Disclaimer: In compliance with MiCA requirements, unauthorized stablecoins are subject to certain restrictions for EEA users. For more information, please click here.

When placing a Limit Order, you will be able to set both [Take Profit] and [Stop Loss] orders simultaneously.

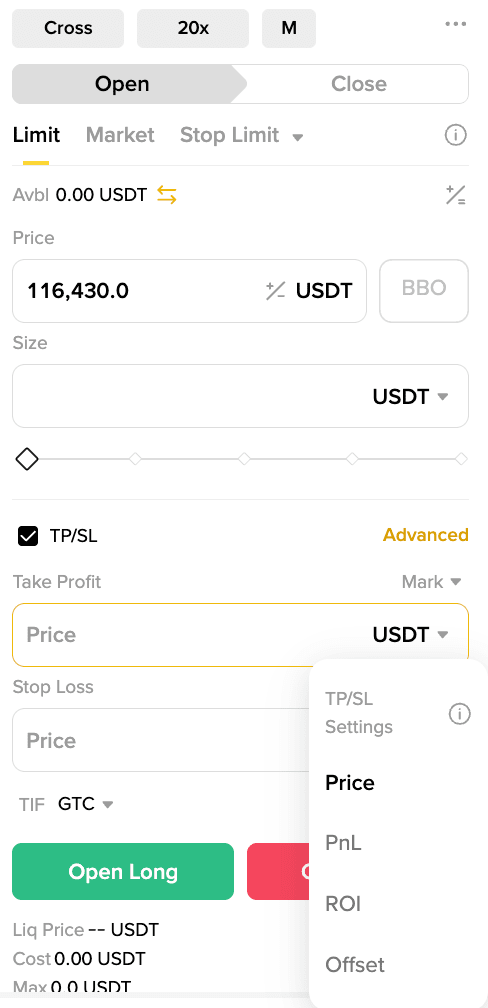

1. Click [Limit] and enter the order price and size. Then, check the box next to [TP/SL] to set the [Take Profit] and [Stop Loss] prices based on the [Last Price] or [Mark Price]. In addition, you can also set your TP/SL trigger price by using the following options:

2. Next, click [Buy/Long] or [Sell/Short] to place the order.

Note:You can only select either [TP/SL] or enable [Reduce-Only] in a single order.

Please note that if you are using the [Hedge Mode], the [TP/SL] function is only available for [Open] orders.

You can check your orders under the [Open Orders] tab.

3. Click [View] under [TP/SL] to view order details.

When an order is triggered, you can add or modify the TP/SL under the [Positions] tab. Similar to opening positions, you can adjust your TP/SL trigger price by PNL, ROI%, and Offset%. This will be applied to the entire position.

After closing the position, the TP/SL will be automatically canceled.

Please note: The Stop Price set for Stop Limit and Stop Market orders is different from this TP/SL and cannot be canceled or modified here.

Note: The [TP/SL] function is supported by Limit Orders, Market Orders, and Stop Orders (Stop Market and Stop Limit).

These orders are executed through strategy orders. Currently, Binance supports two types of strategies: One-Triggers-a-One-Cancels-the-Other (OTOCO) and One-Triggers-the-Other (OTO).

These strategies allow you to place two orders simultaneously – a primary order and a secondary order. The primary order refers to Limit and Market orders, while the secondary order refers to Take Profit and Stop Loss orders.

In an OTOCO order, if the primary order is filled or partially filled, the secondary order (either Take Profit or Stop Loss) will take effect. If Take Profit is filled, the Stop Loss will be canceled, and vice versa. This setup is also known as an OTO order. For more information, please refer to Binance OTO (One-Triggers-the-Other) & OTOCO (One-Triggers-a-One-Cancels-the-Other) Order.

Note: If the trigger price of the secondary order is too close to the primary order, there is a high likelihood that the secondary order will be canceled when the primary order is executed. It’s advisable to set a sufficient price distance between the primary and secondary orders.

Yes, all positions will be closed. You can view these orders under [Open Orders] - [Amount] labeled as [Close Position]. Note that TP/SL orders with a fixed amount will only close the corresponding amount of the position, not the entire position.

Yes, you can set multiple TP/SL orders for a single position. The split target feature is designed specifically for this purpose.

Yes, you can click [View] under [TP/SL] on the primary order to view any unfulfilled TP/SL orders.

To learn more about Binance Futures Contracts, please visit the Types of Orders FAQs page.