On Wednesday, a court convicted a former product manager at OpenSea of fraud and money laundering. Nathaniel Chastain had used inside knowledge of which assets would be featured on the platform’s home page to trade NFTs. This is the first case of insider trading involving NFTs. Plus, it highlights the importance of ethical behavior in the rapidly growing world of cryptocurrency and digital assets. Let’s dive in!

OpenSea Insider Trading Scandal: Former Employee Found Guilty Ex-OpenSea Exec Convicted of First-Ever NFT Insider Trading Case

OpenSea Insider Trading Scandal: Former Employee Found Guilty Ex-OpenSea Exec Convicted of First-Ever NFT Insider Trading Case

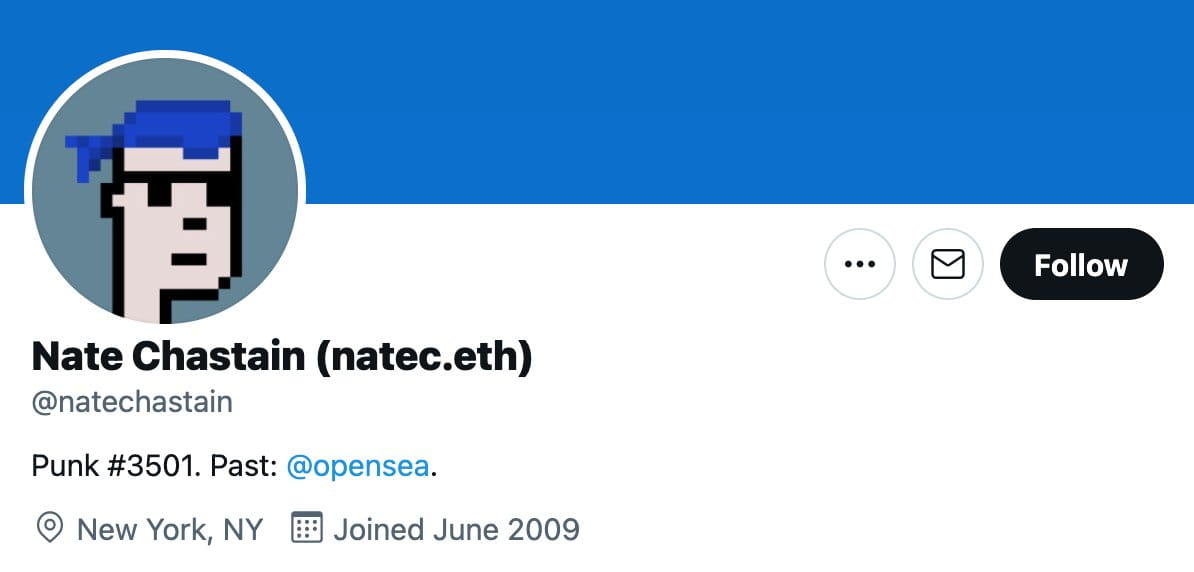

Federal prosecutors in Manhattan accused Nathaniel Chastain of leveraging his position at OpenSea to purchase NFTs he knew would be featured on the company’s website. He then quickly sold them for a profit of over $50,000. The prosecution described this as the first-ever insider trading case involving digital assets. In his closing argument, prosecutor Thomas Burnett stated that Chastain “lied to cover his tracks” and took advantage of his position to benefit himself.

Last June, the U.S. Attorney’s office in Manhattan launched a series of high-profile cases related to digital assets. However, the charges against Chastain were the first. Legal experts believe that this case could have broader implications for assets that do not fit into existing regulations. Chastain’s lawyers argued that OpenSea did not treat knowledge of what NFTs would be featured on its home page as confidential information when Chastain worked at the company. On the other hand, prosecutors argued that Chastain used anonymous OpenSea accounts to make the illegal trades. In their view, this showed that he knew what he was doing was wrong.

“He hid what he was doing,” prosecutors argued in their rebuttal. “He knew that he had violated OpenSea’s confidentiality agreement.”

OpenSea Implements New Procedures After NFT Insider Trading Case. NFTs Not Securities? Judge Dismisses Chastain’s Arguments prior to Insider Trading Trial

OpenSea Implements New Procedures After NFT Insider Trading Case. NFTs Not Securities? Judge Dismisses Chastain’s Arguments prior to Insider Trading Trial

In September 2021, OpenSea requested Chastain’s resignation. Furthermore, they announced the implementation of new procedures to prevent future breaches from occurring internally. According to an OpenSea spokesperson, Chastain was in direct violation of the company’s employee policies and principles. Court documents revealed that prior to the trial, the CEO of OpenSea spoke to prosecutors about the “unfair” nature of the case against Chastain. They also said it had had an impact on his mental well-being.

In April, Judge Jesse Furman rejected Nathaniel Chastain’s five motions to drop evidence regarding his compensation at OpenSea and exclude the term “insider trading.” He stated that his arguments on the matter were irrelevant. Chastain had claimed that NFTs did not fall under securities laws. But, the judge denied his motions, allowing the trial to proceed with the evidence presented.

The post Ex-OpenSea Exec Found GUILTY in First NFT Insider Trading Case! appeared first on NFT Evening.