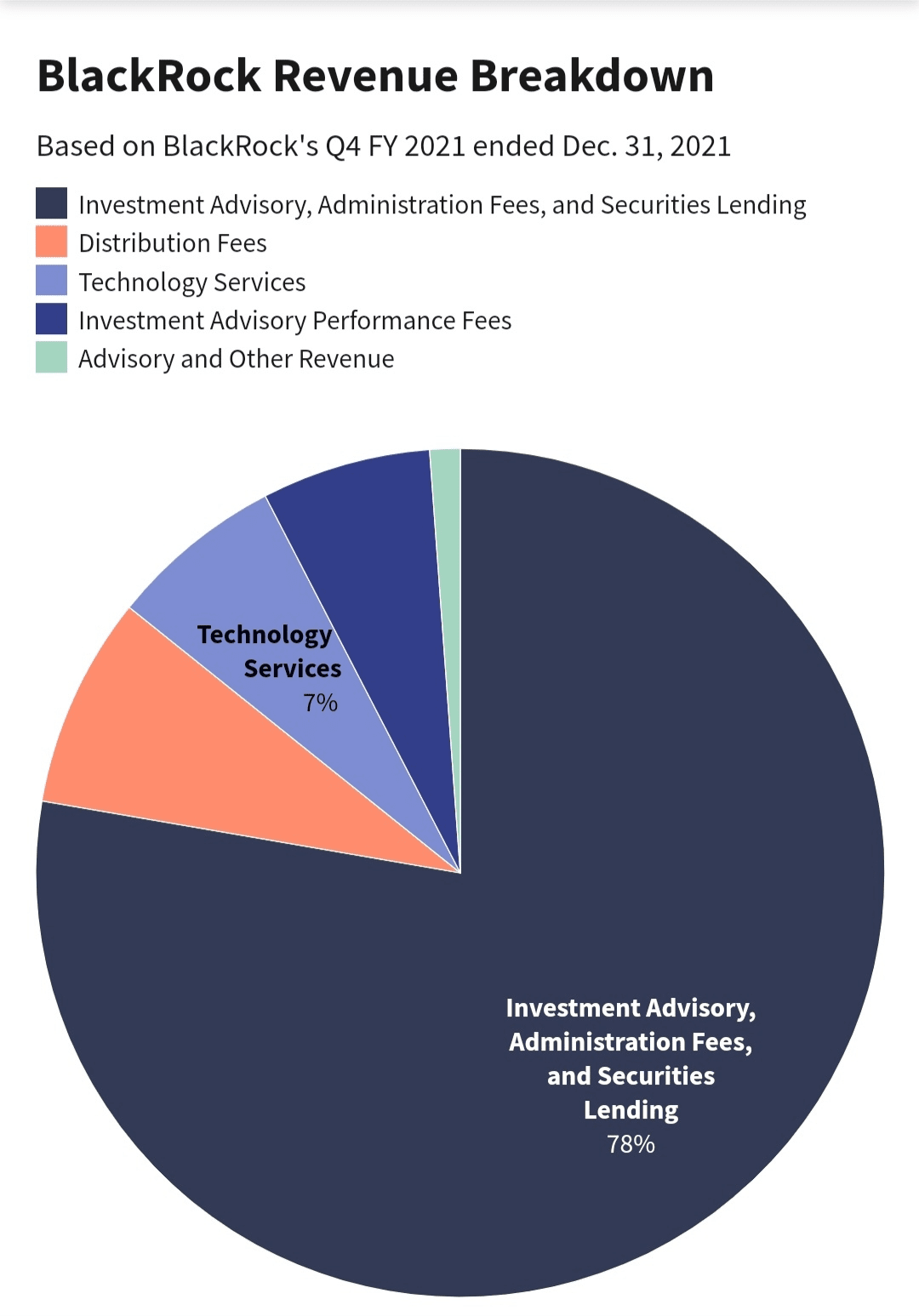

Fees for investment advisory services drive revenue

BlackRock Inc. (BLK) is by some measures the biggest investment management company across the globe, with more than $10.0 trillion in assets under management (AUM) as of Dec. 31, 2021.

As a major publicly traded company with a market capitalization of about $112.3 billion, BlackRock provides investment and technology services to both institutional and retail clients around the world.

The firm offers a variety of funds and portfolios investing in vehicles such as equities, money market instruments, and fixed income. Clients look to BlackRock for access to mutual funds, investments focused on objectives related to retirement income and college savings, and exchange-traded funds (ETFs).

BlackRock is the parent company for the iShares group of ETFs, the largest global provider of ETFs.

BlackRock derives the majority of its revenue from investment advisory and administrative fees charged to its clients. Among BlackRock's major competitors are The Vanguard Group, State Street Corp. (STT), and T. Rowe Price Group Inc. (TROW).

BlackRock's Financials

BlackRock announced in mid-January financial results for Q4 of its 2021 fiscal year (FY), the three-month period ended March 18, 2021. The company reported a net income of $1.6 billion, up 6.1% compared to the year-ago quarter. Revenue grew 14.0% year over year (YOY) to $5.1 billion. The company's AUM rose 15.4% YOY to a new high of $10.0 trillion.

BlackRock generated $212 billion of net inflows during the quarter. The Americas region led all other regions with long-term net flows of $139 billion. The company's ETF offerings generated $104 billion in long-term net inflows, more than the long-term net inflows of retail and institutional investors combined.

BlackRock's Business Segments

BlackRock operates as a single business segment and does not report on income for individual parts of its business. However, it does divide its revenue according to categories for "Investment advisory, administration fees, and securities lending revenue," for "Investment advisory performance fees," for "Technology services revenue," for "Distribution fees," and for "Advisory and other revenue.