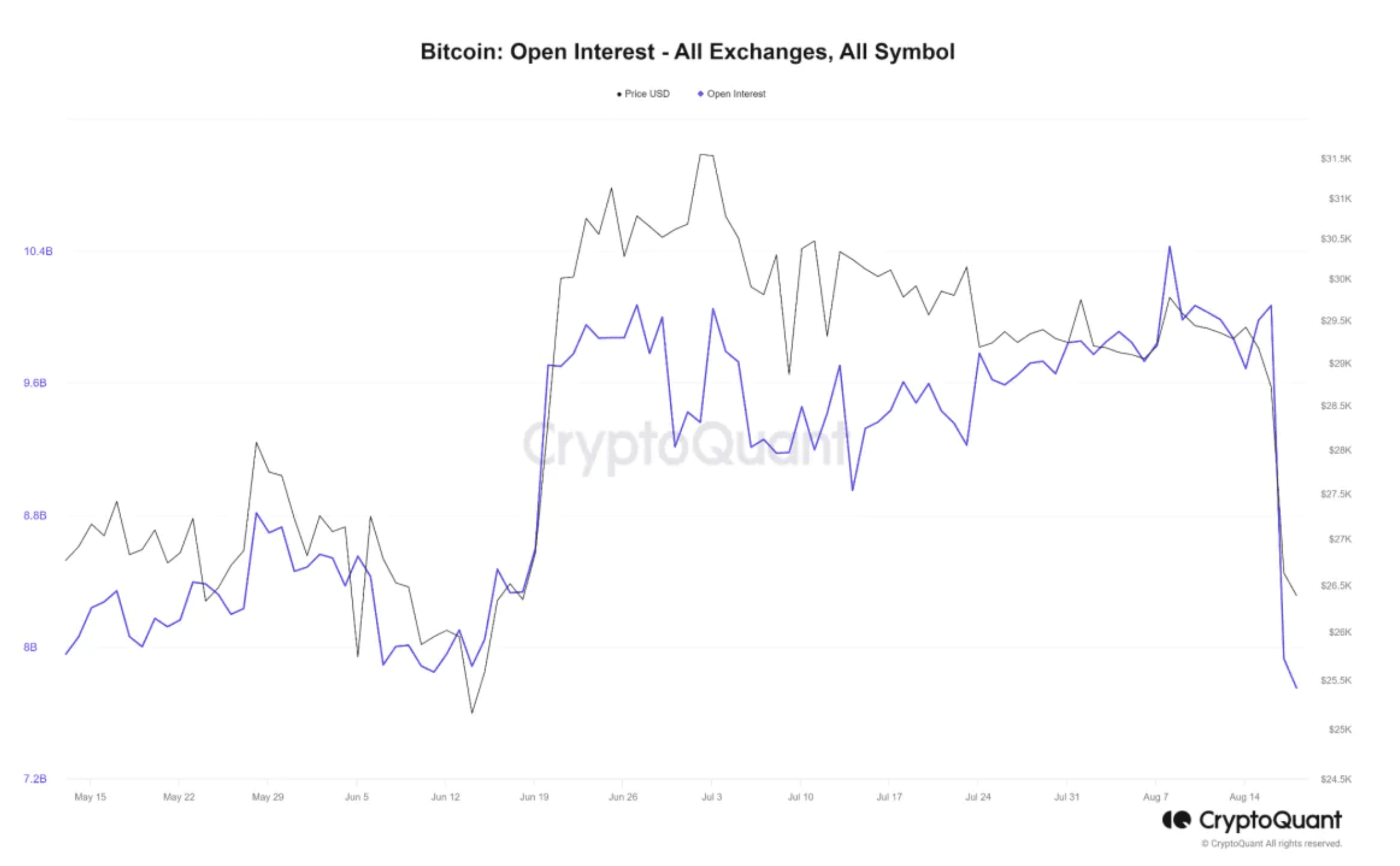

Bitcoin experienced a major repricing between August 17 and August 18, falling by about 10% in the hours between 4pm and 6pm EST. According to Coinbase data, the price of Bitcoin fell 8.8% from its opening price on August 17, hitting a low of $25,244. The decline caused BTCUSD to fall below its 200-day and 200-week moving averages. During and after the event, open interest in the perpetual futures market fell by about $2.75 billion, the largest Bitcoin deleveraging event since the FTX crash in early November 2022.

Many people have begun to speculate on the reasons for the sudden plunge in BTC. Some believe that the reason for the decline in Bitcoin prices is that investors in the market have doubts about the prospects of cryptocurrencies, while others believe that this is just a normal process of market adjustment. In this article, veDAO Research Institute will interpret the reasons and predict the market trend based on some data and analysis conclusions.

Reasons for BTC’s decline

Market hot events

James Butterfill, head of research at CoinShares, tweeted his thoughts on the reasons behind the crash. He highlighted the market's expectations for the US Securities and Exchange Commission (SEC) to approve a Bitcoin ETF, indicating that approval is not expected immediately; he also expressed concerns about China's economic downturn and its potential deflationary effects. In addition, Bitcoin's trading volume has dropped significantly, making the market more vulnerable to larger transactions. Historical data also shows that low volatility in Bitcoin usually precedes large price changes.

Other news that have an impact on BTC include: The Wall Street Journal's report on August 17 examined SpaceX's financial statements, pointing out that SpaceX has written down a total of $373 million worth of Bitcoin in its financial statements, and it seems that it has already sold it. On the same day, the US housing finance institution Freddie Mac released data showing that the average interest rate for 30-year fixed mortgages in the United States rose to 7.09%, setting a record high since April 2002; this may indicate that broader asset classes will also fall. In essence, the price of Bitcoin is affected by a variety of global and market factors, not just such key events.

On-chain data analysis

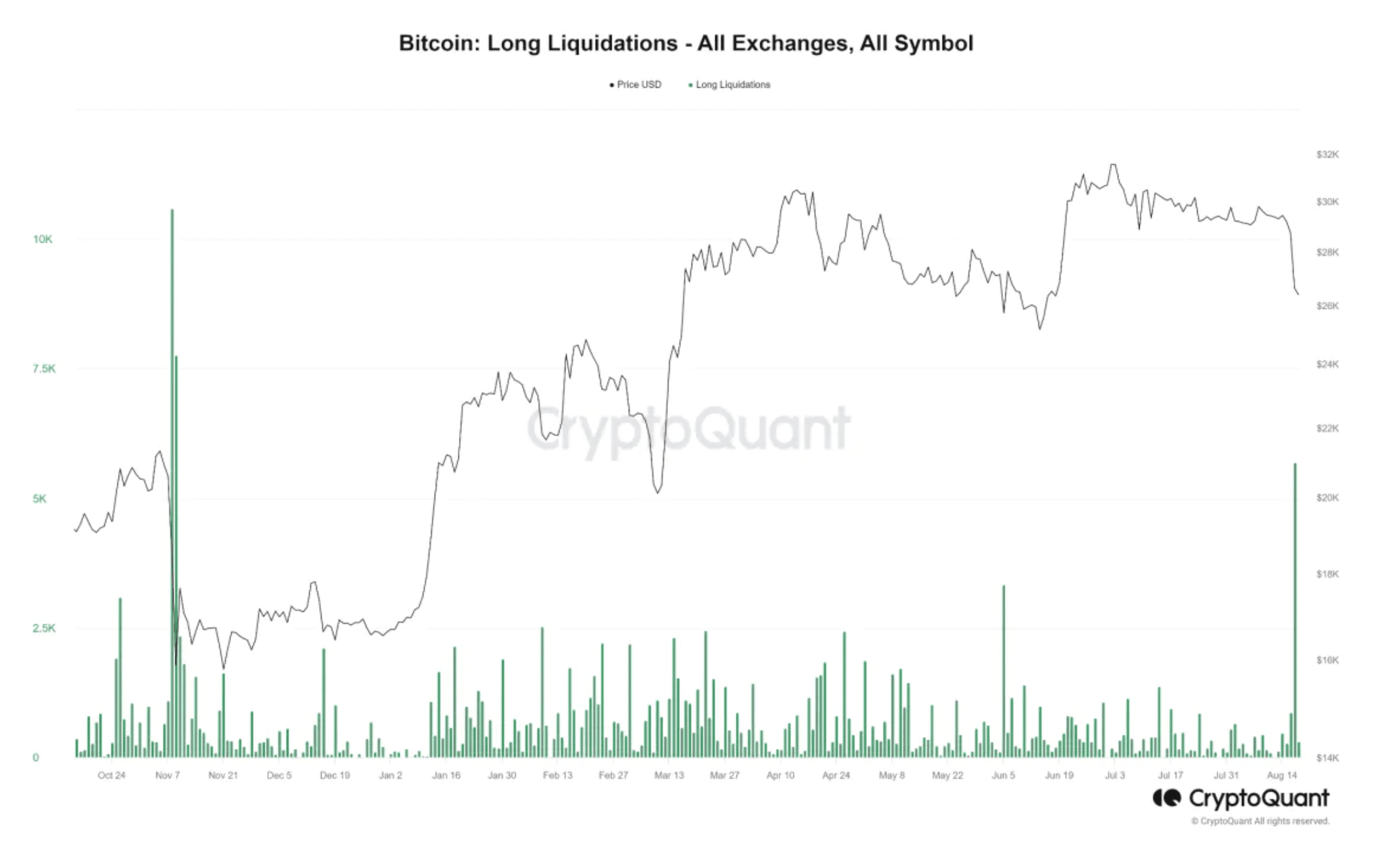

By observing some key on-chain indicators, it is not difficult to see that the real reason behind this plunge came from the derivatives market, especially the large-scale liquidation of leveraged positions and the liquidation of long positions, which eventually led to a long squeeze.

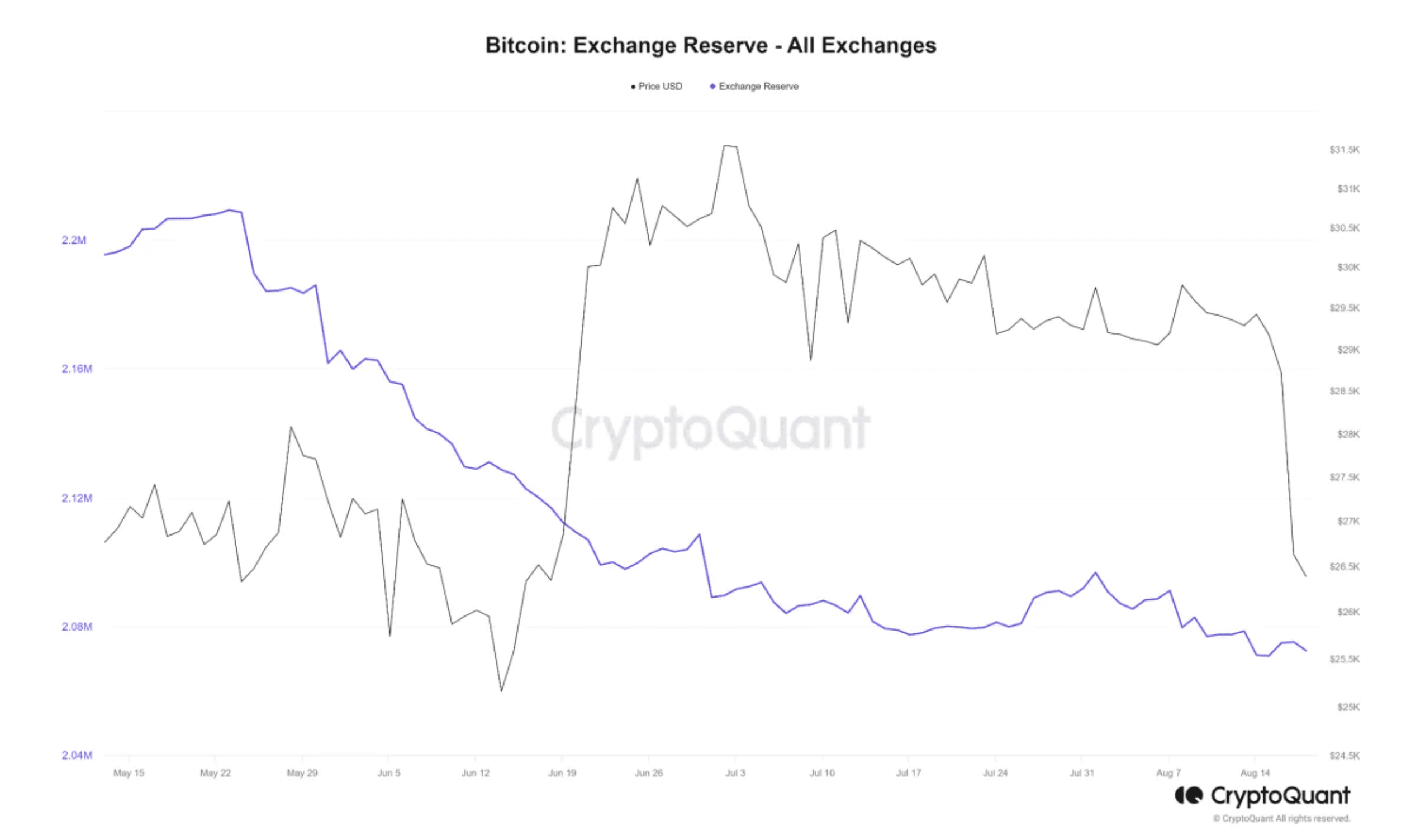

First, by looking at the Bitcoin balances held on major exchanges, we can see that there is no large-scale inflow of funds into exchanges. This means that on-chain holders are not putting their Bitcoin back into exchanges to sell, so the selling pressure is not coming from this side.

But looking at the open interest chart, we can see a different picture. Open interest refers to the number of open positions (both long and short) on a trading pair currently on a derivatives exchange. There is a big drop here, meaning many traders have closed their positions. The vast majority of the positions closed are long.

This event marks the highest long liquidation we have seen this year, with longs closing 5,694 lots on August 17. The last time we saw numbers this high was on November 9, when the number was even slightly higher and the price of Bitcoin fell 27%.

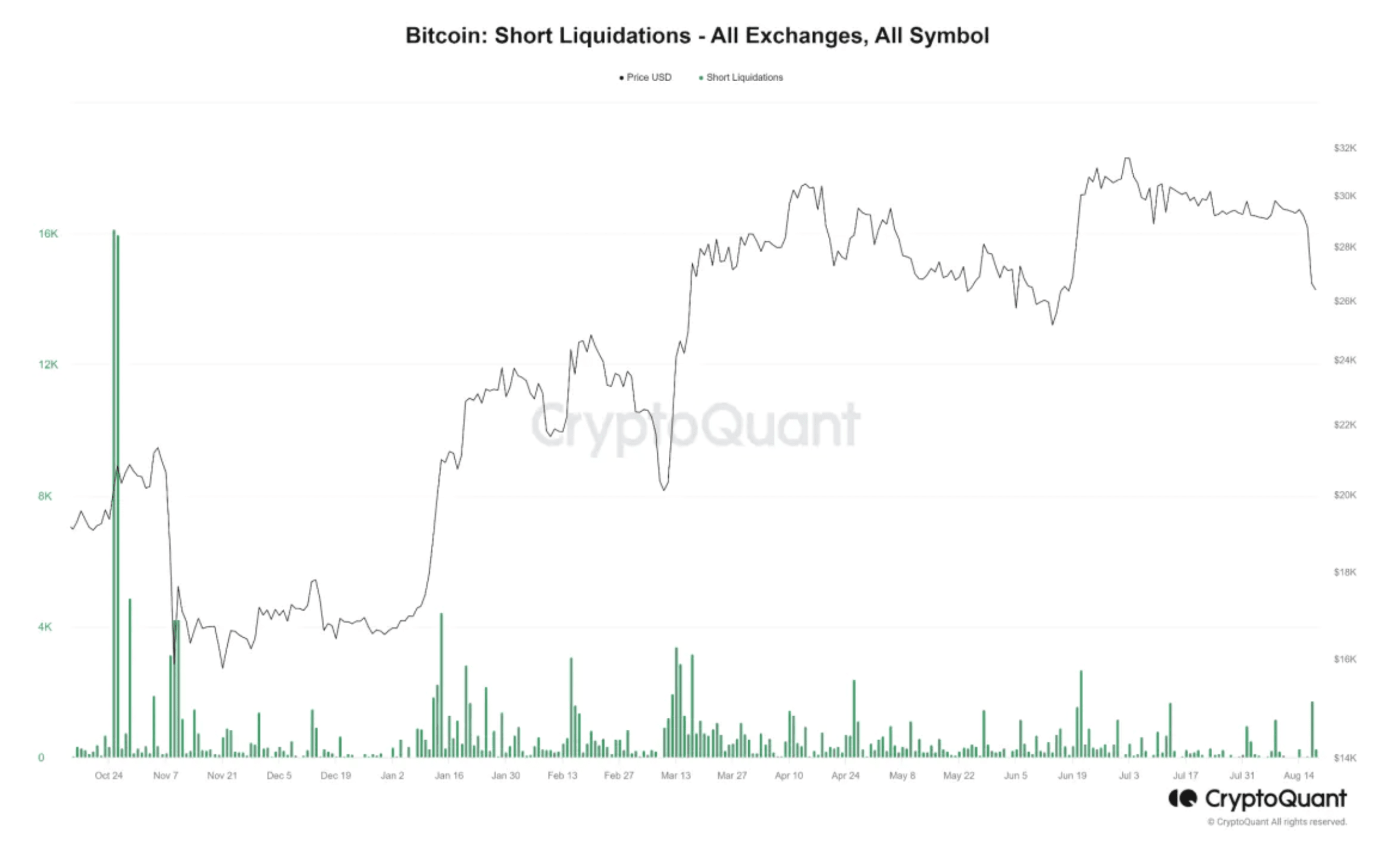

As shown in the chart below, the number of short positions closed is negligible in comparison.

From these charts, we can conclude that long traders were forcefully liquidated, forcing them to sell, leading to a chain reaction known as a long squeeze.

Price Analysis

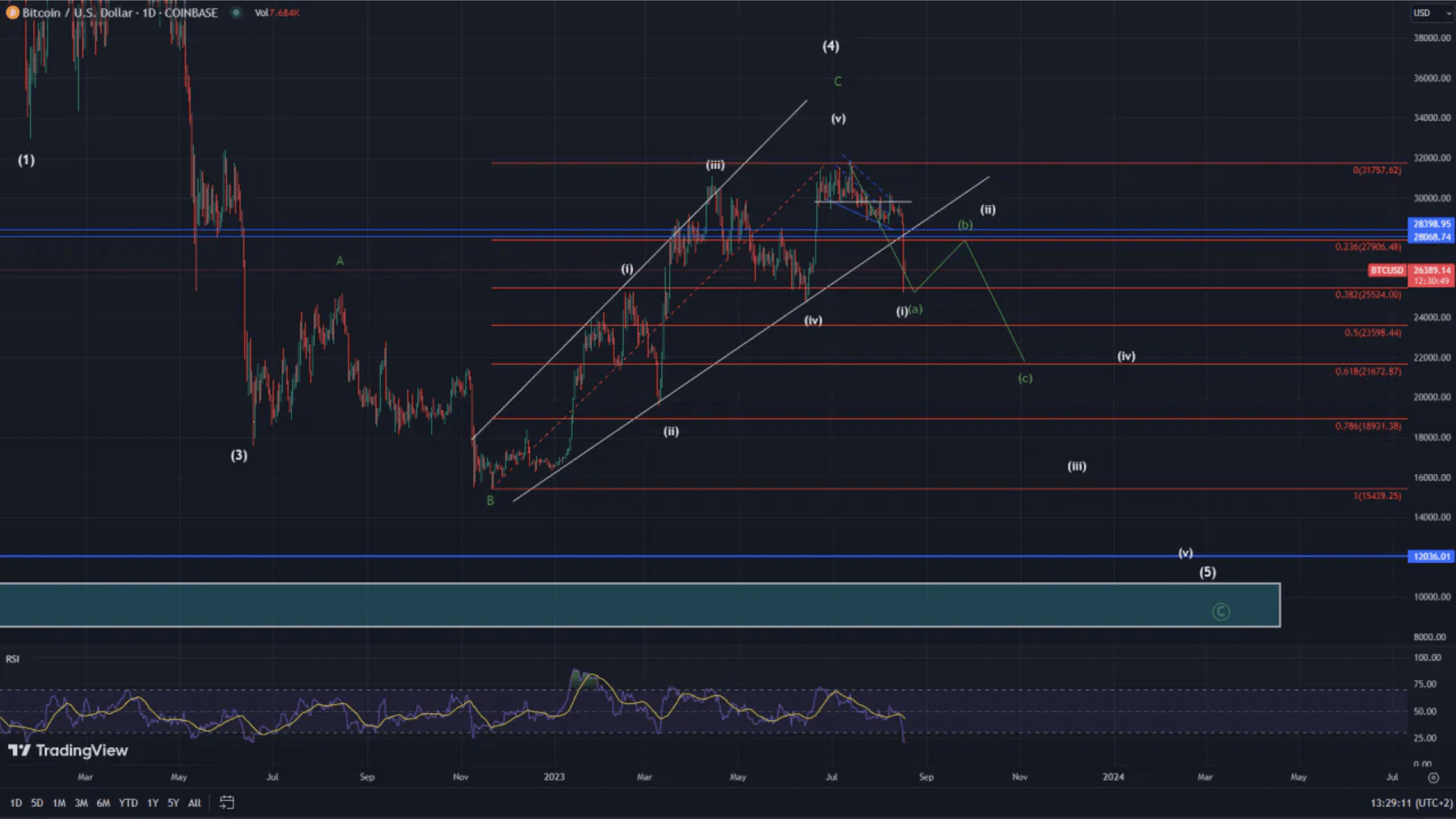

There are two scenarios at the macro level in the future, but both indicate the same short-term price trend. As shown in the figure, according to the Elliott Wave, we can regard the situation since November 21 last year as a completed five-wave drive stage. So now we either see a three-wave correction stage; or a larger five-wave trend, but this will lead to the final bear market for BTC prices.

In the short term, a recovery is expected from current levels, most likely back to $28,000. This recovery will either be a B wave (three-wave correction) in the bullish case or a 2 wave (five-wave drive) in the bearish case.

Next, the price can be expected to start to recover from the current levels, from which we can further verify which scenario will be the primary one. If the bullish trend is in play, the price will head towards the 0.618 Fibonacci retracement level of $21,500. If the price breaks below the 0.618 Fibonacci level, it may indicate that we are seeing the third wave in a five-wave drive phase, and the ultimate target to complete the pattern may be the next most important support area around $11,000.

Conclusion

The entire BTC market has been falling since August 17, but as sharp declines occur, a rebound is likely to follow soon. However, this rebound will only push prices up to a certain point as the market structure suggests the start of a downward trend.

From the historical data, August and September are usually not favorable for mainstream cryptocurrencies. Despite this, BTC has shown considerable resilience in the bull market before August. Although the history is similar, there are still changes brought about by the market environment. For example, the global policy environment, investor confidence, and the application of emerging technologies may have a significant impact on the value of BTC. When analyzing the trend of Bitcoin, it is still necessary to continue to pay attention to these key factors in order to more accurately predict the future direction of the market.

Follow us

veDAO is a decentralized investment and financing platform led by DAO. It will be committed to discovering the most valuable information in the industry and is keen on exploring the underlying logic and cutting-edge tracks in the field of digital encryption, so that every role in the organization can perform their duties and get rewards.

Website: http://www.vedao.com/

Twitter: https://twitter.com/vedao_official

Facebook:bit.ly/3jmSJwN

Telegram:t.me/veDAO_zh

Discord:https://discord.gg/NEmEyrWfjV

🔴Investment is risky, the project is for reference only, please bear the risk yourself🔴