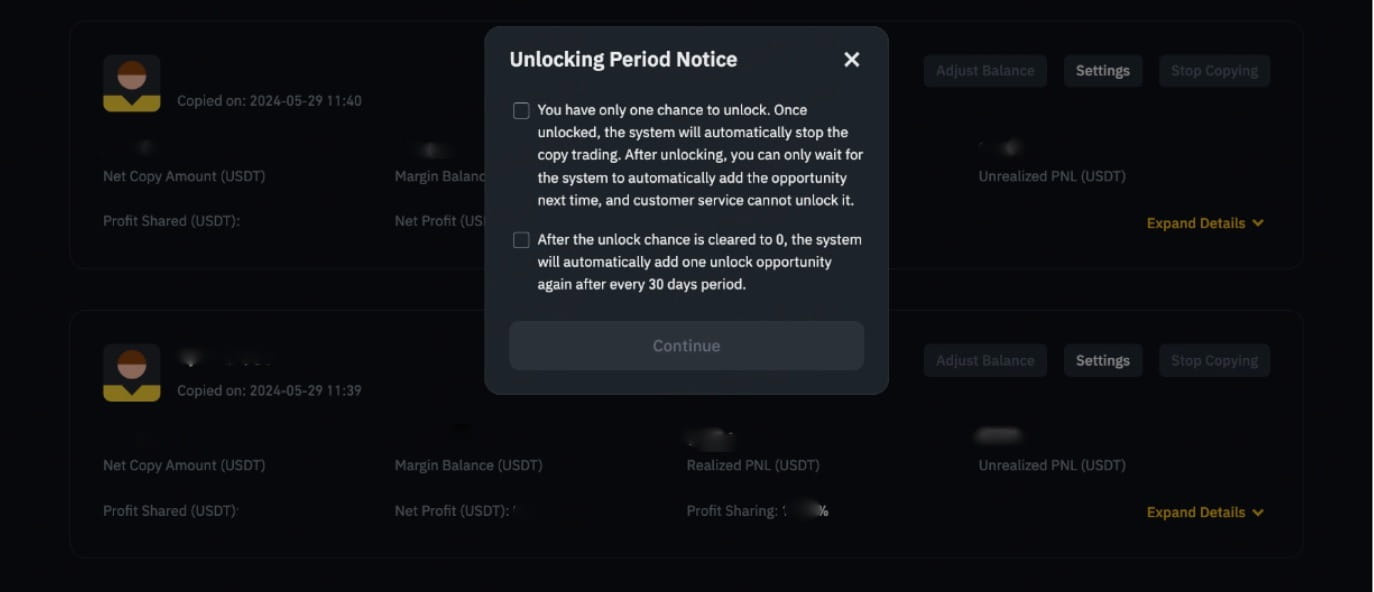

Please note: Each user has one unlock option by default to unlock one portfolio. After using this option, you will need to wait 30 days to receive a new unlock option.

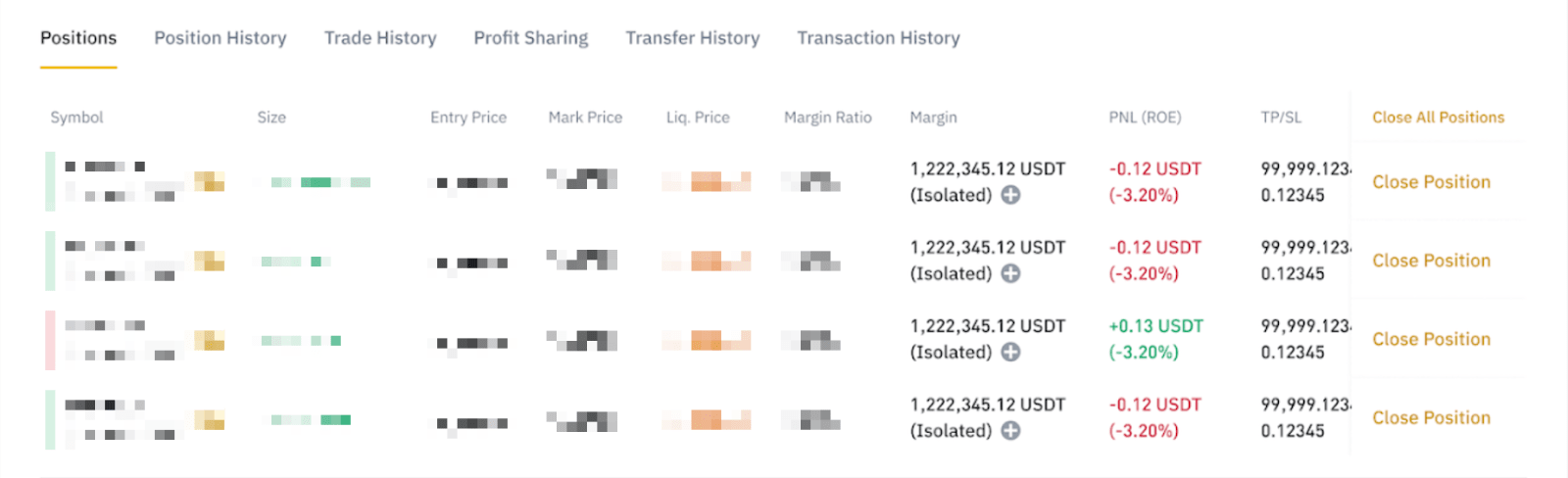

3. Click [Expand Details] to:

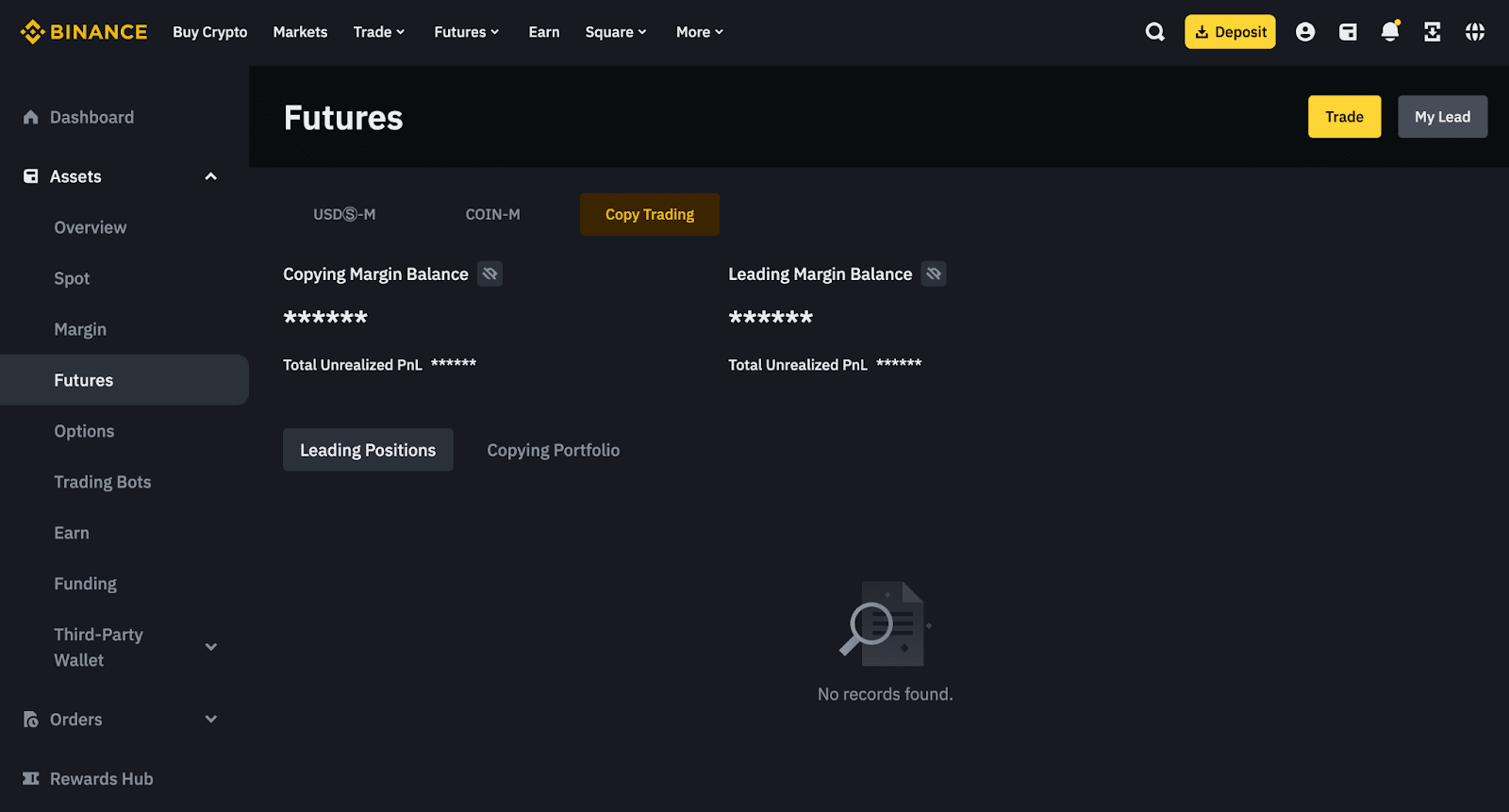

Alternatively, you can also view your copy traders’ portfolio details and performance from your Futures Account. Simply navigate to [Futures] - [Copy Trading] tab.

1. Net Copy Amount (USDT): Initial Copy Amount - Transfer Out Amount - Profit Shared Amount.

2. Margin Balance (USDT): Wallet Balance + Total Unrealized PNL.

3. Realized PNL (Portfolio Level): Total Realized PNL for Positions - Total Fees (including funding fee, trading fee, and insurance clear fee).

4. Unrealized PNL (USDT): Total Unrealized PNL for open positions.

5. Profit Shared (USDT): Profit amount already paid to the lead trader.

6. Net Profit: Total Realized PNL (Portfolio Level) - Profit Shared Amount.

7. Profit Sharing: The profit share rate for the copy portfolio.

To learn more about copy trading on Binance Futures, visit the Futures Copy Trading FAQs page.