Fogo is one of the newer Layer-1 blockchains entering the market, but it is not trying to be just another general-purpose chain. From the beginning, the project has been focused on one specific mission: make on-chain trading feel fast, smooth, and dependable — without giving control to a single company.

Instead of chasing hype around big theoretical numbers, Fogo is positioning itself around something traders actually care about: execution that works when the market gets busy.

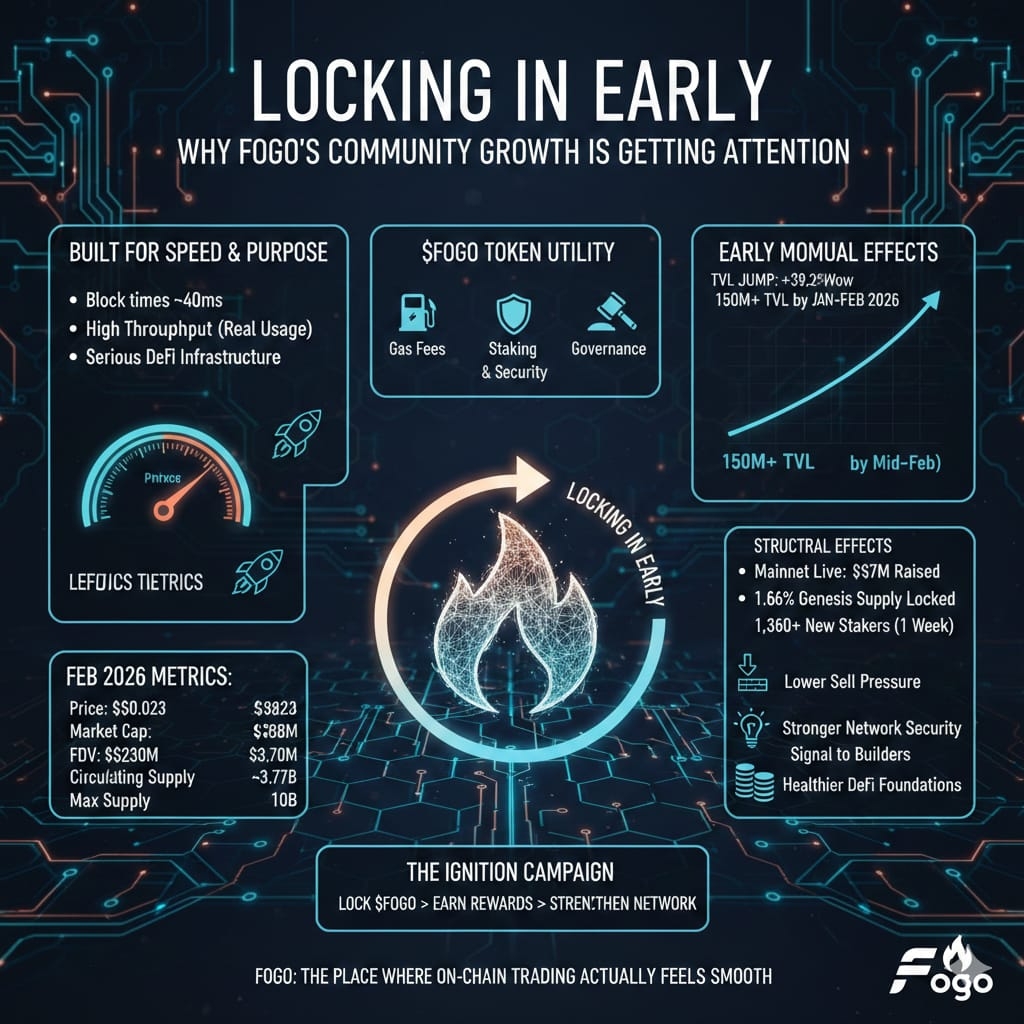

Built for Speed — But With a Purpose

Under the hood, Fogo runs on the Solana Virtual Machine (SVM) and uses a Firedancer-based client to push performance higher. The team’s goal is straightforward. When volatility hits and activity spikes, users should not be dealing with slow confirmations, failed transactions, or heavy friction.

Fogo is targeting:

Block times as low as ~40 milliseconds

High throughput during real usage

Infrastructure that can support serious DeFi and trading activity

In simple terms, the project is trying to close the gap between on-chain execution and the speed users are used to elsewhere.

Where $FOGO Fits Into the System

The FOGO token plays a central role inside the network.

It is used for:

Gas fees:

Every transaction on the network relies on $FOGO, which naturally ties token demand to real activity.

Staking and security:

Users can stake FOGO to help secure the network. Rising staking participation usually signals growing long-term confidence.

Governance:

Holders also have a voice in how the ecosystem evolves over time.

As of February 2026 (based on your data):

Price: around $0.023

Market cap: roughly $88 million

Fully diluted valuation: about $230 million

Circulating supply: ~3.77 billion

Max supply: 10 billion

These numbers alone do not tell the full story — but combined with the recent participation trends, they start to paint a clearer picture.

Mainnet Is Fresh — and Early Signals Matter

Fogo’s mainnet only went live in January 2026, which means the project is still very early in its lifecycle. Before launch, the team also completed a sale on Binance that raised around $7 million, giving the ecosystem some initial momentum.

At this stage, what really matters is not marketing noise but whether users actually show up and stay.

That is exactly why the recent community activity is getting noticed.

The Ignition Campaign and iFOGO: Why Locking Activity Matters

One of the biggest growth drivers right now is the Ignition campaign, which introduced the iFOGO mechanism.

The idea is simple:

Users lock their $FOGO for a set period

They receive rewards and bonuses

The network benefits from stronger long-term alignment

And the early response has been meaningful.

From the figures you shared:

Over 1.6% of the genesis supply has already been locked

More than 1,360 new stakers joined in a single week

Total staked amount has passed 161 million FOGO

TVL jumped 39.2% week-over-week

TVL moved from near zero in mid-January to 150M+ by mid-February

For a network that just launched, that kind of participation curve is worth watching.

Why This Momentum Actually Matters

It is easy to dismiss early campaigns as just incentive farming. But when you look deeper, several structural effects start to appear.

Lower immediate sell pressure

When more tokens are locked or staked, fewer remain liquid. This does not guarantee price stability, but it can reduce sudden supply shocks.

Stronger network security

Higher staking participation generally improves validator alignment and overall network resilience.

Better signal to builders

Developers follow users. When they see rising TVL and active wallets, they are more likely to deploy serious applications.

Healthier DeFi foundations

Sustained locking and staking often become the first step toward deeper liquidity and more organic trading activity.

In other words, early participation is not just cosmetic — it can shape the network’s trajectory.

The Bigger Vision Behind Fogo

What stands out about Fogo is that it was designed by people who understand trading infrastructure. The project openly targets real-time DeFi, order-book style markets, and high-frequency on-chain activity.

The Firedancer approach is meant to help the network stay responsive even when demand spikes — the exact moments when many chains begin to struggle.

If the team executes well, Fogo is aiming to become known as:

> the place where on-chain trading actually feels smooth.

That positioning, if achieved, could become a powerful long-term narrative.

What Needs to Happen Next

Even with strong early signals, the road ahead is what really counts.

For Fogo to mature, several things must continue improving:

More real applications need to launch

Daily active users must keep growing

TVL should remain sticky, not just incentive-driven

The network must stay stable under heavy load

Trading activity needs to deepen beyond staking

Early traction is encouraging, but sustained usage is what separates lasting networks from short-lived hype cycles.

Final Thoughts

Right now, Fogo is still in its early chapter. The mainnet is fresh, the ecosystem is forming, and the community incentives are doing their job by pulling in early participants.

But one thing is already clear:

People are not just watching from the sidelines — they are locking in and committing capital early.

If the network can convert this early energy into real, everyday usage, Fogo could quietly build a strong position in the trading-focused Layer-1 space.

The next few months will be the real test.