The crypto market is not merely a sequence of price increases and declines; it is an ongoing process of evolving investor mindset. Each cycle leaves clear fingerprints in the data - how capital flows, how risk is priced, and how conviction is tested. When these data points are viewed together across time, it becomes evident that crypto has not matured simply because time has passed, but because investors have collectively paid heavy tuition fees in every cycle.

2010–2013: Belief Comes Before Data

In crypto’s earliest phase, analysis barely existed. Bitcoin’s price rose sharply while total market capitalization remained extremely small, trading volume was thin, and institutional participation was nonexistent. On long-term charts, Bitcoin appreciated exponentially even as on-chain data were rudimentary and the market consisted almost entirely of BTC.

This perfectly reflected investor thinking at the time: people bought because they believed in a new idea, not because of models, indicators, or cycle theory. There was no real concept of risk management, nor any urgency to take profits. Alpha in this cycle came from being early and holding long enough, not from investment skill. The market rewarded conviction, not sophistication.

2014–2017: Narrative Dominance and the Collapse of BTC Dominance

After the post-2013 crash, crypto entered its first true awakening. Ethereum emerged, ICOs exploded, and capital began rotating out of Bitcoin into new narratives. During this period, Bitcoin dominance declined sharply while the market capitalization of “Others” surged, clearly showing speculative capital shifting away from BTC.

The dominant mindset was the belief that technology automatically translated into profit. Whitepapers, roadmaps, and long-term visions were treated as guarantees of valuation. The decline in Bitcoin dominance signaled rising systemic risk, even as surface-level enthusiasm remained extremely high. This cycle delivered a crucial lesson: narratives can push prices rapidly, but when capital reverses, valuations collapse without protection.

2018–2021: Cleansing, Accumulation, and the Power of Liquidity

The 2018–2019 crypto winter was a brutal cleansing phase. Market capitalization shrank dramatically, trading volume dried up, and most altcoins lost nearly all their value. Yet this was precisely when data began to speak more clearly. Market cap did not disappear entirely, Bitcoin dominance gradually stabilized, and long-term holding behavior improved.

From 2020 to 2021, global monetary easing flooded risk assets with liquidity, and crypto became one of the primary beneficiaries. Market capitalization expanded in waves, volume surged, and the Fear & Greed Index swung violently between extreme fear and extreme greed. The data showed that the market no longer moved linearly, but according to a clearer capital-flow structure.

Investor thinking also diverged sharply. One group believed “this time is different,” while another focused on liquidity, volume, and capital cycles. The core lesson of this phase was clear: crypto rallies hardest when money is cheap, not when the story is the most compelling.

2022–Present: Maturity, Risk Management, and Survival

From 2022 onward, the market entered its most profound transformation. After a series of systemic collapses, capital became far more selective. Bitcoin dominance rose and remained elevated, reinforcing BTC’s role as the system’s anchor asset. Market capitalization became clearly layered: Bitcoin as the core, stablecoins as liquidity reservoirs, and altcoins as highly cyclical, high-volatility instruments.

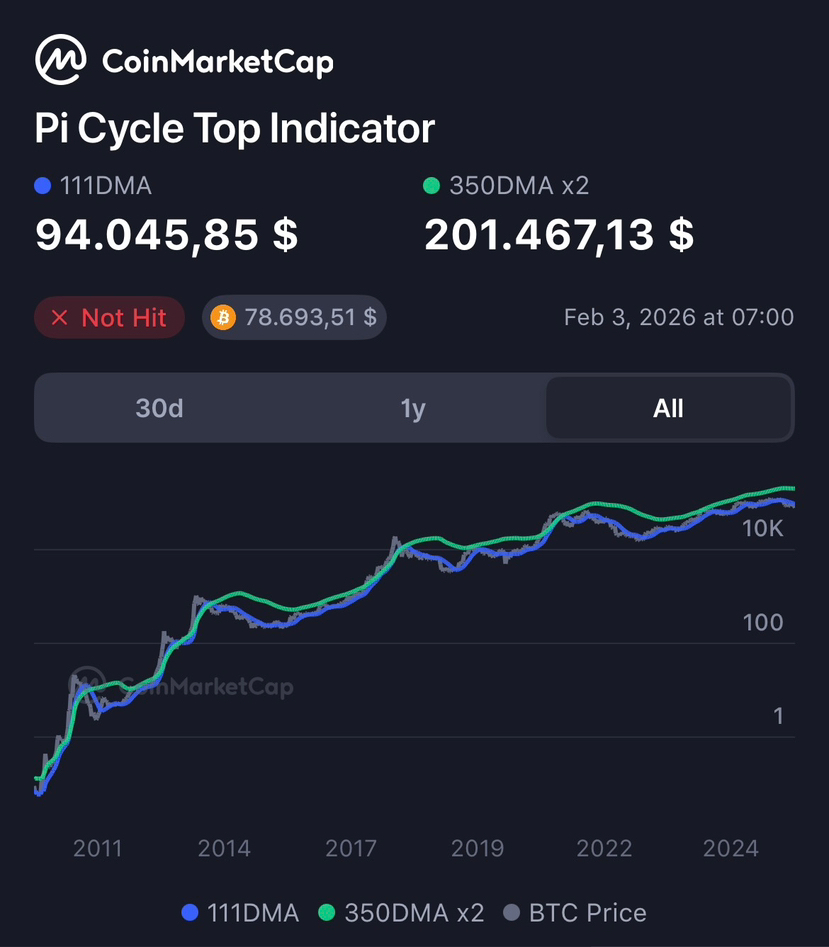

The Fear & Greed Index repeatedly dropped into extreme fear, yet total market capitalization no longer collapsed as it had in prior cycles. Fear no longer signaled the end of the market, but rather periods of redistribution. Long-term cycle indicators such as the Pi Cycle Top suggest that the market has not yet entered its final euphoric phase, despite meaningful price recoveries.

Investor mindset in this era has shifted from “being right” to not losing big. Position sizing, cycle awareness, and capital preservation have become the new alpha. Crypto is no longer a playground of blind faith or collective FOMO—it is a survival game for those who understand where they stand within the market structure.

🚀🚀🚀

Looking back from 2010 to today, crypto does not repeat prices, but it repeats human behavior, each time in more refined forms. Investment thinking has evolved from belief, to narrative, to liquidity, and finally to disciplined survival. The market does not reward the smartest or the fastest participants ==> it rewards those flexible enough to adapt their thinking as data and conditions change.

In crypto, surviving multiple cycles is far more important than winning big in any single one.

#Fualnguyen #LongTermAnalysis #LongTermAnalysis