Blockchain in the Modern Payments Landscape: Synergy and Transformation

Main Takeaways

This blog post is a recap of a recent Binance Research report discussing the state of modern payments, its main pain points, and how blockchain payments can address them, bringing value into the ecosystem.

Despite being one of the largest and fastest-growing global sectors, the payments industry operates on outdated infrastructure that was established more than 50 years ago. Transactions still depend on several intermediaries, such as card networks, issuers, and payment processors, which introduce significant inefficiencies, costs, and delays.

Blockchain technology presents an innovative solution by offering a decentralized, globally-enabled payment infrastructure built from the ground up. Blockchain applications, such as Binance Pay, are already demonstrating the power of this new technology by offering faster, cheaper, and more transparent cross-border transactions.

Thanks to Binance Research, you can take advantage of industry-grade analyses of the processes shaping Web3. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research.

Modern payment systems continue to be plagued by inefficiencies. While cash payments allow for direct peer-to-peer transactions without intermediaries, digital payment systems often involve multiple third-party actors, including banks, card networks, and payment processors, all of which add layers of complexity, costs, and privacy concerns.

Blockchain technology offers a transformative opportunity to eliminate these inefficiencies. By enabling peer-to-peer digital transactions without the need for intermediaries, blockchain can replicate the simplicity of cash payments in the digital world. When Bitcoin was introduced in 2009 by the pseudonymous Satoshi Nakamoto, it aimed to provide financial freedom and transparency through a decentralized digital currency. This marked the birth of blockchain technology, which has since evolved with the introduction of stablecoins and layer-1 and layer-2 scaling solutions that further enhance transaction speeds and reduce costs.

The Modern Payments Landscape

The current global payments infrastructure like the Society for Worldwide Interbank Financial Telecommunications (SWIFT) network, developed during the 1970s, is outdated and fragmented. The systems are heavily dependent on intermediaries such as banks and card networks to process transactions, which introduces inefficiencies. These inefficiencies are most apparent in cross-border transactions, where funds often pass through multiple correspondent banks, adding delays and increasing costs.

For example, cross-border bank transfers can take up to five business days to settle and can incur fees of up to 6.35% of the transaction amount, according to the World Bank. Despite these inefficiencies, the demand for cross-border payments continues to grow. The market for B2B cross-border payments was valued at $39 trillion in 2023 and is projected to grow to $53 trillion by 2030.

Even within domestic transactions, the payments industry continues to grow, with global payment flows reaching approximately $150 trillion in 2022, a 13% increase from the previous year. The rise of payment-focused fintechs like Stripe and PayPal has made payments more accessible and convenient for consumers, but these platforms remain tied to the legacy infrastructure, leading to high transaction fees and slow settlement times.

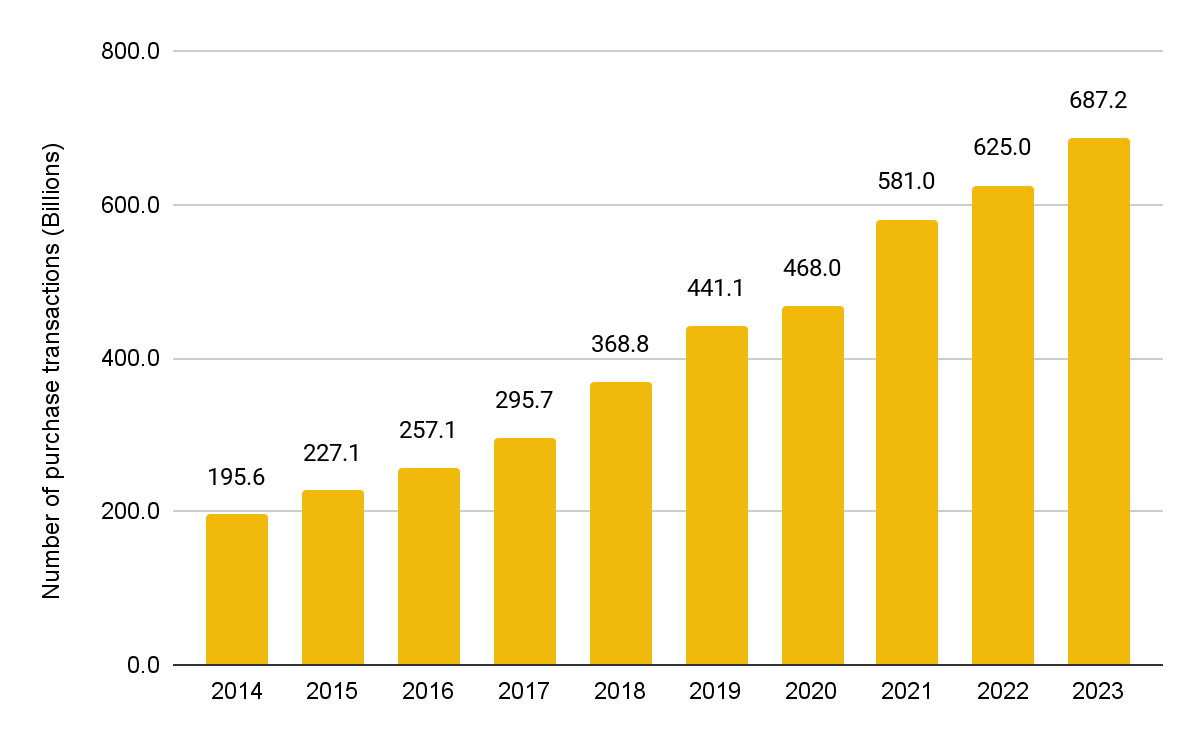

Number of credit card transactions worldwide has been growing at a CAGR of 15.1% since 2014

Open vs. Closed-Loop Payments

In the traditional payments landscape, there are two main types of payment systems: open-loop and closed-loop.

Open-Loop Systems:

Open-loop systems, such as those powered by Visa and Mastercard, enable payments to flow from one bank to another through card networks.

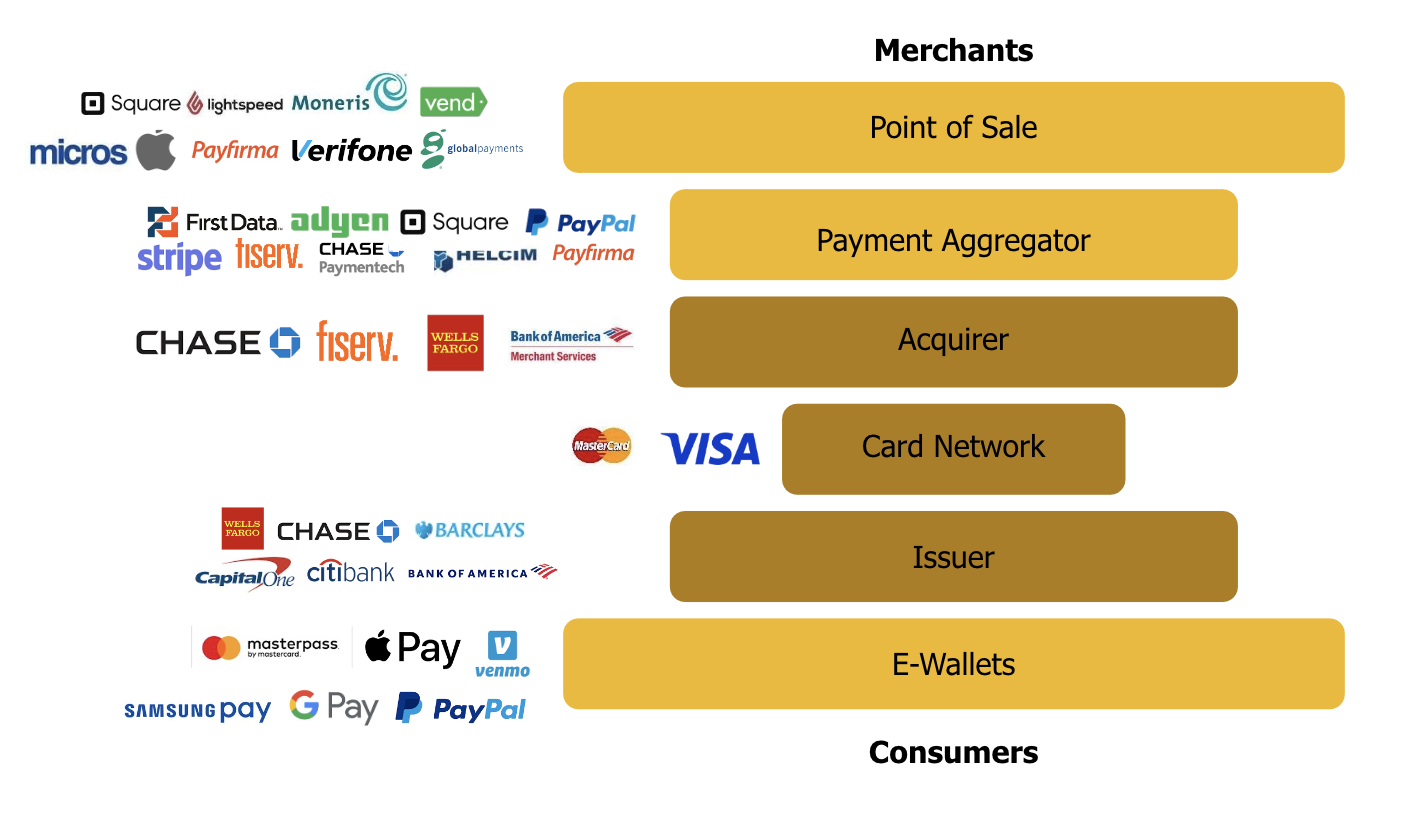

These systems allow consumers to use a single card to pay for goods and services globally. However, in an open-loop transaction, up to six intermediaries, including point-of-sale (POS) systems, payment aggregators, acquirers, issuers, card networks, and e-wallets, sit between the merchant and the consumer. Each of these intermediaries takes a fee from every transaction, driving up costs for merchants and consumers.In contrast, blockchains can function as global, decentralized payment networks, eliminating the need for intermediaries and offering a new form of open-loop system untethered from the slow and costly traditional banking infrastructure.

The Modern Global Payments Stack

Closed-Loop Systems

Closed-loop payment systems, such as those offered by PayPal or Starbucks, operate within a controlled environment. Consumers can only transact with merchants within the closed network. While closed-loop systems can reduce fees for merchants and deepen customer loyalty, they remain fragmented and often require integration with traditional banking systems for transferring funds in and out of the closed loop.

Blockchain technology offers an alternative by allowing fintech companies to bypass traditional banking systems entirely, reducing fees for merchants and enabling global transfers within decentralized closed loops. Binance Pay exemplifies this model, providing a seamless, customizable experience for both consumers and merchants.

The Pain Points of Cross-Border Transactions

Cross-border transactions, particularly remittances, are one of the most expensive and inefficient aspects of the traditional payments system. Worker remittances, where migrants send home part of their earnings, often involve multiple correspondent banks and intermediaries. This process not only incurs high fees but can also take several days to complete.

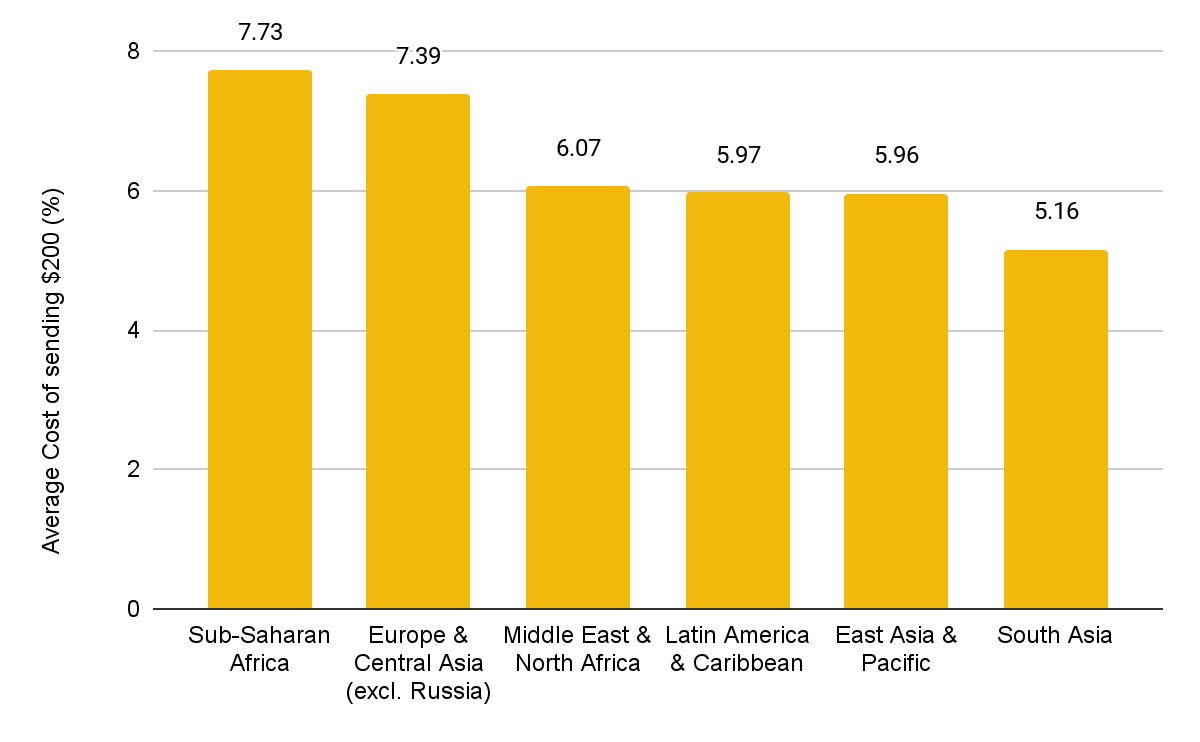

In 2023, global remittance flows reached $857 billion, with significant portions of this value going to developing countries like India, Mexico, and the Philippines. According to The World Bank as of Q1 2024, the average cost of sending money globally is 6.35%, leading to a total of $54 billion in annual fees.

Many layers of additional fees at every step of the transaction when intermediary banks are involved, unfavorable currency exchange rates when more than one currency is involved, lengthy anti-money laundering (AML) and know your customer (KYC) checks, all add up on the cost and length of time for traditional remittances. Adding fuel to the fire, up to 1.4 billion adults globally remain unbanked. The traditional payments system is currently unable to reach a significant portion of the global population.

Around 30% of digital remittances are taking more than one day to reach their destination

The global average cost of sending money across borders currently sits at 6.35%

Blockchain Payments as a Solution

Blockchain technology offers a new paradigm for payments, removing intermediaries and facilitating peer-to-peer transactions directly on a decentralized ledger. This eliminates the need for banks, card networks, and other intermediaries, resulting in faster transactions and lower costs.

Blockchain-based payment systems operate as distributed global networks, where transactions are recorded immutably on the blockchain. Instead of relying on a network of banks to process payments, blockchains allow users to store digital assets in externally owned accounts (EOAs) or smart contract accounts, allowing them to be transferred directly between parties. This direct transfer eliminates the need for intermediaries and allows for near-instantaneous settlement.

Binance Pay is an example of a blockchain-powered payment solution that leverages these principles. By enabling instant, low-cost peer-to-peer transfers and direct merchant payments, Binance Pay provides users with a familiar fintech experience while remaining untethered from traditional banking systems. Its hybrid approach allows consumers and merchants to leverage both blockchain rails for open-loop crypto transfers and traditional banking rails for direct fiat deposits and withdrawals.

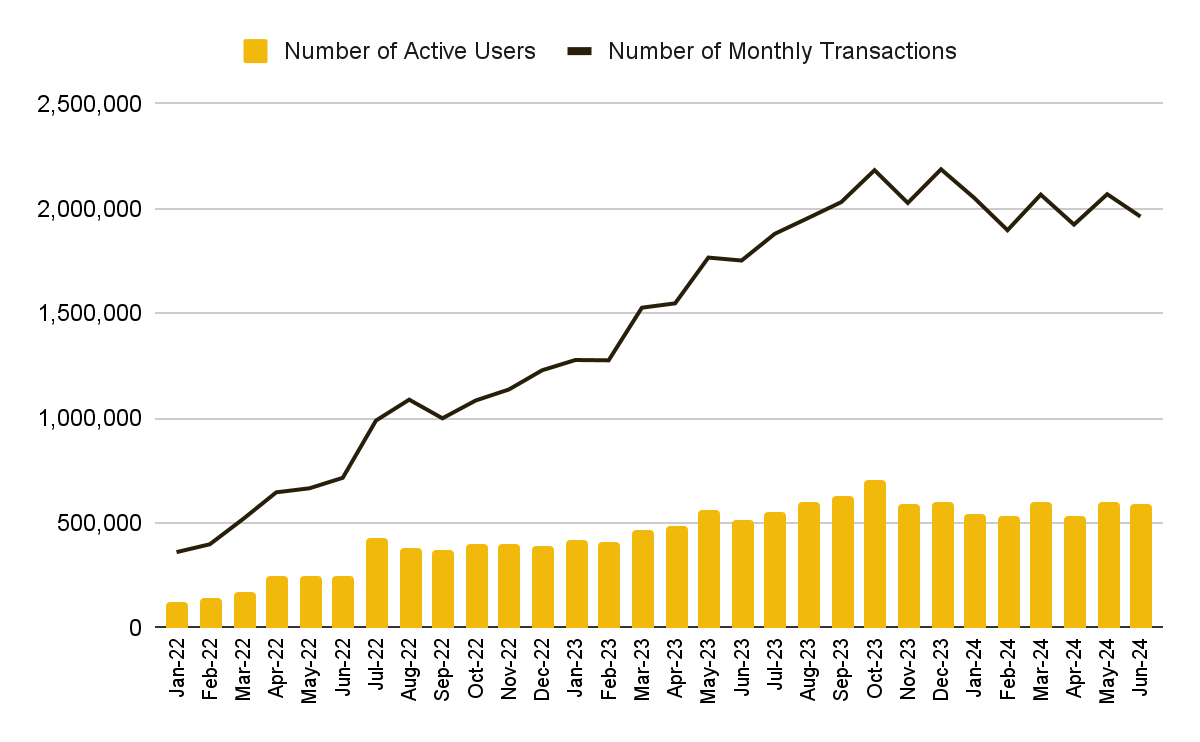

Since 2022, both the number of monthly active users and monthly transaction count has increased almost 5x to ~13.5 million users globally and ~1.96 million transactions, respectively.

Binance Pay has seen a 5x increase in terms of users and activity in the past 3 years

The Current State of Blockchain Payments

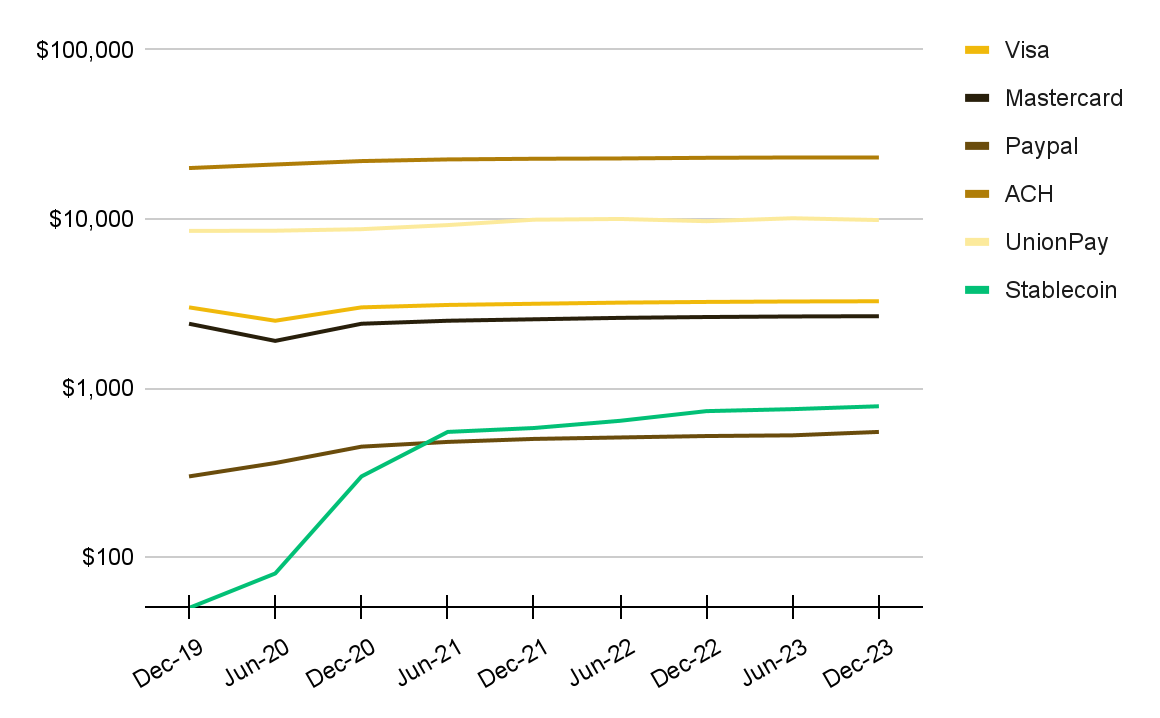

Stablecoins have emerged as a crucial component of blockchain payments, providing a stable, cash-equivalent digital currency for transactions. In 2023, the stablecoin market processed over $10.8 trillion in transactions, demonstrating the growing adoption of blockchain-based payments.

Quarterly volumes of stablecoin payment activity is gaining on those of traditional payment systems

The blockchain payments stack comprises several layers, each of which plays a critical role in the functioning of decentralized payment systems.

Settlement Layer: This includes foundational blockchain infrastructures, such as Bitcoin, Ethereum, and Solana, which are responsible for transaction settlement. These platforms compete on speed, cost, scalability, and security. Over time, the payments use case may become a significant consumer of blockspace on these networks.

Asset Issuer Layer: This layer involves the creation and management of stablecoins, which are often issued by organizations that operate balance-sheet-driven business models similar to banks.

On/Off-Ramp Layer: On/off-ramp providers connect traditional fiat systems to blockchain networks, enabling users to convert between fiat currencies and stablecoins. However, on/off-ramping is currently one of the most expensive aspects of the blockchain payments stack, with providers charging up to 1.5% to transfer funds from blockchain assets to bank accounts.

Interface/Application Layer: This layer includes the user-facing applications that enable blockchain-enabled transactions, such as Binance Pay. These platforms typically generate revenue through transaction and platform fees.

The Blockchain Payments Stack

Source: Galaxy Digital, Binance Research, as of August 2024

Advantages of Blockchain Payments

Near-Instantaneous Settlement: Blockchain networks allow for near-instantaneous settlement of transactions, providing significant advantages over traditional payment systems, where settlement times can extend to several days, especially in the case of cross-border payments.

Lower Costs: Blockchain eliminates the need for intermediaries, significantly reducing transaction costs. For instance, sending stablecoins via an alt-L1 blockchain like Solana costs a fraction of a cent, compared to the 6.35% fee for traditional remittances. Binance Pay further minimizes costs by allowing for low-fee transfers below $140,000, with larger transactions incurring just a $1 fee.

Transparency and Global Trustless Standards: Blockchain's decentralized nature provides greater transparency and security. Every transaction is recorded on a distributed, immutable ledger, reducing the risk of fraud and manipulation. Moreover, blockchain payments are not subject to the geopolitical limitations imposed by traditional systems like SWIFT, making them a more resilient option for global commerce.

Challenges for Blockchain Payments

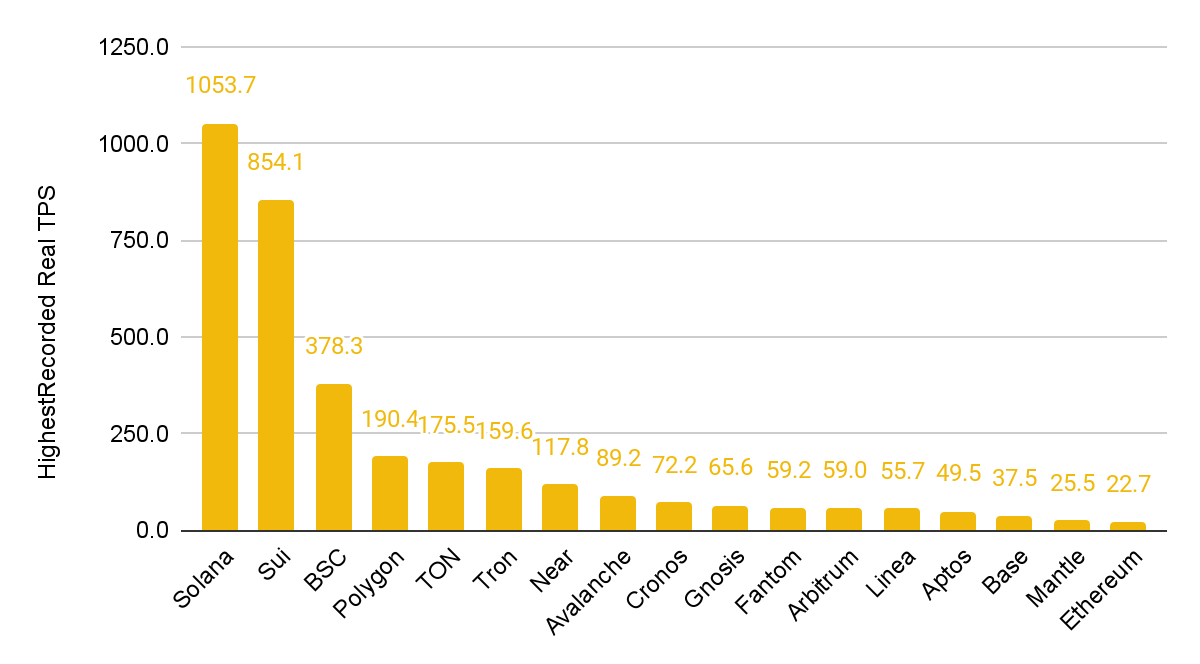

Scalability and Liveliness: Blockchain networks still face challenges in scaling to meet the transaction volumes of traditional payment systems. For example, Visa can process up to 65,000 transactions per second, while the fastest blockchains like Solana only process around 1,000 transactions per second. Additionally, blockchains like Solana have experienced outages that impact their reliability as payment systems.

On-Chain Complexities: The complexity of managing blockchain transactions, such as dealing with seed phrases and gas fees, can deter adoption among average consumers and merchants. However, platforms like Binance Pay are simplifying the user experience by offering familiar fintech interfaces that abstract away these complexities.

Regulatory Uncertainty: The regulatory landscape for blockchain payments is still evolving, with countries adopting different approaches to regulation. Countries like Switzerland and Singapore have developed clear regulatory frameworks to foster innovation, while others lag behind.

Blockchain networks’ highest recorded real Transactions Per Second

Source: Coingecko, Binance Research, as of August 2024

The Future for Blockchain Payments

Blockchains offer a unified, decentralized infrastructure that simplifies the payments landscape by overcoming the inefficiencies of traditional banking, which depends on synchronizing multiple centrally-managed ledgers. As global distributed ledgers, blockchains streamline transactions, reducing costs and increasing payment speeds. Visa, for instance, is leveraging blockchain for faster, cheaper global settlements by enabling cross-border transfers of USDC via the Ethereum blockchain to Circle-managed treasury accounts, replacing the complex, days-long wire transfers. This shift towards blockchain, particularly stablecoins, is likely to expand as companies recognize its benefits over traditional systems. For peer-to-peer remittances, especially for unbanked populations, blockchain technology presents a game-changing opportunity, enabling fast, direct payments with just a smartphone and internet connection. Ultimately, as blockchain becomes more integrated into global finance, it holds the potential to bring about cheaper, faster, and more inclusive financial transactions for everyone.

Read the full version of this Binance Research report here.

Further Reading

Embrace the New Age of Payments with Binance Pay: Start Your Journey As a Merchant

The Future of Finance in Your Wallet: A Huge Year for Binance Pay!

General Disclosure: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities, cryptocurrencies, or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the laws of such jurisdiction. Investment involves risks. In compliance with MiCA requirements, unauthorized stablecoins are subject to certain restrictions for EEA users. For more information, please click here.